Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

Annual Report 2011 - Skanska

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

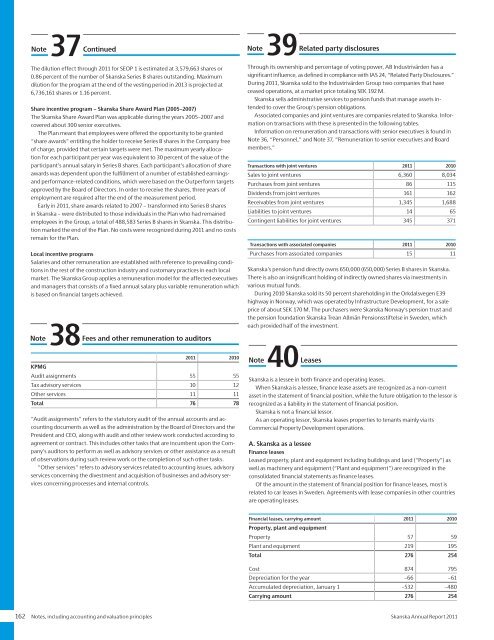

NoteThe dilution effect through <strong>2011</strong> for SEOP 1 is estimated at 3,579,663 shares or0.86 percent of the number of <strong>Skanska</strong> Series B shares outstanding. Maximumdilution for the program at the end of the vesting period in 2013 is projected at6,736,161 shares or 1.16 percent.Share incentive program – <strong>Skanska</strong> Share Award Plan (2005–2007)The <strong>Skanska</strong> Share Award Plan was applicable during the years 2005–2007 andcovered about 300 senior executives.The Plan meant that employees were offered the opportunity to be granted“share awards” entitling the holder to receive Series B shares in the Company freeof charge, provided that certain targets were met. The maximum yearly allocationfor each participant per year was equivalent to 30 percent of the value of theparticipant’s annual salary in Series B shares. Each participant’s allocation of shareawards was dependent upon the fulfillment of a number of established earningsandperformance-related conditions, which were based on the Outperform targetsapproved by the Board of Directors. In order to receive the shares, three years ofemployment are required after the end of the measurement period.Early in <strong>2011</strong>, share awards related to 2007 – transformed into Series B sharesin <strong>Skanska</strong> – were distributed to those individuals in the Plan who had remainedemployees in the Group, a total of 488,583 Series B shares in <strong>Skanska</strong>. This distributionmarked the end of the Plan. No costs were recognized during <strong>2011</strong> and no costsremain for the Plan.Local incentive programsSalaries and other remuneration are established with reference to prevailing conditionsin the rest of the construction industry and customary practices in each localmarket. The <strong>Skanska</strong> Group applies a remuneration model for the affected executivesand managers that consists of a fixed annual salary plus variable remuneration whichis based on financial targets achieved.Note37ContinuedNote38Fees and other remuneration to auditors<strong>2011</strong> 2010KPMGAudit assignments 55 55Tax advisory services 10 12Other services 11 11Total 76 78“Audit assignments” refers to the statutory audit of the annual accounts and accountingdocuments as well as the administration by the Board of Directors and thePresident and CEO, along with audit and other review work conducted according toagreement or contract. This includes other tasks that are incumbent upon the Company’sauditors to perform as well as advisory services or other assistance as a resultof observations during such review work or the completion of such other tasks.“Other services” refers to advisory services related to accounting issues, advisoryservices concerning the divestment and acquisition of businesses and advisory servicesconcerning processes and internal controls.39Related party disclosuresThrough its ownership and percentage of voting power, AB Industrivärden has asignificant influence, as defined in compliance with IAS 24, “Related Party Disclosures.”During <strong>2011</strong>, <strong>Skanska</strong> sold to the Industrivärden Group two companies that haveceased operations, at a market price totaling SEK 192 M.<strong>Skanska</strong> sells administrative services to pension funds that manage assets intendedto cover the Group’s pension obligations.Associated companies and joint ventures are companies related to <strong>Skanska</strong>. Informationon transactions with these is presented in the following tables.Information on remuneration and transactions with senior executives is found inNote 36, “Personnel,” and Note 37, “Remuneration to senior executives and Boardmembers.”Transactions with joint ventures <strong>2011</strong> 2010Sales to joint ventures 6,360 8,034Purchases from joint ventures 86 115Dividends from joint ventures 161 162Receivables from joint ventures 1,345 1,688Liabilities to joint ventures 14 65Contingent liabilities for joint ventures 345 371Transactions with associated companies <strong>2011</strong> 2010Purchases from associated companies 15 11<strong>Skanska</strong>’s pension fund directly owns 650,000 (650,000) Series B shares in <strong>Skanska</strong>.There is also an insignificant holding of indirectly owned shares via investments invarious mutual funds.During 2010 <strong>Skanska</strong> sold its 50 percent shareholding in the Orkdalsvegen E39highway in Norway, which was operated by Infrastructure Development, for a saleprice of about SEK 170 M. The purchasers were <strong>Skanska</strong> Norway’s pension trust andthe pension foundation <strong>Skanska</strong> Trean Allmän Pensionsstiftelse in Sweden, whicheach provided half of the investment.Note40Leases<strong>Skanska</strong> is a lessee in both finance and operating leases.When <strong>Skanska</strong> is a lessee, finance lease assets are recognized as a non-currentasset in the statement of financial position, while the future obligation to the lessor isrecognized as a liability in the statement of financial position.<strong>Skanska</strong> is not a financial lessor.As an operating lessor, <strong>Skanska</strong> leases properties to tenants mainly via itsCommercial Property Development operations.A. <strong>Skanska</strong> as a lesseeFinance leasesLeased property, plant and equipment including buildings and land (“Property”) aswell as machinery and equipment (“Plant and equipment”) are recognized in theconsolidated financial statements as finance leases.Of the amount in the statement of financial position for finance leases, most isrelated to car leases in Sweden. Agreements with lease companies in other countriesare operating leases.Financial leases, carrying amount <strong>2011</strong> 2010Property, plant and equipmentProperty 57 59Plant and equipment 219 195Total 276 254Cost 874 795Depreciation for the year –66 –61Accumulated depreciation, January 1 –532 –480Carrying amount 276 254162 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>