Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

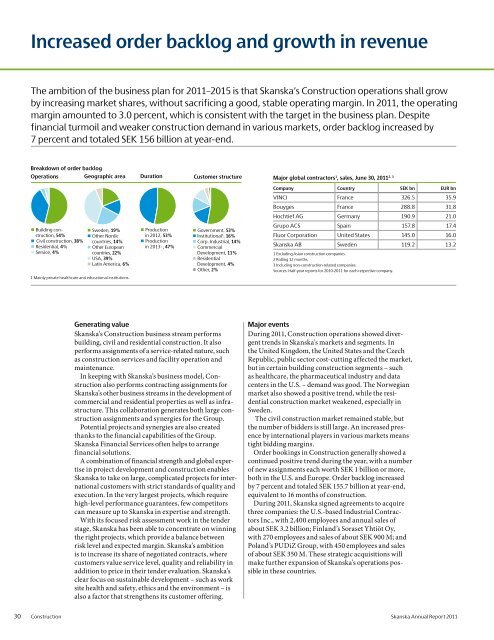

Andel av orderstockenIncreased order backlog and growth in revenueVerksamheterGeografisk fördelningTidsfördelningKundstrukturThe ambition of the business plan for <strong>2011</strong>–2015 is that <strong>Skanska</strong>’s Construction operations shall growby Husbyggande,increasing54%market Sverige, 19% shares, • Produktionwithout sacrificing Stat & kommun, a 53% good, stable operating margin. In <strong>2011</strong>, the operating• Anläggnings-Övr. Norden, 14% under 2012, 53%Institutionermargin amounted to 3.0 percent, • 1) , 16%byggande, 38%Övr. Europa, 22% Produktionwhich Företag, 14%is consistent with the target in the business plan. DespiteBostäder, 4%USA, 39%2013–, 47% • Kommersiella fastighetsutvecklare,11%financial • Service, 4%turmoil • Latinamerika, 6%and weaker construction Bostadsutvecklare,demand4%in various markets, order backlog increased by1) Främst hälsovård och utbildning i privat regi7 percent and totaled SEK 156 billion at• Övrigt, 2%year-end.Breakdown of order backlogOperations Geographic areaDurationCustomer structureMajor global contractors 1 , sales, June 30, <strong>2011</strong> 2, 3Company Country SEK bn EUR bnVINCI France 326.5 35.9Bouyges France 288.8 31.8Hochtief AG Germany 190.9 21.0Grupo ACS Spain 157.8 17.4Fluor Corporation United States 145.0 16.0<strong>Skanska</strong> AB Sweden 119.2 13.2• Building construction,54%• Civil construction, 38%• Residential, 4%• Service, 4%• Sweden, 19%• Other Nordiccountries, 14%• Other Europeancountries, 22%• USA, 39%• Latin America, 6%1 Mainly private healthcare and educational institutions.• Productionin 2012, 53%• Productionin 2013–, 47%Government, 53%Institutional 1 , 16%Corp. Industrial, 14%• CommercialDevelopment, 11%• ResidentialDevelopment, 4%• Other, 2%1 Excluding Asian construction companies.2 Rolling 12 months.3 Including non-construction-related companies.Sources: Half-year reports for 2010-<strong>2011</strong> for each respective company.Generating value<strong>Skanska</strong>’s Construction business stream performsbuilding, civil and residential construction. It alsoperforms assignments of a service-related nature, suchas construction services and facility operation andmaintenance.In keeping with <strong>Skanska</strong>’s business model, Constructionalso performs contracting assignments for<strong>Skanska</strong>’s other business streams in the development ofcommercial and residential properties as well as infrastructure.This collaboration generates both large constructionassignments and synergies for the Group.Potential projects and synergies are also createdthanks to the financial capabilities of the Group.<strong>Skanska</strong> Financial Services often helps to arrangefinancial solutions.A combination of financial strength and global expertisein project development and construction enables<strong>Skanska</strong> to take on large, complicated projects for internationalcustomers with strict standards of quality andexecution. In the very largest projects, which requirehigh-level performance guarantees, few competitorscan measure up to <strong>Skanska</strong> in expertise and strength.With its focused risk assessment work in the tenderstage, <strong>Skanska</strong> has been able to concentrate on winningthe right projects, which provide a balance betweenrisk level and expected margin. <strong>Skanska</strong>’s ambitionis to increase its share of negotiated contracts, wherecustomers value service level, quality and reliability inaddition to price in their tender evaluation. <strong>Skanska</strong>’sclear focus on sustainable development – such as worksite health and safety, ethics and the environment – isalso a factor that strengthens its customer offering.Major eventsDuring <strong>2011</strong>, Construction operations showed divergenttrends in <strong>Skanska</strong>’s markets and segments. Inthe United Kingdom, the United States and the CzechRepublic, public sector cost-cutting affected the market,but in certain building construction segments – suchas healthcare, the pharmaceutical industry and datacenters in the U.S. – demand was good. The Norwegianmarket also showed a positive trend, while the residentialconstruction market weakened, especially inSweden.The civil construction market remained stable, butthe number of bidders is still large. An increased presenceby international players in various markets meanstight bidding margins.Order bookings in Construction generally showed acontinued positive trend during the year, with a numberof new assignments each worth SEK 1 billion or more,both in the U.S. and Europe. Order backlog increasedby 7 percent and totaled SEK 155.7 billion at year-end,equivalent to 16 months of construction.During <strong>2011</strong>, <strong>Skanska</strong> signed agreements to acquirethree companies: the U.S.-based Industrial ContractorsInc., with 2,400 employees and annual sales ofabout SEK 3.2 billion; Finland’s Soraset Yhtiöt Oy,with 270 employees and sales of about SEK 900 M; andPoland’s PUDiZ Group, with 450 employees and salesof about SEK 350 M. These strategic acquisitions willmake further expansion of <strong>Skanska</strong>’s operations possiblein these countries.30 Construction <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>