in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

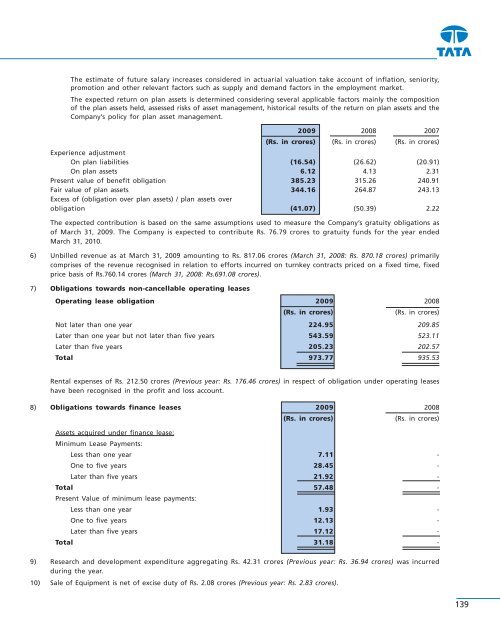

The estimate of future salary <strong>in</strong>creases considered <strong>in</strong> actuarial valuation take account of <strong>in</strong>flation, seniority,promotion and other relevant factors such as supply and demand factors <strong>in</strong> the employment market.The expected return on plan assets is determ<strong>in</strong>ed consider<strong>in</strong>g several applicable factors ma<strong>in</strong>ly the compositionof the plan assets held, assessed risks of asset management, historical results of the return on plan assets and theCompany’s policy for plan asset management.2009 2008 2007(Rs. <strong>in</strong> crores) (Rs. <strong>in</strong> crores) (Rs. <strong>in</strong> crores)Experience adjustmentOn plan liabilities (16.54) (26.62) (20.91)On plan assets 6.12 4.13 2.31Present value of benefit obligation 385.23 315.26 240.91Fair value of plan assets 344.16 264.87 243.13Excess of (obligation over plan assets) / plan assets overobligation (41.07) (50.39) 2.22The expected contribution is based on the same assumptions used to measure the Company’s gratuity obligations asof March 31, 2009. The Company is expected to contribute Rs. 76.79 crores to gratuity funds for the year endedMarch 31, 2010.6) Unbilled revenue as at March 31, 2009 amount<strong>in</strong>g to Rs. 817.06 crores (March 31, 2008: Rs. 870.18 crores) primarilycomprises of the revenue recognised <strong>in</strong> relation to efforts <strong>in</strong>curred on turnkey contracts priced on a fixed time, fixedprice basis of Rs.760.14 crores (March 31, 2008: Rs.691.08 crores).7) Obligations towards non-cancellable operat<strong>in</strong>g leasesOperat<strong>in</strong>g lease obligation 2009 2008(Rs. <strong>in</strong> crores)(Rs. <strong>in</strong> crores)Not later than one year 224.95 209.85Later than one year but not later than five years 543.59 523.11Later than five years 205.23 202.57Total 973.77 935.53Rental expenses of Rs. 212.50 crores (Previous year: Rs. 176.46 crores) <strong>in</strong> respect of obligation under operat<strong>in</strong>g leaseshave been recognised <strong>in</strong> the profit and loss account.8) Obligations towards f<strong>in</strong>ance leases 2009 2008(Rs. <strong>in</strong> crores)(Rs. <strong>in</strong> crores)Assets acquired under f<strong>in</strong>ance lease:M<strong>in</strong>imum Lease Payments:Less than one year 7.11 -One to five years 28.45 -Later than five years 21.92 -Total 57.48 -Present Value of m<strong>in</strong>imum lease payments:Less than one year 1.93 -One to five years 12.13 -Later than five years 17.12 -Total 31.18 -9) Research and development expenditure aggregat<strong>in</strong>g Rs. 42.31 crores (Previous year: Rs. 36.94 crores) was <strong>in</strong>curreddur<strong>in</strong>g the year.10) Sale of Equipment is net of excise duty of Rs. 2.08 crores (Previous year: Rs. 2.83 crores).139