7. Providing services for Industrial Canteen at ONGC Mangalore ...

7. Providing services for Industrial Canteen at ONGC Mangalore ...

7. Providing services for Industrial Canteen at ONGC Mangalore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

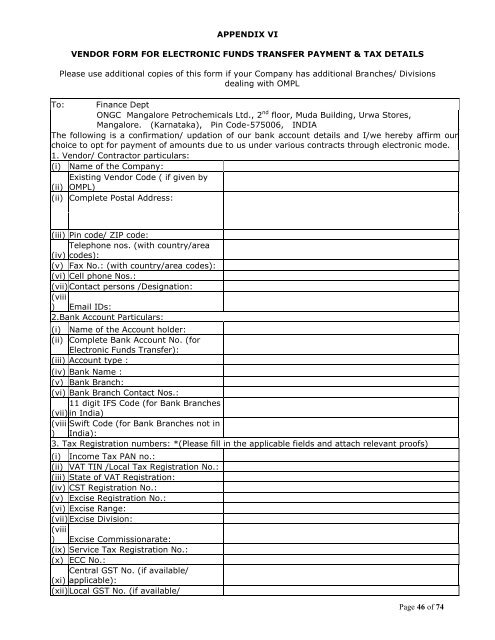

APPENDIX VIVENDOR FORM FOR ELECTRONIC FUNDS TRANSFER PAYMENT & TAX DETAILSPlease use additional copies of this <strong>for</strong>m if your Company has additional Branches/ Divisionsdealing with OMPLTo: Finance Dept<strong>ONGC</strong> <strong>Mangalore</strong> Petrochemicals Ltd., 2 nd floor, Muda Building, Urwa Stores,<strong>Mangalore</strong>. (Karn<strong>at</strong>aka), Pin Code-575006, INDIAThe following is a confirm<strong>at</strong>ion/ upd<strong>at</strong>ion of our bank account details and I/we hereby affirm ourchoice to opt <strong>for</strong> payment of amounts due to us under various contracts through electronic mode.1. Vendor/ Contractor particulars:(i) Name of the Company:Existing Vendor Code ( if given by(ii) OMPL)(ii) Complete Postal Address:(iii) Pin code/ ZIP code:Telephone nos. (with country/area(iv) codes):(v) Fax No.: (with country/area codes):(vi) Cell phone Nos.:(vii) Contact persons /Design<strong>at</strong>ion:(viii) Email IDs:2.Bank Account Particulars:(i) Name of the Account holder:(ii) Complete Bank Account No. (<strong>for</strong>Electronic Funds Transfer):(iii) Account type :(iv) Bank Name :(v) Bank Branch:(vi) Bank Branch Contact Nos.:11 digit IFS Code (<strong>for</strong> Bank Branches(vii) in India)(viii Swift Code (<strong>for</strong> Bank Branches not in) India):3. Tax Registr<strong>at</strong>ion numbers: *(Please fill in the applicable fields and <strong>at</strong>tach relevant proofs)(i) Income Tax PAN no.:(ii) VAT TIN /Local Tax Registr<strong>at</strong>ion No.:(iii) St<strong>at</strong>e of VAT Registr<strong>at</strong>ion:(iv) CST Registr<strong>at</strong>ion No.:(v) Excise Registr<strong>at</strong>ion No.:(vi) Excise Range:(vii) Excise Division:(viii) Excise Commissionar<strong>at</strong>e:(ix) Service Tax Registr<strong>at</strong>ion No.:(x) ECC No.:Central GST No. (if available/(xi) applicable):(xii) Local GST No. (if available/Page 46 of 74