Investments/DivestmentsSEK M <strong>2011</strong> 2010Operations – InvestmentsIntangible assets –70 –72Property, plant and equipment –2,206 –1,338Assets in Infrastructure Development –988 –692Shares –366 –155Current-asset properties –10,773 –8,492of which Residential Development –7,288 –5,367of which Commercial Property Development –3,485 –3,125Investments –14,403 –10,749Operations – DivestmentsIntangible assets 1 4Property, plant and equipment 198 240Assets in Infrastructure Development 5,808 403Shares 4 16Current-asset properties 9,518 11,955of which Residential Development 5,696 5,366of which Commercial Property Development 3,822 6,589Divestments 15,529 12,618Net investments/divestments in operations 1,126 1,869Strategic investments ,Acquisitions of businesses –1,444 0Strategic investments –1,444 0Strategic divestmentsDivestments of businesses 0 4Divestments of shares 0 –19Strategic divestments 0 –15Net strategic investments/divestments –1,444 –15Total net investments/divestments –318 1,854Depreciation/amortization, non-current assets –1,393 –1,301The Group’s investments totaled SEK –15,847 M (–10,749). Of this,SEK –1,444 M (0) was related to acquisitions of businesses, which refersprimarily to the acquisition of U.S.-based Industrial Contractors andthe acquisitions of Finland’s Soraset Yhtiöt Oy and Poland’s PUDiZGroup. Divestments totaled SEK 15,529 M (12,603), and the Group’snet divestments amounted to SEK –318 M (1,854).Investments in property, plant and equipment, which mainly consistedof continuous replacement investments in operations, amounted toSEK –2,206 M (–1,338). Divestments of property, plant and equipmentamounted to SEK 198 M (240).Depreciation on property, plant and equipment amounted toSEK –1,304 M (–1,222).Net investments in current-asset properties amounted toSEK –1,255 M (3,463). Projects were sold for SEK 9,518 M (11,955),while investments amounted to SEK –10,773 M (–8,492).In Residential Development, investments in current-asset propertiesamounted to SEK –7,288 M (–5,367) and total investments amountedto SEK –7,688 M (–5,562), of which about SEK –1,346 M (–1,876) wasrelated to acquisitions of land equivalent to 5,442 building rights.Total investments also included shares and participations in associatedcompanies, such as Täby Galopp, a future residential area outsideStockholm, which represented investments of SEK –329 M. Completedhomes were sold for SEK 5,696 M (5,366).In Commercial Property Development, investments in current-assetproperties amounted to SEK 3,485 M (–3,125), and total investmentsamounted to SEK –3,493 M (–3,147). Of this, SEK –1,027 M (–806) wasrelated to investments in land. Divestments of current-asset propertiestotaled SEK 3,822 M (6,589). Net divestments of current-asset propertiesin Commercial Property Development amounted to SEK 337 M(3,464).Investments in the form of equity and subordinated loans in InfrastructureDevelopment amounted to SEK –988 M (–692). Divestments,which largely refer to the Autopista Central in Chile, but also theAntofagasta highway in Chile and the Midlothian Schools in the U.K.,amounted to SEK 5,808 M (403). Net divestments in InfrastructureDevelopment totaled SEK 4,820 M (–289).Cash flowThe Group’s operating cash flowSEK M <strong>2011</strong> 2010Cash flow from business operations before changein working capital 3,309 4,528Change in working capital –443 48Net investments/divestments in the business 1,126 1,869Adjustments in payment dates of net investments 368 –160Taxes paid in business operations –1,758 –1,655Cash flow from business operations 2,602 4,630Net interest items and other financial items –154 –62Taxes paid in financial activities 46 19Cash flow from financial activities –108 –43Cash flow from operations 2,494 4,587Strategic net investments –1,444 –15Taxes paid on strategic divestments 0 0Cash flow from strategic divestments –1,444 –15Dividend etc 1 –5,096 –2,873Cash flow before change in interest-bearing receivablesand liabilities –4,046 1,699Change in interest-bearing receivables and liabilities 2,771 –4,199Cash flow for the year –1,275 –2,500Cash and cash equivalents, January 1 6,654 9,409Exchange rate differences in cash and cash equivalents–70 –255Cash and cash equivalents, December 31 5,309 6,6541 Of which repurchases of shares –184 –252Cash flow for the year amounted to SEK –1,275 M (–2,500).Reduced cash flows from a majority of the units in all businessstreams contributed to the decrease in cash flow from business operationsbefore change in working capital to SEK 3,309 M (4,528).Tied-up working capital increased during the year, and the changeamounted to SEK –443 M (48).Overall, net divestments in business operations decreased bySEK 743 M to SEK 1,126 M (1,869), despite the divestment of theAutopista Central. This was due, among other things, to increasedinvestments in Residential Development.Taxes paid in business operations amounted to SEK –1,758 M(–1,655).Change in interest-bearing receivables and liabilities amounted toSEK 2,771 M (–4,199).Cash flow for the year, SEK –1,275 M (–2,500), together withexchange rate differences of SEK –70 M (–255) decreased cash and cashequivalents to SEK 5,309 M (6,654).86 <strong>Report</strong> of the Directors <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>

