Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

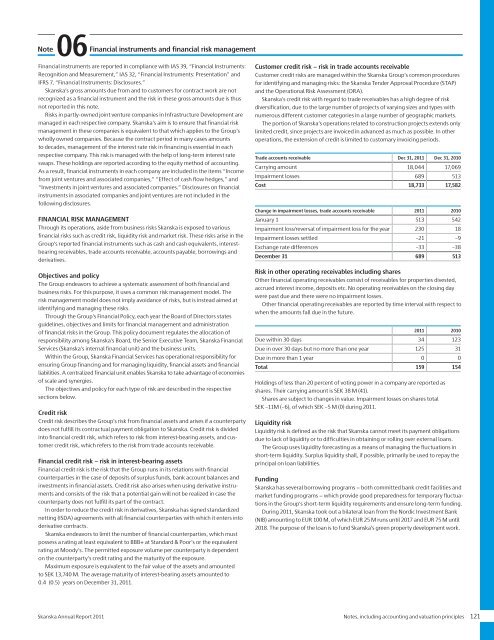

06NoteFinancial instruments and financial risk managementFinancial instruments are reported in compliance with IAS 39, “Financial Instruments:Recognition and Measurement,” IAS 32, “Financial Instruments: Presentation” andIFRS 7, “Financial Instruments: Disclosures.”<strong>Skanska</strong>’s gross amounts due from and to customers for contract work are notrecognized as a financial instrument and the risk in these gross amounts due is thusnot reported in this note.Risks in partly-owned joint venture companies in Infrastructure Development aremanaged in each respective company. <strong>Skanska</strong>’s aim is to ensure that financial riskmanagement in these companies is equivalent to that which applies to the Group’swholly owned companies. Because the contract period in many cases amountsto decades, management of the interest rate risk in financing is essential in eachrespective company. This risk is managed with the help of long-term interest rateswaps. These holdings are reported according to the equity method of accounting.As a result, financial instruments in each company are included in the items “Incomefrom joint ventures and associated companies,” “Effect of cash flow hedges,” and“Investments in joint ventures and associated companies.” Disclosures on financialinstruments in associated companies and joint ventures are not included in thefollowing disclosures.FINANCIAL RISK MANAGEMENTThrough its operations, aside from business risks <strong>Skanska</strong> is exposed to variousfinancial risks such as credit risk, liquidity risk and market risk. These risks arise in theGroup’s reported financial instruments such as cash and cash equivalents, interestbearingreceivables, trade accounts receivable, accounts payable, borrowings andderivatives.Customer credit risk − risk in trade accounts receivableCustomer credit risks are managed within the <strong>Skanska</strong> Group’s common proceduresfor identifying and managing risks: the <strong>Skanska</strong> Tender Approval Procedure (STAP)and the Operational Risk Assessment (ORA).<strong>Skanska</strong>’s credit risk with regard to trade receivables has a high degree of riskdiversification, due to the large number of projects of varying sizes and types withnumerous different customer categories in a large number of geographic markets.The portion of <strong>Skanska</strong>’s operations related to construction projects extends onlylimited credit, since projects are invoiced in advanced as much as possible. In otheroperations, the extension of credit is limited to customary invoicing periods.Trade accounts receivable Dec 31, <strong>2011</strong> Dec 31, 2010Carrying amount 18,044 17,069Impairment losses 689 513Cost 18,733 17,582Change in impairment losses, trade accounts receivable <strong>2011</strong> 2010January 1 513 542Impairment loss/reversal of impairment loss for the year 230 18Impairment losses settled –21 –9Exchange rate differences –33 –38December 31 689 513Objectives and policyThe Group endeavors to achieve a systematic assessment of both financial andbusiness risks. For this purpose, it uses a common risk management model. Therisk management model does not imply avoidance of risks, but is instead aimed atidentifying and managing these risks.Through the Group’s Financial Policy, each year the Board of Directors statesguidelines, objectives and limits for financial management and administrationof financial risks in the Group. This policy document regulates the allocation ofresponsibility among <strong>Skanska</strong>’s Board, the Senior Executive Team, <strong>Skanska</strong> FinancialServices (<strong>Skanska</strong>’s internal financial unit) and the business units.Within the Group, <strong>Skanska</strong> Financial Services has operational responsibility forensuring Group financing and for managing liquidity, financial assets and financialliabilities. A centralized financial unit enables <strong>Skanska</strong> to take advantage of economiesof scale and synergies.The objectives and policy for each type of risk are described in the respectivesections below.Credit riskCredit risk describes the Group’s risk from financial assets and arises if a counterpartydoes not fulfill its contractual payment obligation to <strong>Skanska</strong>. Credit risk is dividedinto financial credit risk, which refers to risk from interest-bearing assets, and customercredit risk, which refers to the risk from trade accounts receivable.Financial credit risk − risk in interest-bearing assetsFinancial credit risk is the risk that the Group runs in its relations with financialcounterparties in the case of deposits of surplus funds, bank account balances andinvestments in financial assets. Credit risk also arises when using derivative instrumentsand consists of the risk that a potential gain will not be realized in case thecounterparty does not fulfill its part of the contract.In order to reduce the credit risk in derivatives, <strong>Skanska</strong> has signed standardizednetting (ISDA) agreements with all financial counterparties with which it enters intoderivative contracts.<strong>Skanska</strong> endeavors to limit the number of financial counterparties, which mustpossess a rating at least equivalent to BBB+ at Standard & Poor’s or the equivalentrating at Moody’s. The permitted exposure volume per counterparty is dependenton the counterparty’s credit rating and the maturity of the exposure.Maximum exposure is equivalent to the fair value of the assets and amountedto SEK 13,740 M. The average maturity of interest-bearing assets amounted to0.4 (0.5) years on December 31, <strong>2011</strong>.Risk in other operating receivables including sharesOther financial operating receivables consist of receivables for properties divested,accrued interest income, deposits etc. No operating receivables on the closing daywere past due and there were no impairment losses.Other financial operating receivables are reported by time interval with respect towhen the amounts fall due in the future.<strong>2011</strong> 2010Due within 30 days 34 123Due in over 30 days but no more than one year 125 31Due in more than 1 year 0 0Total 159 154Holdings of less than 20 percent of voting power in a company are reported asshares. Their carrying amount is SEK 38 M (41).Shares are subject to changes in value. Impairment losses on shares totalSEK –11M (–6), of which SEK –5 M (0) during <strong>2011</strong>.Liquidity riskLiquidity risk is defined as the risk that <strong>Skanska</strong> cannot meet its payment obligationsdue to lack of liquidity or to difficulties in obtaining or rolling over external loans.The Group uses liquidity forecasting as a means of managing the fluctuations inshort-term liquidity. Surplus liquidity shall, if possible, primarily be used to repay theprincipal on loan liabilities.Funding<strong>Skanska</strong> has several borrowing programs − both committed bank credit facilities andmarket funding programs − which provide good preparedness for temporary fluctuationsin the Group’s short-term liquidity requirements and ensure long-term funding.During <strong>2011</strong>, <strong>Skanska</strong> took out a bilateral loan from the Nordic Investment Bank(NIB) amounting to EUR 100 M, of which EUR 25 M runs until 2017 and EUR 75 M until2018. The purpose of the loan is to fund <strong>Skanska</strong>’s green property development work.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> Notes, including accounting and valuation principles 121