SEEU Review vol. 6 Nr. 2 (pdf) - South East European University

SEEU Review vol. 6 Nr. 2 (pdf) - South East European University

SEEU Review vol. 6 Nr. 2 (pdf) - South East European University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

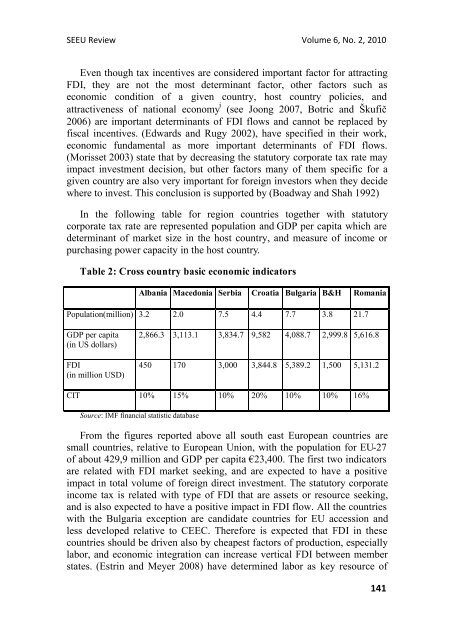

<strong>SEEU</strong> <strong>Review</strong> Volume 6, No. 2, 2010Even though tax incentives are considered important factor for attractingFDI, they are not the most determinant factor, other factors such aseconomic condition of a given country, host country policies, andattractiveness of national economy i (see Joong 2007, Botric and Škufič2006) are important determinants of FDI flows and cannot be replaced byfiscal incentives. (Edwards and Rugy 2002), have specified in their work,economic fundamental as more important determinants of FDI flows.(Morisset 2003) state that by decreasing the statutory corporate tax rate mayimpact investment decision, but other factors many of them specific for agiven country are also very important for foreign investors when they decidewhere to invest. This conclusion is supported by (Boadway and Shah 1992)In the following table for region countries together with statutorycorporate tax rate are represented population and GDP per capita which aredeterminant of market size in the host country, and measure of income orpurchasing power capacity in the host country.Table 2: Cross country basic economic indicatorsAlbania Macedonia Serbia Croatia Bulgaria B&H RomaniaPopulation(million) 3.2 2.0 7.5 4.4 7.7 3.8 21.7GDP per capita(in US dollars)FDI(in million USD)2,866.3 3,113.1 3,834.7 9,582 4,088.7 2,999.8 5,616.8450 170 3,000 3,844.8 5,389.2 1,500 5,131.2CIT 10% 15% 10% 20% 10% 10% 16%Source: IMF financial statistic databaseFrom the figures reported above all south east <strong>European</strong> countries aresmall countries, relative to <strong>European</strong> Union, with the population for EU-27of about 429,9 million and GDP per capita €23,400. The first two indicatorsare related with FDI market seeking, and are expected to have a positiveimpact in total <strong>vol</strong>ume of foreign direct investment. The statutory corporateincome tax is related with type of FDI that are assets or resource seeking,and is also expected to have a positive impact in FDI flow. All the countrieswith the Bulgaria exception are candidate countries for EU accession andless developed relative to CEEC. Therefore is expected that FDI in thesecountries should be driven also by cheapest factors of production, especiallylabor, and economic integration can increase vertical FDI between memberstates. (Estrin and Meyer 2008) have determined labor as key resource of141