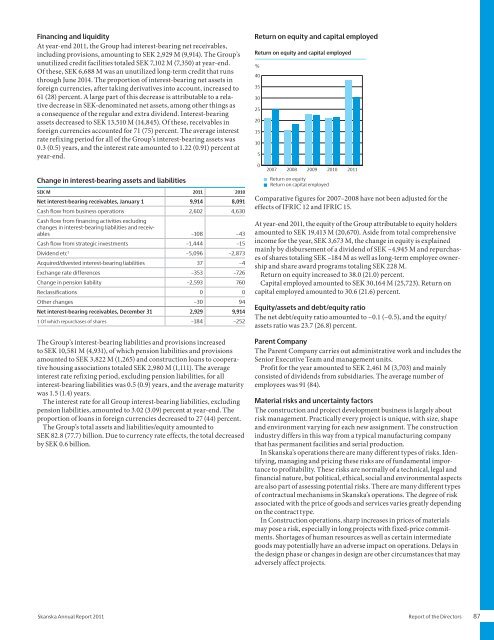

Avkastning på eget kapital•Avkastning på sysselsatt kapitalFinancing and liquidityAt year-end <strong>2011</strong>, the Group had interest-bearing net receivables,including provisions, amounting to SEK 2,929 M (9,914). The Group’sunutilized credit facilities totaled SEK 7,102 M (7,350) at year-end.Of these, SEK 6,688 M was an unutilized long-term credit that runsthrough June 2014. The proportion of interest-bearing net assets inforeign currencies, after taking derivatives into account, increased to61 (28) percent. A large part of this decrease is attributable to a relativedecrease in SEK-denominated net assets, among other things asa consequence of the regular and extra dividend. Interest-bearingassets decreased to SEK 13,510 M (14,845). Of these, receivables inforeign currencies accounted for 71 (75) percent. The average interestrate refixing period for all of the Group’s interest-bearing assets was0.3 (0.5) years, and the interest rate amounted to 1.22 (0.91) percent atyear-end.Change in interest-bearing assets and liabilitiesSEK M <strong>2011</strong> 2010Net interest-bearing receivables, January 1 9,914 8,091Cash flow from business operations 2,602 4,630Cash flow from financing activities excludingchanges in interest-bearing liabilities and receivables–108 –43Cash flow from strategic investments –1,444 –15Dividend etc 1 –5,096 –2,873Acquired/divested interest-bearing liabilities 37 –4Exchange rate differences –353 –726Change in pension liability –2,593 760Reclassifications 0 0Other changes –30 94Net interest-bearing receivables, December 31 2,929 9,9141 Of which repurchases of shares –184 –252The Group’s interest-bearing liabilities and provisions increasedto SEK 10,581 M (4,931), of which pension liabilities and provisionsamounted to SEK 3,822 M (1,265) and construction loans to cooperativehousing associations totaled SEK 2,980 M (1,111). The averageinterest rate refixing period, excluding pension liabilities, for allinterest-bearing liabilities was 0.5 (0.9) years, and the average maturitywas 1.5 (1.4) years.The interest rate for all Group interest-bearing liabilities, excludingpension liabilities, amounted to 3.02 (3.09) percent at year-end. Theproportion of loans in foreign currencies decreased to 27 (44) percent.The Group’s total assets and liabilities/equity amounted toSEK 82.8 (77.7) billion. Due to currency rate effects, the total decreasedby SEK 0.6 billion.Return on equity and capital employedReturn on equity and capital employed%40353025201510502007•20082009Return on equityReturn on capital employed2010<strong>2011</strong>Comparative figures for 2007–2008 have not been adjusted for theeffects of IFRIC 12 and IFRIC 15.At year-end <strong>2011</strong>, the equity of the Group attributable to equity holdersamounted to SEK 19,413 M (20,670). Aside from total comprehensiveincome for the year, SEK 3,673 M, the change in equity is explainedmainly by disbursement of a dividend of SEK –4,945 M and repurchasesof shares totaling SEK –184 M as well as long-term employee ownershipand share award programs totaling SEK 228 M.Return on equity increased to 38.0 (21.0) percent.Capital employed amounted to SEK 30,164 M (25,723). Return oncapital employed amounted to 30.6 (21.6) percent.Equity/assets and debt/equity ratioThe net debt/equity ratio amounted to –0.1 (–0.5), and the equity/assets ratio was 23.7 (26.8) percent.Parent CompanyThe Parent Company carries out administrative work and includes theSenior Executive Team and management units.Profit for the year amounted to SEK 2,461 M (3,703) and mainlyconsisted of dividends from subsidiaries. The average number ofemployees was 91 (84).Material risks and uncertainty factorsThe construction and project development business is largely aboutrisk management. Practically every project is unique, with size, shapeand environment varying for each new assignment. The constructionindustry differs in this way from a typical manufacturing companythat has permanent facilities and serial production.In <strong>Skanska</strong>’s operations there are many different types of risks. Identifying,managing and pricing these risks are of fundamental importanceto profitability. These risks are normally of a technical, legal andfinancial nature, but political, ethical, social and environmental aspectsare also part of assessing potential risks. There are many different typesof contractual mechanisms in <strong>Skanska</strong>’s operations. The degree of riskassociated with the price of goods and services varies greatly dependingon the contract type.In Construction operations, sharp increases in prices of materialsmay pose a risk, especially in long projects with fixed-price commitments.Shortages of human resources as well as certain intermediategoods may potentially have an adverse impact on operations. Delays inthe design phase or changes in design are other circumstances that mayadversely affect projects.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> <strong>Report</strong> of the Directors 87

