- Page 1 and 2:

Annual Report 2008 - 09agilityina D

- Page 3 and 4:

ContentsBoard of Directors 2Our Lea

- Page 5 and 6:

Laura M ChaIndependentDirectorDr. R

- Page 7 and 8:

N ChandrasekaranChief Operating Off

- Page 9 and 10:

Your Company remained focused on he

- Page 11 and 12:

"TCS is a valued customer, supplier

- Page 13 and 14:

“Nielsen is moving quickly to tra

- Page 19 and 20:

Board of DirectorsR N Tata (Chairma

- Page 21 and 22:

Management TeamFunctionNameIndustry

- Page 23 and 24:

3. DividendBased on the Company's p

- Page 25 and 26:

The Company has also been rated by

- Page 27 and 28:

11. Corporate SustainabilityIn keep

- Page 29 and 30:

13. Corporate Governance Report and

- Page 31 and 32:

Annexure to the Directors’ Report

- Page 33 and 34:

Expenditure on R&D(Rs. in crore)Yea

- Page 35 and 36:

Sr. Name Age Designation Gross Net

- Page 37 and 38:

Sr. Name Age Designation Gross Net

- Page 39 and 40:

Sr. Name Age Designation Gross Net

- Page 41 and 42:

Sr. Name Age Designation Gross Net

- Page 43 and 44:

Sr. Name Age Designation Gross Net

- Page 45 and 46:

Sr. Name Age Designation Gross Net

- Page 47 and 48:

Sr. Name Age Designation Gross Net

- Page 49 and 50:

DECLARATION REGARDING COMPLIANCE BY

- Page 51 and 52:

Chart 3: IT Services spends by indu

- Page 53 and 54:

B. FOCUS AREAS OF THE COMPANY1. Vis

- Page 55 and 56:

2.6 Organisation: From April 2008,

- Page 57 and 58:

Company also offers PerformanceMana

- Page 59 and 60:

4. R&D and Innovation Labs: TCS est

- Page 61 and 62:

Chart 24: Diversity: Global work fo

- Page 63 and 64:

The Company’s ability to bid for

- Page 65 and 66:

Corporate Governance practices and

- Page 67 and 68:

TCS LIMITED (UNCONSOLIDATED)RESULTS

- Page 69 and 70:

eduction in cost of software licens

- Page 71 and 72:

FINANCIAL POSITION - TCS LIMITED(UN

- Page 73 and 74:

Deferred tax assets (net)Details of

- Page 75 and 76:

Cash flow from investing activities

- Page 77 and 78:

RevenuesRevenues from operationsThe

- Page 79 and 80:

The primary reasons for the decreas

- Page 81 and 82:

obligations under finance lease was

- Page 83 and 84:

Rs.137.03 crore as at March 31, 200

- Page 85 and 86:

COMPANY'S CONSOLIDATED PERFORMANCE

- Page 87 and 88:

INTERNAL CONTROL SYSTEMS AND THEIR

- Page 89 and 90:

Name of Category Number of Board Wh

- Page 91 and 92:

(v)The composition of the Audit Com

- Page 93 and 94:

(ix)Group Health Insurance as separ

- Page 95 and 96:

Capital and revenue budgets and cap

- Page 97 and 98:

(vi)Market Price Data:High, Low (ba

- Page 99 and 100:

(xi) Shareholding as on March 31, 2

- Page 101 and 102:

COMPLIANCE CERTIFICATETO THE MEMBER

- Page 103 and 104:

ANNEXURE TO THE AUDITORS' REPORT(Re

- Page 105 and 106:

trading in shares, securities, debe

- Page 107 and 108:

INCOMEProfit and Loss Account for t

- Page 109 and 110:

Schedules forming part of the Balan

- Page 111 and 112:

Schedules forming part of the Balan

- Page 113 and 114:

Schedules forming part of the Balan

- Page 115 and 116:

Schedules forming part of the Balan

- Page 117 and 118:

Schedules forming part of the Balan

- Page 119 and 120:

Schedules forming part of the Balan

- Page 121 and 122:

Schedules forming part of the Balan

- Page 123 and 124:

Schedules forming part of the Balan

- Page 125 and 126:

Schedules forming part of the Balan

- Page 127 and 128: Schedules forming part of the Balan

- Page 129 and 130: Schedules forming part of the Balan

- Page 131 and 132: Schedules forming part of the Balan

- Page 133 and 134: Schedules forming part of the Profi

- Page 135 and 136: SCHEDULE ‘Q’ - NOTES TO ACCOUNT

- Page 137 and 138: services are rendered. Revenue from

- Page 139 and 140: 3) The Company has given undertakin

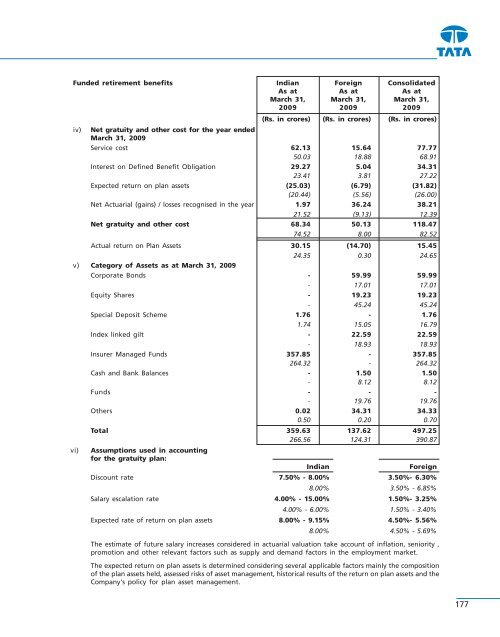

- Page 141 and 142: The estimate of future salary incre

- Page 143 and 144: Particulars Geographic Segment (Rs.

- Page 145 and 146: ii) TCS Financial Solutions Austral

- Page 147 and 148: (Rs. in crores)Particulars Holding

- Page 149 and 150: (Rs. in crores)2009 2008Remuneratio

- Page 151 and 152: 19) Micro and Small Enterprises(Rs.

- Page 153 and 154: Number of Number of Gross AmountNon

- Page 155 and 156: No. of Shares* Tata Consultancy Ser

- Page 157 and 158: AUDITORS’ REPORT ON CONSOLIDATED

- Page 159 and 160: Consolidated Profit and Loss Accoun

- Page 161 and 162: Schedules forming part of the Conso

- Page 163 and 164: SCHEDULE ‘D’UNSECURED LOANSSche

- Page 165 and 166: Schedules forming part of the Conso

- Page 167 and 168: Schedules forming part of the Conso

- Page 169 and 170: Schedules forming part of the Conso

- Page 171 and 172: e) DepreciationDepreciation other t

- Page 173 and 174: Dividends are recorded when the rig

- Page 175 and 176: Name of the Company Country of Perc

- Page 177: 3) Acquisitions / Divestmenta) On M

- Page 181 and 182: 7) Unbilled revenue as at March 31,

- Page 183 and 184: Particulars Geographic Segment (Rs.

- Page 185 and 186: B) Transactions with related partie

- Page 187 and 188: 2009 2008(Rs. in crores)(Rs. in cro

- Page 189 and 190: Net loss on derivative instruments

- Page 191 and 192: Rs. in croresSr. Name of the Subsid

- Page 193 and 194: Awards and RecognitionsWall Street