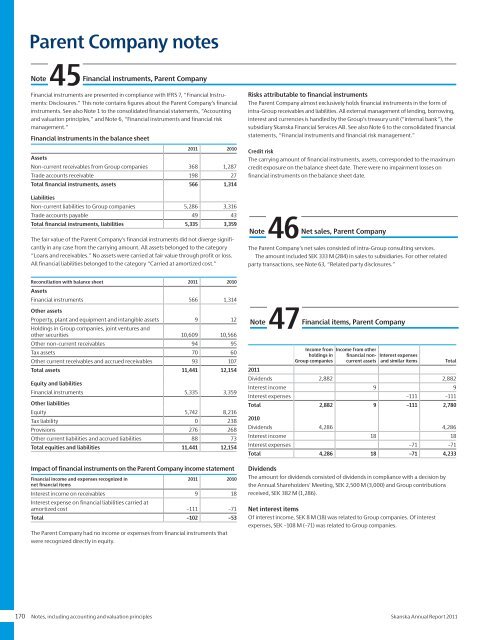

Parent Company notes45NoteFinancial instruments, Parent CompanyFinancial instruments are presented in compliance with IFRS 7, “Financial Instruments:Disclosures.” This note contains figures about the Parent Company’s financialinstruments. See also Note 1 to the consolidated financial statements, “Accountingand valuation principles,” and Note 6, “Financial instruments and financial riskmanagement.”Financial instruments in the balance sheet<strong>2011</strong> 2010AssetsNon-current receivables from Group companies 368 1,287Trade accounts receivable 198 27Total financial instruments, assets 566 1,314LiabilitiesNon-current liabilities to Group companies 5,286 3,316Trade accounts payable 49 43Total financial instruments, liabilities 5,335 3,359The fair value of the Parent Company’s financial instruments did not diverge significantlyin any case from the carrying amount. All assets belonged to the category“Loans and receivables.” No assets were carried at fair value through profit or loss.All financial liabilities belonged to the category “Carried at amortized cost.”Risks attributable to financial instrumentsThe Parent Company almost exclusively holds financial instruments in the form ofintra-Group receivables and liabilities. All external management of lending, borrowing,interest and currencies is handled by the Group’s treasury unit (“internal bank”), thesubsidiary <strong>Skanska</strong> Financial Services AB. See also Note 6 to the consolidated financialstatements, “Financial instruments and financial risk management.”Credit riskThe carrying amount of financial instruments, assets, corresponded to the maximumcredit exposure on the balance sheet date. There were no impairment losses onfinancial instruments on the balance sheet date.46NoteNet sales, Parent CompanyThe Parent Company’s net sales consisted of intra-Group consulting services.The amount included SEK 333 M (284) in sales to subsidiaries. For other relatedparty transactions, see Note 63, “Related party disclosures.”Reconciliation with balance sheet <strong>2011</strong> 2010AssetsFinancial instruments 566 1,314Other assetsProperty, plant and equipment and intangible assets 9 12Holdings in Group companies, joint ventures andother securities 10,609 10,566Other non-current receivables 94 95Tax assets 70 60Other current receivables and accrued receivables 93 107Total assets 11,441 12,154Equity and liabilitiesFinancial instruments 5,335 3,359Other liabilitiesEquity 5,742 8,216Tax liability 0 238Provisions 276 268Other current liabilities and accrued liabilities 88 73Total equities and liabilities 11,441 12,154Impact of financial instruments on the Parent Company income statementFinancial income and expenses recognized in<strong>2011</strong> 2010net financial itemsInterest income on receivables 9 18Interest expense on financial liabilities carried atamortized cost –111 –71Total –102 –53The Parent Company had no income or expenses from financial instruments thatwere recognized directly in equity.Note47Financialitems, Parent CompanyIncome from Income from otherholdings inGroup companiesfinancial noncurrentassetsInterest expensesand similar itemsTotal<strong>2011</strong>Dividends 2,882 2,882Interest income 9 9Interest expenses –111 –111Total 2,882 9 –111 2,7802010Dividends 4,286 4,286Interest income 18 18Interest expenses –71 –71Total 4,286 18 –71 4,233DividendsThe amount for dividends consisted of dividends in compliance with a decision bythe <strong>Annual</strong> Shareholders’ Meeting, SEK 2,500 M (3,000) and Group contributionsreceived, SEK 382 M (1,286).Net interest itemsOf interest income, SEK 8 M (18) was related to Group companies. Of interestexpenses, SEK –108 M (–71) was related to Group companies.170 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>