- Page 1 and 2:

Annual Report 2011

- Page 4 and 5:

NordenÖvriga EuropaIntäkterByggve

- Page 6:

2011 in briefFirst quarterSecond qu

- Page 9 and 10:

In Central Europe, our new green of

- Page 11 and 12:

”The business plan for 2011-2015

- Page 13 and 14:

Return on capital employed 2007−2

- Page 15 and 16:

20,000students participated.Safe ro

- Page 17 and 18:

per day to the blogenabled the gene

- Page 19 and 20:

”The divestment of the Group’s

- Page 21 and 22:

Skanska uses a Groupwide procedure

- Page 23 and 24:

New Karolinska Solna (NKS) , a univ

- Page 25 and 26:

A day on the job with John Crecco,

- Page 27:

A day on the job with Cecilia Fasth

- Page 30 and 31:

20 00010 00001999 2000 2001 2002 20

- Page 32 and 33:

Above left: United Nations Headquar

- Page 34 and 35:

Andel av orderstockenIncreased orde

- Page 36 and 37:

Nordic countriesAndel av orderstock

- Page 38 and 39:

Partihall InterchangeLength: 1,150

- Page 40 and 41: Other European countriesAndel av or

- Page 42 and 43: Heron TowerAddress: 110 Bishopsgate

- Page 44 and 45: The AmericasAndel av orderstockenUS

- Page 46 and 47: 1960 - 20111960: Karl Koch Erecting

- Page 48 and 49: Above left: Adjutantti, Helsinki, F

- Page 50 and 51: New Planläggning markets in Poland

- Page 52 and 53: Nordic countriesSwedenNorwayFinland

- Page 54 and 55: Other European countriesPolandCzech

- Page 56 and 57: Above left: Deloitte House, Warsaw,

- Page 58 and 59: 4. Byggande5. Förvaltning3. Uthyrn

- Page 60 and 61: Norden Europa AmerikaFördelningout

- Page 62 and 63: LustgårdenKvarteret Lustgården, L

- Page 64 and 65: EuropaAmerikaFördelningFördelning

- Page 66 and 67: AmerikaFördelningoutnyttjade Unite

- Page 68 and 69: Above left: London Hospital, London

- Page 70 and 71: 4. Constructionmanagement3. Leasing

- Page 72 and 73: Bedömt bruttonuvärdeGeografiKateg

- Page 74 and 75: A1 Expressway, PolandRoute: Gdańsk

- Page 76 and 77: Top left: Čertovo břemeno golf cl

- Page 78 and 79: Skanska’s Journey to Deep Green a

- Page 80 and 81: Initiatives in the carbon fieldThan

- Page 82 and 83: 876543210Skanska decided at an earl

- Page 84 and 85: 200100Skanska takes the lead0200420

- Page 86 and 87: Mdr kr175175The Board of Directors

- Page 88 and 89: Operating incomeSEK M 2011 2010Oper

- Page 92 and 93: Certain counterparties − for exam

- Page 94 and 95: The members and deputy members of t

- Page 96 and 97: Aside from day-to-day operations of

- Page 98 and 99: local management teams and were app

- Page 100 and 101: Consolidated income statementSEK M

- Page 102 and 103: Consolidated statement of financial

- Page 104 and 105: Consolidated statement of changes i

