Graduate School - The University of Akron

Graduate School - The University of Akron

Graduate School - The University of Akron

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

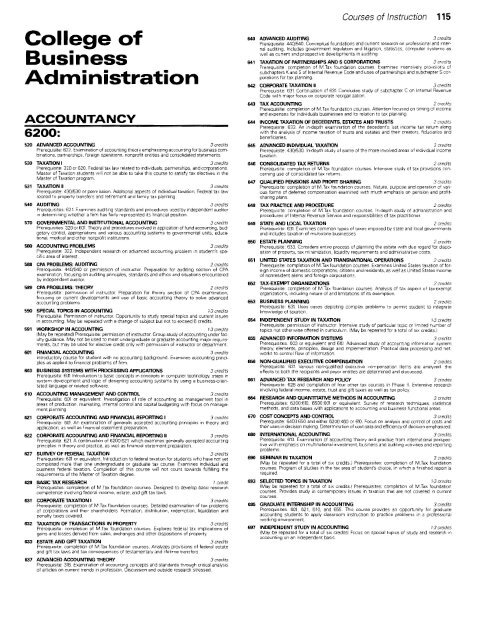

College <strong>of</strong>BusinessAdministrationACCOUNTANCY6200:520 ADVANCED ACCOUNTING 3 cred1tsPrerequis1te: 622. Examination <strong>of</strong> accounting theory emphasizing account1ng for bus1ness combinations.partnerships, foreign operations, nonpr<strong>of</strong>it entities and consol•dated statements530 TAXATION I 3 creditsPrerequiSite: 320 or 620. Federal tax law related to Individuals, partnerships, and corporat1onsMaster <strong>of</strong> Taxat1on students will not be able to take th1s course to sat1sfy tax elect1ves 1n theMaster <strong>of</strong> Taxation program.531 TAXATION II 3 cred1tsPrerequ1s1te: 430/530 or permission. Additional aspects <strong>of</strong> 1ndiv1dual taxation. Federal tax lawrelated to property transfers and retirement and fam1ly tax plann1ng.540 AUDmNG 3 creditsPrerequiSites. 621. Exam1nes aud1t1ng standards and procedures used by Independent aud1tor1n determ1n1ng whether a firm has fairly represented 1ts fmanc1al pos1t1on.570 GOVERNMENTAL AND INSTITUTIONAL ACCOUNTING 3 cred1tsPrerequisites: 320 or 601. <strong>The</strong>ory and procedures 1nvolved in appiJcat1on <strong>of</strong> fund accounting, budgetarycontrol, appropnat1ons and various accounting systems to governmental un1ts, educational,medtcal and other nonpr<strong>of</strong>it JnstJtutJons580 ACCOUNTING PROBLEMS 3 creditsPrerequiSite: 322. Independent research on advanced account1ng problem m student's specificarea <strong>of</strong> interest.588 CPA PROBLEMS: AUDmNG 2 cred1tsPrerequ1site: 440/540 or permission <strong>of</strong> instructor. Preparat1on for auditing sect1on <strong>of</strong> CPAexamination, focusing on aud1t1ng pnnc1ples, standards and eth1cs and Situations encounteredby Independent aud1tor.589 CPA PROBLEMS: TliEORY 2 cred1tsPrerequ1site: permiSSIOn <strong>of</strong> mstructor. Preparation for theory section <strong>of</strong> CPA examination,focusing on current developments and use <strong>of</strong> basic accounting theory to solve advancedaccounting problems590 SPECIAL TOPICS IN ACCOUNTING 7-3 cred1tsPrerequisite: Permission <strong>of</strong> mstructor. Opportunity to study spec1al topics and current issuesin accounting. May be repeated w1th a change <strong>of</strong> subject but not to exceed 6 credits.591 WORKSHOP IN ACCOUNTING 7-3 cred1ts(May be repeated) Prerequisite: permission <strong>of</strong> 1nstructor. Group study <strong>of</strong> accounting under facultyguidance. May not be used to meet undergraduate or graduate accounting major requirements,but may be used for elect1ve credit only w1th perm1ssion <strong>of</strong> Instructor or department.601 RNANCIAL ACCOUNTING 3 creditsIntroductory course for student w1th no accounting background. Exam1nes account1ng pnnciplesas applied to f1nancial problems <strong>of</strong> flfm.603 BUSINESS SYSTEMS WITH PROCESSING APPUCATIONS 3 cred1tsPrerequis1te: 601. Introduction to basic concepts 1n concepts in computer technology, steps insystem development and log1c <strong>of</strong> des1gning account1ng systems by us1ng a busJness-onentatedlanguage or related s<strong>of</strong>tware.610 ACCOUNTING MANAGEMENT AND CONTROL 3 creditsPrerequis"ite: 601 or equivalent Investigation <strong>of</strong> role <strong>of</strong> account1ng as management tool inareas <strong>of</strong> production, marketing, internal control and cap1tal budgeting w1th focus on managementplanning621 CORPORATE ACCOUNTING AND RNANCIAL REPORTING I 3 creditsPrerequisite: 601. An exam1nation <strong>of</strong> generally accepted accounting pnnciples in theory andapp!icat1on, as well as financial statement preparation.622 CORPORATE ACCOUNTING AND RNANCIAL REPORTING II 3 cred1tsPrerequisite: 621. A continuatiOn <strong>of</strong> 6200:621 wh1ch examines generally accepted account1ngpnnc1ples 1n theory and practice, as well as financial