Note48Income taxes, Parent Company<strong>2011</strong> 2010Current taxes 0 –229Deferred tax expenses/income from change in temporarydifferences 0 –1Total 0 –230The relation between the Swedish tax rate of 26.3 percent and taxes recognized isexplained in the table below.<strong>2011</strong> 2010Income after financial items 2,461 3,933Tax at tax rate of 26.3 (26.3) percent –647 –1 035Tax effect of:Dividends from subsidiaries 658 789Employee-related expenses –1 –1Other non-deductible expenses –10 –4Change in tax assessment 0 21Recognized tax expense 0 –230Deferred tax assets <strong>2011</strong> 2010Deferred tax assets for employee-related provisions 62 62Minus deferred tax liabilities for holdings –2 –2Total 60 60Change in deferred taxes in balance sheet<strong>2011</strong> 2010Deferred tax assets, January 60 61Deferred tax expense/income 0 –1Deferred tax assets, December 31 60 60The Parent Company expects to be able to utilize deferred tax assets to offset Groupcontributions from Swedish operating subsidiaries.49NoteIntangible assets, Parent CompanyIntangible assets are reported in compliance with IAS 38, “Intangible assets.” See Note 1, “Accounting and valuation principles.”Amortization of intangible assets amounted to SEK –2 M (–2) during the year andwas included in selling and administrative expenses.In determining the amortization amount, the Parent Company paid particularattention to estimated residual value at the end of useful life.Intangible assets<strong>2011</strong> 2010Accumulated costJanuary 1 10 26Acquisitions 0 5Disposals 0 –2110 10Accumulated amortizationJanuary 1 –1 –9Amortization for the year –2 –2Disposals for the year 0 10–3 –1Accumulated impairment lossesJanuary 1 0 00 0Carrying amount, December 31 7 9Carrying amount, January 1 9 1750NoteProperty, plant and equipment, Parent CompanyProperty, plant and equipment are reported in compliance with IAS 16, “Property,Plant and Equipment.” See Note 1, “Accounting and valuation principles.”Machinery and equipment owned by the Parent Company are recognized asproperty, plant and equipment.The year’s depreciation on property, plant and equipment amounted to SEK –1 M(–1) and was included in selling and administrative expenses.Machinery and equipment<strong>2011</strong> 2010Accumulated costJanuary 1 5 3Additions 0 2Disposals5 5Accumulated depreciationJanuary 1 –2 –1Depreciation for the year –1 –1Disposals for the year–3 –2Carrying amount, December 31 2 3Carrying amount, January 1 3 2<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> Notes, including accounting and valuation principles 171

- Page 1 and 2:

Annual Report 2011

- Page 4 and 5:

NordenÖvriga EuropaIntäkterByggve

- Page 6:

2011 in briefFirst quarterSecond qu

- Page 9 and 10:

In Central Europe, our new green of

- Page 11 and 12:

”The business plan for 2011-2015

- Page 13 and 14:

Return on capital employed 2007−2

- Page 15 and 16:

20,000students participated.Safe ro

- Page 17 and 18:

per day to the blogenabled the gene

- Page 19 and 20:

”The divestment of the Group’s

- Page 21 and 22:

Skanska uses a Groupwide procedure

- Page 23 and 24:

New Karolinska Solna (NKS) , a univ

- Page 25 and 26:

A day on the job with John Crecco,

- Page 27:

A day on the job with Cecilia Fasth

- Page 30 and 31:

20 00010 00001999 2000 2001 2002 20

- Page 32 and 33:

Above left: United Nations Headquar

- Page 34 and 35:

Andel av orderstockenIncreased orde

- Page 36 and 37:

Nordic countriesAndel av orderstock

- Page 38 and 39:

Partihall InterchangeLength: 1,150

- Page 40 and 41:

Other European countriesAndel av or

- Page 42 and 43:

Heron TowerAddress: 110 Bishopsgate

- Page 44 and 45:

The AmericasAndel av orderstockenUS

- Page 46 and 47:

1960 - 20111960: Karl Koch Erecting

- Page 48 and 49:

Above left: Adjutantti, Helsinki, F

- Page 50 and 51:

New Planläggning markets in Poland

- Page 52 and 53:

Nordic countriesSwedenNorwayFinland

- Page 54 and 55:

Other European countriesPolandCzech

- Page 56 and 57:

Above left: Deloitte House, Warsaw,

- Page 58 and 59:

4. Byggande5. Förvaltning3. Uthyrn

- Page 60 and 61:

Norden Europa AmerikaFördelningout

- Page 62 and 63:

LustgårdenKvarteret Lustgården, L

- Page 64 and 65:

EuropaAmerikaFördelningFördelning

- Page 66 and 67:

AmerikaFördelningoutnyttjade Unite

- Page 68 and 69:

Above left: London Hospital, London

- Page 70 and 71:

4. Constructionmanagement3. Leasing

- Page 72 and 73:

Bedömt bruttonuvärdeGeografiKateg

- Page 74 and 75:

A1 Expressway, PolandRoute: Gdańsk

- Page 76 and 77:

Top left: Čertovo břemeno golf cl

- Page 78 and 79:

Skanska’s Journey to Deep Green a

- Page 80 and 81:

Initiatives in the carbon fieldThan

- Page 82 and 83:

876543210Skanska decided at an earl

- Page 84 and 85:

200100Skanska takes the lead0200420

- Page 86 and 87:

Mdr kr175175The Board of Directors

- Page 88 and 89:

Operating incomeSEK M 2011 2010Oper

- Page 90 and 91:

Investments/DivestmentsSEK M 2011 2

- Page 92 and 93:

Certain counterparties − for exam

- Page 94 and 95:

The members and deputy members of t

- Page 96 and 97:

Aside from day-to-day operations of

- Page 98 and 99:

local management teams and were app

- Page 100 and 101:

Consolidated income statementSEK M

- Page 102 and 103:

Consolidated statement of financial

- Page 104 and 105:

Consolidated statement of changes i

- Page 106 and 107:

Consolidated cash flow statementCon

- Page 108 and 109:

Parent Company balance sheetSEK M N

- Page 110 and 111:

Parent Company cash flow statementS

- Page 112 and 113:

Note01Consolidated accounting and v

- Page 114 and 115:

Note01Continuedcontract premium is

- Page 116 and 117:

Note01Continuedintended manner. Exa

- Page 118 and 119:

Note01ContinuedIf the terms of a de

- Page 120 and 121:

of transfers of resources to a comp

- Page 122 and 123:

Note04Continued2011 ConstructionRes

- Page 124 and 125: Note04ContinuedExternal revenue by

- Page 126 and 127: Note06ContinuedSEK M Maturity Curre

- Page 128 and 129: 06NoteContinuedThe role of financia

- Page 130 and 131: Note06ContinuedReconciliation with

- Page 132 and 133: 06NoteContinuedCollateralThe Group

- Page 134 and 135: Note08RevenueNoteProjects in Skansk

- Page 136 and 137: Note13Impairment losses/Reversals o

- Page 138 and 139: Note16ContinuedTax assets and tax l

- Page 140 and 141: Note18GoodwillGoodwill is recognize

- Page 142 and 143: Note20Investments in joint ventures

- Page 144 and 145: Note20ContinuedInformation on the G

- Page 146 and 147: Note22Current-asset properties/Proj

- Page 148 and 149: Note26Equity/earnings per shareIn t

- Page 150 and 151: Note27Financial liabilitiesNoteFina

- Page 152 and 153: NotePension obligations2011 2010Jan

- Page 154 and 155: Note31Specification of interest-bea

- Page 156 and 157: Note33Assets pledged, contingent li

- Page 158 and 159: 34NoteContinuedConsolidated stateme

- Page 160 and 161: 35NoteContinuedRelation between con

- Page 162 and 163: Note37Remuneration to senior execut

- Page 164 and 165: 37NoteContinuedRemuneration and ben

- Page 166 and 167: NoteThe dilution effect through 201

- Page 168 and 169: Note42Consolidatedquarterly results

- Page 170 and 171: Note43Five-yearGroup financial summ

- Page 172 and 173: Financial ratios etc. 4, 5 Dec 31,

- Page 176 and 177: Note51Financial non-current assets,

- Page 178 and 179: Note58Liabilities, Parent CompanyLi

- Page 180 and 181: Note63Related party disclosures, Pa

- Page 182 and 183: Auditors’ ReportTo the Annual Sha

- Page 184 and 185: 180 Notes, including accounting and

- Page 186 and 187: Senior Executive TeamJohan Karlstr

- Page 188 and 189: Board of DirectorsSverker Martin-L

- Page 190 and 191: Major events during 2011This page s

- Page 192 and 193: Below are the investments, divestme

- Page 194 and 195: Definitions and explanationsAverage

- Page 196 and 197: Annual Shareholders’ MeetingInves

- Page 198 and 199: 1887 Aktiebolaget Skånska Cementgj

- Page 200: Skanska ABwww.skanska.comRåsundav