Note16ContinuedTax assets and tax liabilitiesDec 31, <strong>2011</strong> Dec 31, 2010Tax assets 436 506Tax liabilities 263 1 003Net tax assets (+), tax liabilities (–) 173 –497Tax assets and tax liabilities refer to the difference between estimated income taxfor the year and preliminary tax paid as well as income taxes for prior years that havenot yet been settled.Deferred tax assets and deferred tax liabilitiesDec 31, <strong>2011</strong> Dec 31, 2010Deferred tax assets according to the statement offinancial position 1,671 1,472Deferred tax liabilities according to the statement offinancial position 927 1,637Net deferred tax assets (+), deferred tax liabilities (–) 744 –165Dec 31, <strong>2011</strong> Dec 31, 2010Deferred tax assets for loss carry-forwards 371 188Deferred tax assets for other assets 504 460Deferred tax assets for provisions for pensions 938 305Deferred tax assets for ongoing projects 442 530Other deferred tax assets 1,111 1,205Total before net accounting 3,366 2,688Net accounting of offset table deferred taxassets/liabilities –1,695 –1,216Deferred tax assets according to the statementof financial position 1,671 1,472Dec 31, <strong>2011</strong> Dec 31, 2010Deferred tax liabilities for shares and participations 7 256Deferred tax liabilities for other non-current assets 331 297Deferred tax liabilities for other current assets 427 405Deferred tax liabilities for ongoing projects 1,145 1,104Other deferred tax liabilities 712 791Total before net accounting 2,622 2,853Net accounting of offset table deferred taxassets/liabilities –1,695 –1,216Deferred tax liabilities according to the statementof financial position 927 1,637The net amount of deferred tax assets and deferred tax liabilities changed bySEK 909 M from a net liability to a net asset.Deferred tax assets other than for loss carry-forwards refer to temporary differencesbetween carrying amounts for tax purposes and carrying amounts recognizedin the statement of financial position. These differences arise, among other things,when the Group’s valuation principles diverge from those applied locally by a subsidiary.These deferred tax assets are mostly expected to be realized within five years.Deferred tax assets arise, for example, when a recognized depreciation/amortization/impairmentloss on assets becomes deductible for tax purposes only in a laterperiod, when eliminating intra-Group profits, when the provisions for definedbenefitpensions differ between local rules and IAS 19, when the required provisionsbecome tax-deductible in a later period and when advance payments to ongoingprojects are taxed on a cash basis.Deferred tax liabilities on other assets and other deferred tax liabilities refer totemporary differences between carrying amounts for tax purposes and carryingamounts in the statement of financial position. These differences arise, among otherthings, when the Group’s valuation principles diverge from those applied locally bya Group company. These deferred tax liabilities are expected to be mostly realizedwithin five years.For example, deferred tax liabilities arise when depreciation/amortization for taxpurposes in the current period is larger than the required economic depreciation/amortization and when accrued profits in ongoing projects are taxed only when theproject is completed.Temporary differences attributable to investments in Group companies, branches,associated companies and joint ventures for which deferred tax liabilities were notrecognized totaled SEK 0 M (0).In Sweden and a number of other countries, divestments of holdings in limitedcompanies are tax-exempt under certain circumstances. Temporary differences thusdo not normally exist for shareholdings by the Group’s companies in these countries.Temporary differences and loss carry-forwards that are not recognizedas deferred tax assetsDec 31, <strong>2011</strong> Dec 31, 2010Loss carry-forwards that expire within one year 2 0Loss carry-forwards that expire in more thanone year but within three years 188 283Loss carry-forwards that expire in more thanthree years 1,136 863Total 1,326 1,146<strong>Skanska</strong> has loss carry-forwards in a number of different countries. In some of thesecountries, <strong>Skanska</strong> currently has no operations or limited ones. In certain countries,current earnings generation is at such a level that the likelihood that a loss carryforwardcan be utilized is difficult to assess. There may also be limitations on theright to offset loss carry-forwards against income. In these cases, no deferred taxasset is reported for these loss carry-forwards.Change in net deferred tax assets (+), liabilities (–)<strong>2011</strong> 2010Net deferred tax liabilities/assets, January 1 –165 20Divestments of companies 23 61Recognized under other comprehensive income 868 –293Deferred tax benefits 91 137Exchange rate differences –73 –90Net deferred tax liabilities/assets, December 31 744 –165134 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>

