Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

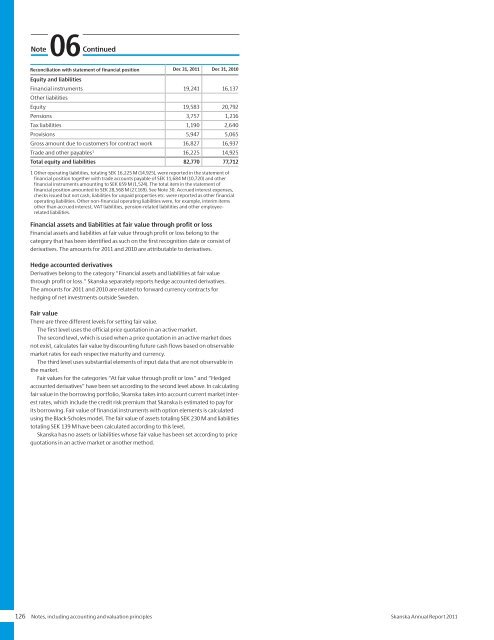

Note06ContinuedReconciliation with statement of financial position Dec 31, <strong>2011</strong> Dec 31, 2010Equity and liabilitiesFinancial instruments 19,241 16,137Other liabilitiesEquity 19,583 20,792Pensions 3,757 1,216Tax liabilities 1,190 2,640Provisions 5,947 5,065Gross amount due to customers for contract work 16,827 16,937Trade and other payables 1 16,225 14,925Total equity and liabilities 82,770 77,7121 Other operating liabilities, totaling SEK 16,225 M (14,925), were reported in the statement offinancial position together with trade accounts payable of SEK 11,684 M (10,720) and otherfinancial instruments amounting to SEK 659 M (1,524). The total item in the statement offinancial position amounted to SEK 28,568 M (27,169). See Note 30. Accrued interest expenses,checks issued but not cash, liabilities for unpaid properties etc. were reported as other financialoperating liabilities. Other non-financial operating liabilities were, for example, interim itemsother than accrued interest, VAT liabilities, pension-related liabilities and other employeerelatedliabilities.Financial assets and liabilities at fair value through profit or lossFinancial assets and liabilities at fair value through profit or loss belong to thecategory that has been identified as such on the first recognition date or consist ofderivatives. The amounts for <strong>2011</strong> and 2010 are attributable to derivatives.Hedge accounted derivativesDerivatives belong to the category “Financial assets and liabilities at fair valuethrough profit or loss.” <strong>Skanska</strong> separately reports hedge accounted derivatives.The amounts for <strong>2011</strong> and 2010 are related to forward currency contracts forhedging of net investments outside Sweden.Fair valueThere are three different levels for setting fair value.The first level uses the official price quotation in an active market.The second level, which is used when a price quotation in an active market doesnot exist, calculates fair value by discounting future cash flows based on observablemarket rates for each respective maturity and currency.The third level uses substantial elements of input data that are not observable inthe market.Fair values for the categories “At fair value through profit or loss” and “Hedgedaccounted derivatives” have been set according to the second level above. In calculatingfair value in the borrowing portfolio, <strong>Skanska</strong> takes into account current market interestrates, which include the credit risk premium that <strong>Skanska</strong> is estimated to pay forits borrowing. Fair value of financial instruments with option elements is calculatedusing the Black-Scholes model. The fair value of assets totaling SEK 230 M and liabilitiestotaling SEK 139 M have been calculated according to this level.<strong>Skanska</strong> has no assets or liabilities whose fair value has been set according to pricequotations in an active market or another method.126 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>