in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

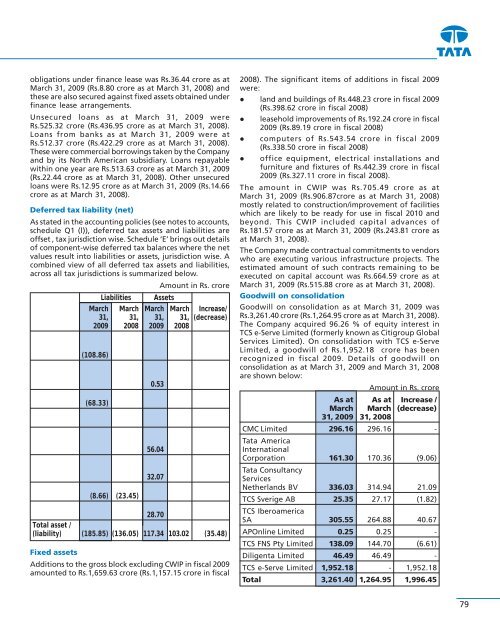

obligations under f<strong>in</strong>ance lease was Rs.36.44 crore as atMarch 31, 2009 (Rs.8.80 crore as at March 31, 2008) andthese are also secured aga<strong>in</strong>st fixed assets obta<strong>in</strong>ed underf<strong>in</strong>ance lease arrangements.Unsecured loans as at March 31, 2009 wereRs.525.32 crore (Rs.436.95 crore as at March 31, 2008).Loans from banks as at March 31, 2009 were atRs.512.37 crore (Rs.422.29 crore as at March 31, 2008).These were commercial borrow<strong>in</strong>gs taken by the Companyand by its North American subsidiary. Loans repayablewith<strong>in</strong> one year are Rs.513.63 crore as at March 31, 2009(Rs.22.44 crore as at March 31, 2008). Other unsecuredloans were Rs.12.95 crore as at March 31, 2009 (Rs.14.66crore as at March 31, 2008).Deferred tax liability (net)As stated <strong>in</strong> the account<strong>in</strong>g policies (see notes to accounts,schedule Q1 (l)), deferred tax assets and liabilities areoffset , tax jurisdiction wise. Schedule ‘E’ br<strong>in</strong>gs out detailsof component-wise deferred tax balances where the netvalues result <strong>in</strong>to liabilities or assets, jurisdiction wise. Acomb<strong>in</strong>ed view of all deferred tax assets and liabilities,across all tax jurisdictions is summarized below.Amount <strong>in</strong> Rs. croreLiabilities AssetsMarch March March March Increase/31, 31, 31, 31, (decrease)2009 2008 2009 2008(108.86)(68.33)(8.66) (23.45)0.5356.0432.0728.70Total asset /(liability) (185.85) (136.05) 117.34 103.02 (35.48)Fixed assetsAdditions to the gross block exclud<strong>in</strong>g CWIP <strong>in</strong> fiscal 2009amounted to Rs.1,659.63 crore (Rs.1,157.15 crore <strong>in</strong> fiscal2008). The significant items of additions <strong>in</strong> fiscal 2009were: land and build<strong>in</strong>gs of Rs.448.23 crore <strong>in</strong> fiscal 2009(Rs.398.62 crore <strong>in</strong> fiscal 2008) leasehold improvements of Rs.192.24 crore <strong>in</strong> fiscal2009 (Rs.89.19 crore <strong>in</strong> fiscal 2008) computers of Rs.543.54 crore <strong>in</strong> fiscal 2009(Rs.338.50 crore <strong>in</strong> fiscal 2008) office equipment, electrical <strong>in</strong>stallations andfurniture and fixtures of Rs.442.39 crore <strong>in</strong> fiscal2009 (Rs.327.11 crore <strong>in</strong> fiscal 2008).The amount <strong>in</strong> CWIP was Rs.705.49 crore as atMarch 31, 2009 (Rs.906.87crore as at March 31, 2008)mostly related to construction/improvement of facilitieswhich are likely to be ready for use <strong>in</strong> fiscal 2010 andbeyond. This CWIP <strong>in</strong>cluded capital advances ofRs.181.57 crore as at March 31, 2009 (Rs.243.81 crore asat March 31, 2008).The Company made contractual commitments to vendorswho are execut<strong>in</strong>g various <strong>in</strong>frastructure projects. Theestimated amount of such contracts rema<strong>in</strong><strong>in</strong>g to beexecuted on capital account was Rs.664.59 crore as atMarch 31, 2009 (Rs.515.88 crore as at March 31, 2008).Goodwill on consolidationGoodwill on consolidation as at March 31, 2009 wasRs.3,261.40 crore (Rs.1,264.95 crore as at March 31, 2008).The Company acquired 96.26 % of equity <strong>in</strong>terest <strong>in</strong>TCS e-Serve Limited (formerly known as Citigroup GlobalServices Limited). On consolidation with TCS e-ServeLimited, a goodwill of Rs.1,952.18 crore has beenrecognized <strong>in</strong> fiscal 2009. Details of goodwill onconsolidation as at March 31, 2009 and March 31, 2008are shown below:Amount <strong>in</strong> Rs. croreAs at As at Increase /March March (decrease)31, 2009 31, 2008CMC Limited 296.16 296.16 -Tata AmericaInternationalCorporation 161.30 170.36 (9.06)Tata ConsultancyServicesNetherlands BV 336.03 314.94 21.09TCS Sverige AB 25.35 27.17 (1.82)TCS IberoamericaSA 305.55 264.88 40.67APOnl<strong>in</strong>e Limited 0.25 0.25 -TCS FNS Pty Limited 138.09 144.70 (6.61)Diligenta Limited 46.49 46.49 -TCS e-Serve Limited 1,952.18 - 1,952.18Total 3,261.40 1,264.95 1,996.4579