in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

in a Dynamic Environment - Domain-b

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

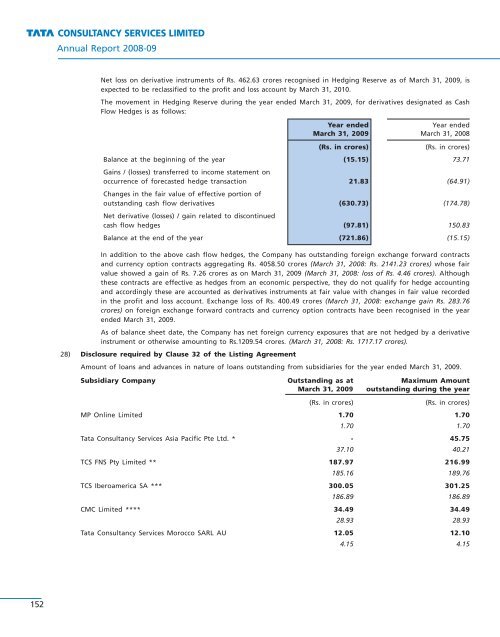

Annual Report 2008-09Net loss on derivative <strong>in</strong>struments of Rs. 462.63 crores recognised <strong>in</strong> Hedg<strong>in</strong>g Reserve as of March 31, 2009, isexpected to be reclassified to the profit and loss account by March 31, 2010.The movement <strong>in</strong> Hedg<strong>in</strong>g Reserve dur<strong>in</strong>g the year ended March 31, 2009, for derivatives designated as CashFlow Hedges is as follows:Year endedYear endedMarch 31, 2009 March 31, 2008(Rs. <strong>in</strong> crores)(Rs. <strong>in</strong> crores)Balance at the beg<strong>in</strong>n<strong>in</strong>g of the year (15.15) 73.71Ga<strong>in</strong>s / (losses) transferred to <strong>in</strong>come statement onoccurrence of forecasted hedge transaction 21.83 (64.91)Changes <strong>in</strong> the fair value of effective portion ofoutstand<strong>in</strong>g cash flow derivatives (630.73) (174.78)Net derivative (losses) / ga<strong>in</strong> related to discont<strong>in</strong>uedcash flow hedges (97.81) 150.83Balance at the end of the year (721.86) (15.15)In addition to the above cash flow hedges, the Company has outstand<strong>in</strong>g foreign exchange forward contractsand currency option contracts aggregat<strong>in</strong>g Rs. 4058.50 crores (March 31, 2008: Rs. 2141.23 crores) whose fairvalue showed a ga<strong>in</strong> of Rs. 7.26 crores as on March 31, 2009 (March 31, 2008: loss of Rs. 4.46 crores). Althoughthese contracts are effective as hedges from an economic perspective, they do not qualify for hedge account<strong>in</strong>gand accord<strong>in</strong>gly these are accounted as derivatives <strong>in</strong>struments at fair value with changes <strong>in</strong> fair value recorded<strong>in</strong> the profit and loss account. Exchange loss of Rs. 400.49 crores (March 31, 2008: exchange ga<strong>in</strong> Rs. 283.76crores) on foreign exchange forward contracts and currency option contracts have been recognised <strong>in</strong> the yearended March 31, 2009.As of balance sheet date, the Company has net foreign currency exposures that are not hedged by a derivative<strong>in</strong>strument or otherwise amount<strong>in</strong>g to Rs.1209.54 crores. (March 31, 2008: Rs. 1717.17 crores).28) Disclosure required by Clause 32 of the List<strong>in</strong>g AgreementAmount of loans and advances <strong>in</strong> nature of loans outstand<strong>in</strong>g from subsidiaries for the year ended March 31, 2009.Subsidiary Company Outstand<strong>in</strong>g as at Maximum AmountMarch 31, 2009 outstand<strong>in</strong>g dur<strong>in</strong>g the year(Rs. <strong>in</strong> crores)(Rs. <strong>in</strong> crores)MP Onl<strong>in</strong>e Limited 1.70 1.701.70 1.70Tata Consultancy Services Asia Pacific Pte Ltd. * - 45.7537.10 40.21TCS FNS Pty Limited ** 187.97 216.99185.16 189.76TCS Iberoamerica SA *** 300.05 301.25186.89 186.89CMC Limited **** 34.49 34.4928.93 28.93Tata Consultancy Services Morocco SARL AU 12.05 12.104.15 4.15152