statement preparation.627 SURVEY OF FEDERAL TAXATION 3 creditsPrerequ1sites: 601 or equivalent. Introduction to federal taxation for students who have not yetcompleted more than one undergraduate or graduate tax course. Examines indiVidual andbus1ness federal taxat1on. Completion <strong>of</strong> this course w1!1 not count towards fulfilling therequirements <strong>of</strong> the Master <strong>of</strong> Taxation degree.628 BASIC TAX RESEARCH 7 cred1tPrereqUISites: completion <strong>of</strong> M.Tax foundat1on courses. Designed to develop basic researchcompetence involv1ng federal income, estate, and gift tax laws631 CORPORATE TAXATION I 3 cred1tsPrerequisite: completion <strong>of</strong> M.Tax foundation courses. Detailed exammation <strong>of</strong> tax problems<strong>of</strong> corporations and the1r shareholders Formation, distnbution, redemption, liquidation andpenalty taxes covered.632 TAXATION OF TRANSACTIONS IN PROPERTY 3 cred1tsPrerequ1site: complet1on <strong>of</strong> M.Tax foundation courses. Explores federal tax implicatiOns <strong>of</strong>gains and losses denved from sales, exchanges and other dispositions <strong>of</strong> property633 ESTATE AND GIFT TAXATION 3 cred1tsPrerequisite: completion <strong>of</strong> M.Tax foundation courses. Analyzes provisions <strong>of</strong> federal estateand g1ft tax laws and tax consequences <strong>of</strong> testamentary and lifet1me transfers637 ADVANCED ACCOUNTING TliEORV 3 cred1tsPrerequ1s1te: 318. Examination <strong>of</strong> account1ng concepts and standards through cntical analys1s<strong>of</strong> articles on current trends 1n pr<strong>of</strong>ession. Discuss1on and outside research stressed.Courses <strong>of</strong> Instruction 115640 ADVANCED AUDmNG 3 cred1tsPrerequ1s1te: 440/540. Conceptual foundations and current research on pr<strong>of</strong>ess1onal and Internalauditing. Includes government regulation and litigation, statistics, computer systems aswell as current and prospective developments in auditing641 TAXATION OF PARTNERSHIPS AND S CORPORATIONS 3 cred1tsPrerequisite· completion <strong>of</strong> M.Tax foundation courses. Exam1nes 1mensively proviSIOns <strong>of</strong>subchapters K and S <strong>of</strong> Internal Revenue Code and uses <strong>of</strong> partnerships and subchapter S corporationsfor tax planning642 CORPORATE TAXATION II 3 cred1tsPrerequisite: 631. Cont1nuat1on <strong>of</strong> 631. Concludes study <strong>of</strong> subchapter C on Internal RevenueCode w1th major focus on corporate reorganization643 TAX ACCOUNTING 2 creditsPrerequisite: completion <strong>of</strong> M.Tax foundation courses. Attention focused on t1ming <strong>of</strong> 1ncomeand expenses for 1nd1viduals businesses and its relatton to tax plann1ng644 INCOME TAXATION OF DECEDENTS, ESTATES AND TRUSTS 2 cred1tsPrerequ1s1te: 633. An in-depth examination <strong>of</strong> the decedent's last tncome tax return alongwith the analysis <strong>of</strong> 1ncome taxatton <strong>of</strong> trusts and estates and their creators, fiduc1aries andbenefic1anes.645 ADVANCED INDIVIDUAL TAXATION 3 cred1tsPrerequisite: 430/530. In-depth study <strong>of</strong> some <strong>of</strong> the more 1nvolved areas <strong>of</strong> JndiVJduaiJncometaxation.646 CONSOUDATED TAX RETURNS 2 creditsPrerequ1s1te completion <strong>of</strong> M.Tax foundation courses. lntens1ve study <strong>of</strong> tax prov1sions concerntnguse <strong>of</strong> consolidated tax returns.647 QUAURED PENSIONS AND PROFIT SHARING 3 cred1tsPrerequ1s1te: complet1on <strong>of</strong> M.Tax foundatiOn courses. Nature, purpose and operat1on <strong>of</strong> vanousforms <strong>of</strong> deferred compensation exam1ned w1th much emphasis on pension and pr<strong>of</strong>itshanngplans.648 TAX PRACTICE AND PROCEDURE 2 cred1tsPrerequisite· completion <strong>of</strong> M.Tax foundation courses. In-depth study <strong>of</strong> administratiOn andprocedures <strong>of</strong> Internal Revenue Serv1ce and responsibilities <strong>of</strong> tax practitioner649 