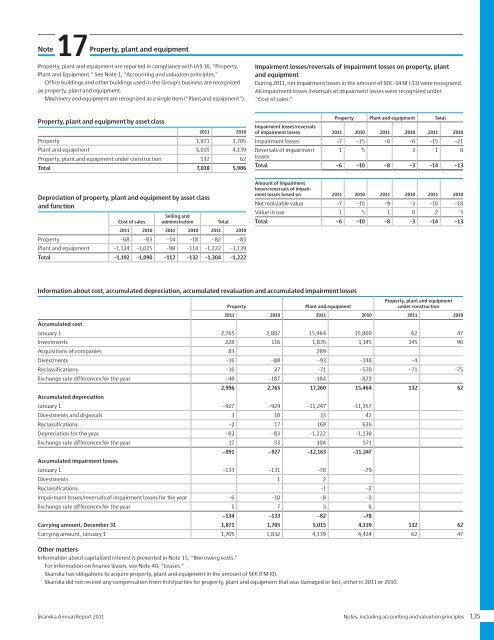

Note17Property, plant and equipmentProperty, plant and equipment are reported in compliance with IAS 16, “Property,Plant and Equipment.” See Note 1, “Accounting and valuation principles.”Office buildings and other buildings used in the Group’s business are recognizedas property, plant and equipment.Machinery and equipment are recognized as a single item (“Plant and equipment”).Impairment losses/reversals of impairment losses on property, plantand equipmentDuring <strong>2011</strong>, net impairment losses in the amount of SEK -14 M (-13) were recognized.All impairment losses /reversals of impairment losses were recognized under“Cost of sales.”Property, plant and equipment by asset class<strong>2011</strong> 2010Property 1,871 1,705Plant and equipment 5,015 4,139Property, plant and equipment under construction 132 62Total 7,018 5,906Depreciation of property, plant and equipment by asset classand functionSelling andCost of sales administrationTotal<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Property –68 –65 –14 –18 –82 –83Plant and equipment –1,124 –1,025 –98 –114 –1,222 –1,139Total –1,192 –1,090 –112 –132 –1,304 –1,222Property Plant and equipment TotalImpairment losses/reversalsof impairment losses <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Impairment losses –7 –15 –8 –6 –15 –21Reversals of impairment 1 5 3 1 8lossesTotal –6 –10 –8 –3 –14 –13Amount of impairmentlosses/reversals of impairmentlosses based on <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Net realizable value –7 –15 –9 –3 –16 –18Value in use 1 5 1 0 2 5Total –6 –10 –8 –3 –14 –13Information about cost, accumulated depreciation, accumulated revaluation and accumulated impairment lossesPropertyPlant and equipmentProperty, plant and equipmentunder construction<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010Accumulated costJanuary 1 2,765 2,887 15,464 15,860 62 47Investments 228 116 1,835 1,145 145 90Acquisitions of companies 83 289Divestments –16 –88 –93 –148 –4Reclassifications –16 37 –71 –570 –71 –75Exchange rate differences for the year –48 –187 –164 –8232,996 2,765 17,260 15,464 132 62Accumulated depreciationJanuary 1 –927 –924 –11,247 –11,357Divestments and disposals 3 10 33 42Reclassifications –2 17 169 636Depreciation for the year –82 –83 –1,222 –1,139Exchange rate differences for the year 17 53 104 571–991 –927 –12,163 –11,247Accumulated impairment lossesJanuary 1 –133 –131 –78 –79Divestments 1 2Reclassifications –1 –2Impairment losses/reversals of impairment losses for the year –6 –10 –8 –3Exchange rate differences for the year 5 7 3 6–134 –133 –82 –78Carrying amount, December 31 1,871 1,705 5,015 4,139 132 62Carrying amount, January 1 1,705 1,832 4,139 4,424 62 47Other mattersInformation about capitalized interest is presented in Note 15, “Borrowing costs.”For information on finance leases, see Note 40, “Leases.”<strong>Skanska</strong> has obligations to acquire property, plant and equipment in the amount of SEK 0 M (0).<strong>Skanska</strong> did not receive any compensation from third parties for property, plant and equipment that was damaged or lost, either in <strong>2011</strong> or 2010.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> Notes, including accounting and valuation principles 135

- Page 1 and 2:

Annual Report 2011

- Page 4 and 5:

NordenÖvriga EuropaIntäkterByggve

- Page 6:

2011 in briefFirst quarterSecond qu

- Page 9 and 10:

In Central Europe, our new green of

- Page 11 and 12:

”The business plan for 2011-2015

- Page 13 and 14:

Return on capital employed 2007−2

- Page 15 and 16:

20,000students participated.Safe ro

- Page 17 and 18:

per day to the blogenabled the gene

- Page 19 and 20:

”The divestment of the Group’s

- Page 21 and 22:

Skanska uses a Groupwide procedure

- Page 23 and 24:

New Karolinska Solna (NKS) , a univ

- Page 25 and 26:

A day on the job with John Crecco,

- Page 27:

A day on the job with Cecilia Fasth

- Page 30 and 31:

20 00010 00001999 2000 2001 2002 20

- Page 32 and 33:

Above left: United Nations Headquar

- Page 34 and 35:

Andel av orderstockenIncreased orde

- Page 36 and 37:

Nordic countriesAndel av orderstock

- Page 38 and 39:

Partihall InterchangeLength: 1,150

- Page 40 and 41:

Other European countriesAndel av or

- Page 42 and 43:

Heron TowerAddress: 110 Bishopsgate

- Page 44 and 45:

The AmericasAndel av orderstockenUS

- Page 46 and 47:

1960 - 20111960: Karl Koch Erecting

- Page 48 and 49:

Above left: Adjutantti, Helsinki, F

- Page 50 and 51:

New Planläggning markets in Poland

- Page 52 and 53:

Nordic countriesSwedenNorwayFinland

- Page 54 and 55:

Other European countriesPolandCzech

- Page 56 and 57:

Above left: Deloitte House, Warsaw,

- Page 58 and 59:

4. Byggande5. Förvaltning3. Uthyrn

- Page 60 and 61:

Norden Europa AmerikaFördelningout

- Page 62 and 63:

LustgårdenKvarteret Lustgården, L

- Page 64 and 65:

EuropaAmerikaFördelningFördelning

- Page 66 and 67:

AmerikaFördelningoutnyttjade Unite

- Page 68 and 69:

Above left: London Hospital, London

- Page 70 and 71:

4. Constructionmanagement3. Leasing

- Page 72 and 73:

Bedömt bruttonuvärdeGeografiKateg

- Page 74 and 75:

A1 Expressway, PolandRoute: Gdańsk

- Page 76 and 77:

Top left: Čertovo břemeno golf cl

- Page 78 and 79:

Skanska’s Journey to Deep Green a

- Page 80 and 81:

Initiatives in the carbon fieldThan

- Page 82 and 83:

876543210Skanska decided at an earl

- Page 84 and 85:

200100Skanska takes the lead0200420

- Page 86 and 87:

Mdr kr175175The Board of Directors

- Page 88 and 89: Operating incomeSEK M 2011 2010Oper

- Page 90 and 91: Investments/DivestmentsSEK M 2011 2

- Page 92 and 93: Certain counterparties − for exam

- Page 94 and 95: The members and deputy members of t

- Page 96 and 97: Aside from day-to-day operations of

- Page 98 and 99: local management teams and were app

- Page 100 and 101: Consolidated income statementSEK M

- Page 102 and 103: Consolidated statement of financial

- Page 104 and 105: Consolidated statement of changes i

- Page 106 and 107: Consolidated cash flow statementCon

- Page 108 and 109: Parent Company balance sheetSEK M N

- Page 110 and 111: Parent Company cash flow statementS

- Page 112 and 113: Note01Consolidated accounting and v

- Page 114 and 115: Note01Continuedcontract premium is

- Page 116 and 117: Note01Continuedintended manner. Exa

- Page 118 and 119: Note01ContinuedIf the terms of a de

- Page 120 and 121: of transfers of resources to a comp

- Page 122 and 123: Note04Continued2011 ConstructionRes

- Page 124 and 125: Note04ContinuedExternal revenue by

- Page 126 and 127: Note06ContinuedSEK M Maturity Curre

- Page 128 and 129: 06NoteContinuedThe role of financia

- Page 130 and 131: Note06ContinuedReconciliation with

- Page 132 and 133: 06NoteContinuedCollateralThe Group

- Page 134 and 135: Note08RevenueNoteProjects in Skansk

- Page 136 and 137: Note13Impairment losses/Reversals o

- Page 140 and 141: Note18GoodwillGoodwill is recognize

- Page 142 and 143: Note20Investments in joint ventures

- Page 144 and 145: Note20ContinuedInformation on the G

- Page 146 and 147: Note22Current-asset properties/Proj

- Page 148 and 149: Note26Equity/earnings per shareIn t

- Page 150 and 151: Note27Financial liabilitiesNoteFina

- Page 152 and 153: NotePension obligations2011 2010Jan

- Page 154 and 155: Note31Specification of interest-bea

- Page 156 and 157: Note33Assets pledged, contingent li

- Page 158 and 159: 34NoteContinuedConsolidated stateme

- Page 160 and 161: 35NoteContinuedRelation between con

- Page 162 and 163: Note37Remuneration to senior execut

- Page 164 and 165: 37NoteContinuedRemuneration and ben

- Page 166 and 167: NoteThe dilution effect through 201

- Page 168 and 169: Note42Consolidatedquarterly results

- Page 170 and 171: Note43Five-yearGroup financial summ

- Page 172 and 173: Financial ratios etc. 4, 5 Dec 31,

- Page 174 and 175: Parent Company notes45NoteFinancial

- Page 176 and 177: Note51Financial non-current assets,

- Page 178 and 179: Note58Liabilities, Parent CompanyLi

- Page 180 and 181: Note63Related party disclosures, Pa

- Page 182 and 183: Auditors’ ReportTo the Annual Sha

- Page 184 and 185: 180 Notes, including accounting and

- Page 186 and 187: Senior Executive TeamJohan Karlstr

- Page 188 and 189:

Board of DirectorsSverker Martin-L

- Page 190 and 191:

Major events during 2011This page s

- Page 192 and 193:

Below are the investments, divestme

- Page 194 and 195:

Definitions and explanationsAverage

- Page 196 and 197:

Annual Shareholders’ MeetingInves

- Page 198 and 199:

1887 Aktiebolaget Skånska Cementgj

- Page 200:

Skanska ABwww.skanska.comRåsundav