- Page 106 and 107: Consolidated cash flow statementCon

- Page 108 and 109: Parent Company balance sheetSEK M N

- Page 110 and 111: Parent Company cash flow statementS

- Page 112 and 113: Note01Consolidated accounting and v

- Page 114 and 115: Note01Continuedcontract premium is

- Page 116 and 117: Note01Continuedintended manner. Exa

- Page 118 and 119: Note01ContinuedIf the terms of a de

- Page 120 and 121: of transfers of resources to a comp

- Page 122 and 123: Note04Continued2011 ConstructionRes

- Page 124 and 125: Note04ContinuedExternal revenue by

- Page 126 and 127: Note06ContinuedSEK M Maturity Curre

- Page 128 and 129: 06NoteContinuedThe role of financia

- Page 130 and 131: Note06ContinuedReconciliation with

- Page 132 and 133: 06NoteContinuedCollateralThe Group

- Page 134 and 135: Note08RevenueNoteProjects in Skansk

- Page 136 and 137: Note13Impairment losses/Reversals o

- Page 138 and 139: Note16ContinuedTax assets and tax l

- Page 140 and 141:

Note18GoodwillGoodwill is recognize

- Page 142 and 143:

Note20Investments in joint ventures

- Page 144 and 145:

Note20ContinuedInformation on the G

- Page 146 and 147:

Note22Current-asset properties/Proj

- Page 148 and 149:

Note26Equity/earnings per shareIn t

- Page 150 and 151:

Note27Financial liabilitiesNoteFina

- Page 152 and 153:

NotePension obligations2011 2010Jan

- Page 154 and 155:

Note31Specification of interest-bea

- Page 156 and 157:

Note33Assets pledged, contingent li

- Page 158 and 159:

34NoteContinuedConsolidated stateme

- Page 160 and 161:

35NoteContinuedRelation between con

- Page 162 and 163:

Note37Remuneration to senior execut

- Page 164 and 165:

37NoteContinuedRemuneration and ben

- Page 166 and 167:

NoteThe dilution effect through 201

- Page 168 and 169:

Note42Consolidatedquarterly results

- Page 170 and 171:

Note43Five-yearGroup financial summ

- Page 172 and 173:

Financial ratios etc. 4, 5 Dec 31,

- Page 174 and 175:

Parent Company notes45NoteFinancial

- Page 176 and 177:

Note51Financial non-current assets,

- Page 178 and 179:

Note58Liabilities, Parent CompanyLi

- Page 180 and 181:

Note63Related party disclosures, Pa

- Page 182 and 183:

Auditors’ ReportTo the Annual Sha

- Page 184 and 185:

180 Notes, including accounting and

- Page 186 and 187:

Senior Executive TeamJohan Karlstr

- Page 188 and 189:

Board of DirectorsSverker Martin-L

- Page 190 and 191:

Major events during 2011This page s

- Page 192 and 193:

Below are the investments, divestme

- Page 194 and 195:

Definitions and explanationsAverage

- Page 196 and 197:

Annual Shareholders’ MeetingInves

- Page 198 and 199:

1887 Aktiebolaget Skånska Cementgj

- Page 200:

Skanska ABwww.skanska.comRåsundav