STATE AND LOCAL TAXATION 2 cred1tsPrerequisite: 631. Exam1nes common types <strong>of</strong> taxes Imposed by state and local governmentsand includes taxation <strong>of</strong> multistate businesses650 ESTATE PLANNING 2 cred1tsPrerequisite: 633. Considers entlfe process <strong>of</strong> plann1ng the estate w1th due regard for dispoSition <strong>of</strong> property, tax mJnJmJzatJon, liQUidity requ1rements and adm1nistrat1ve costs.651 UNITED STATES TAXATION AND TRANSNATIONAL OPERATIONS 2 cred1tsPrerequ1site. completion <strong>of</strong> M.Tax foundat1on courses. Exam1nes United States taxat1on <strong>of</strong> forSign 1ncome <strong>of</strong> domestic corporations, citizens and residents, as we!l as Un1ted States 1ncome<strong>of</strong> nonresident aliens and fore1gn corporations652 TAX-EXEMPT ORGANIZATIONS 2 cred1tsPrerequiSite: completion <strong>of</strong> M Tax foundation courses. Analys1s <strong>of</strong> tax aspect <strong>of</strong> tax-exemptorganizations, 1ncludJng nature <strong>of</strong> and limitations <strong>of</strong> its exempt1on.653 BUSINESS PLANNING 2 creditsPrerequ1s1te: 631. Uses cases depicting complex problems to permit student to 1ntegrateknowledge <strong>of</strong> taxat1on654 INDEPENDENT STUDY IN TAXATION 7-3 cred1tsPrerequiSite: permission <strong>of</strong> instructor lntens1ve study <strong>of</strong> particular top1c or limited number <strong>of</strong>topics not otherwise <strong>of</strong>fered in curnculum. (May be repeated for a total <strong>of</strong> SIX credits.)655 ADVANCED INFORMATION SYSTEMS 3 C1ed1tsPrerequiSites. 603 or equivalent and 610 Advanced study <strong>of</strong> account1ng 1nformat1on systemtheory, elements, pnnc1ples, design and implementation. Pract1cal data processing and networksto control flow <strong>of</strong> 1nformat1on.656 NON-OUAUFIED EXECUTIVE COMPENSATION 2 cred1tsPrerequisite: 631 Vanous non-qualif1ed executive compensation items are analyzed. theeffects to both the recip1ents and payor ent1tles are determined and discussed.661 ADVANCED TAX RESEARCH AND POUCY 3 cred1tsPrerequ1s1te: 628 and completion <strong>of</strong> four other tax courses in Phase II. Extensive researchinvolving federal income, estate, trust and g1ft taxes as well as tax policy664 RESEARCH AND QUANTITATIVE METHODS IN ACCOUNTING 3 cred1tsPrerequisites: 6200:610, 6500:601 or equivalent. Survey <strong>of</strong> research techniques, statist1calmethods, and data bases with applications to account1ng and bus1ness funct1onal areas.670 COST CONCEPTS AND CONTROL 3 creditsPrerequisite: 6400:650 and either 6200:460 or 610. Focus on analysis and control <strong>of</strong> costs andtheir uses in decision making. Determination <strong>of</strong> cost data and effic1ency <strong>of</strong> decis1on emphas1zed.680 INTERNATIONAL ACCOUNTING 3 cred1tsPrerequisite: 610. Examination <strong>of</strong> accounting theory and practice from InternatiOnal perspectiVewith emphaSIS on multinational investment, bus1ness and auditing actiVItieS and report1ngproblems.690 SEMINAR IN TAXATION 3 cred1ts(May be repeated for a total <strong>of</strong> SIX credits.) Prerequisites: complet1on <strong>of</strong> M.Tax foundationcourses. Program <strong>of</strong> stud1es in the tax area <strong>of</strong> student's cho1ce, in wh1ch a fmished report isrequired693 SELECTED TOPICS IN TAXATION 7-3 cred1ts(May be repeated for a total <strong>of</strong> SIX credits.) PrerequiSites: complet1on <strong>of</strong> M.Tax foundationcourses. Prov1des study Jn contemporary issues in taxat1on that are not covered 1n currentcourses695 GRADUATE INTERNSHIP IN ACCOUNTING 3 creditsPrerequisites. 601, 621, 610, and 655. Th1s course prov1des an opportun1ty for graduateaccounting students to apply classroom instruction to practice problems 1n a pr<strong>of</strong>ess1onalworking environment697 INDEPENDENT STUDY IN ACCOUNTING 7-3 cred1ts(May be repeated for a total <strong>of</strong> six credtts) Focus on spec1al topics <strong>of</strong> study and research 1naccounting on an Independent bas1s.