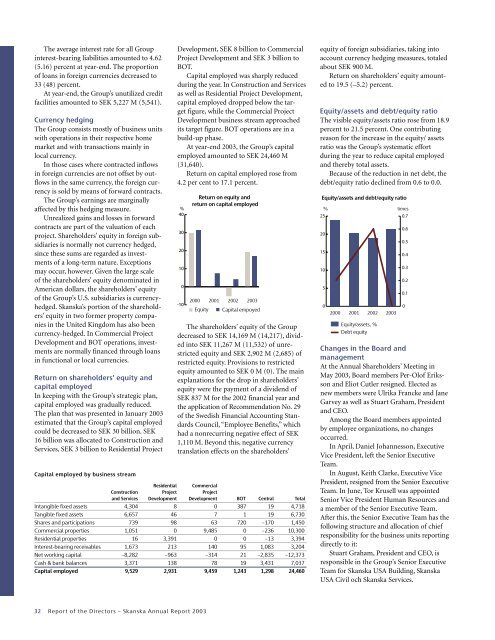

The average interest rate for all Groupinterest-bearing liabilities amounted to 4.62(5.16) percent at year-end. The proportionof loans in foreign currencies decreased to33 (48) percent.At year-end, the Group’s unutilized creditfacilities amounted to SEK 5,227 M (5,541).Currency hedgingThe Group consists mostly of business unitswith operations in their respective homemarket and with transactions mainly inlocal currency.In those cases where contracted inflowsin foreign currencies are not offset by outflowsin the same currency, the foreign currencyis sold by means of forward contracts.The Group’s earnings are marginallyaffected by this hedging measure.Unrealized gains and losses in forwardcontracts are part of the valuation of eachproject. Shareholders’ equity in foreign subsidiariesis normally not currency hedged,since these sums are regarded as investmentsof a long-term nature. Exceptionsmay occur, however. Given the large scaleof the shareholders’ equity denominated inAmerican dollars, the shareholders’ equityof the Group’s U.S. subsidiaries is currencyhedged.<strong>Skanska</strong>’s portion of the shareholders’equity in two former property companiesin the United Kingdom has also beencurrency-hedged. In Commercial ProjectDevelopment and BOT operations, investmentsare normally financed through loansin functional or local currencies.Return on shareholders’ equity andcapital employedIn keeping with the Group’s strategic plan,capital employed was gradually reduced.The plan that was presented in January <strong>2003</strong>estimated that the Group’s capital employedcould be decreased to SEK 30 billion. SEK16 billion was allocated to Construction andServices, SEK 3 billion to Residential ProjectCapital employed by business streamDevelopment, SEK 8 billion to CommercialProject Development and SEK 3 billion toBOT.Capital employed was sharply reducedduring the year. In Construction and Servicesas well as Residential Project Development,capital employed dropped below the targetfigure, while the Commercial ProjectDevelopment business stream approachedits target figure. BOT operations are in abuild-up phase.At year-end <strong>2003</strong>, the Group’s capitalemployed amounted to SEK 24,460 M(31,640).Return on capital employed rose from4.2 per cent to 17.1 percent.Return on equity andreturn on capital employedThe shareholders’ equity of the Groupdecreased to SEK 14,169 M (14,217), dividedinto SEK 11,267 M (11,532) of unrestrictedequity and SEK 2,902 M (2,685) ofrestricted equity. Provisions to restrictedequity amounted to SEK 0 M (0). The mainexplanations for the drop in shareholders’equity were the payment of a dividend ofSEK 837 M for the 2002 financial year andthe application of Recommendation No. 29of the Swedish Financial Accounting StandardsCouncil, “Employee Benefits,” whichhad a nonrecurring negative effect of SEK1,110 M. Beyond this, negative currencytranslation effects on the shareholders’Residential CommercialConstruction Project Projectand Services Development Development BOT Central TotalIntangible fixed assets 4,304 8 0 387 19 4,718Tangible fixed assets 6,657 46 7 1 19 6,730Shares and participations 739 98 63 720 –170 1,450Commercial properties 1,051 0 9,485 0 –236 10,300Residential properties 16 3,391 0 0 –13 3,394Interest-bearing receivables 1,673 213 140 95 1,083 3,204Net working capital –8,282 –963 –314 21 –2,835 –12,373Cash & bank balances 3,371 138 78 19 3,431 7,037Capital employed 9,529 2,931 9,459 1,243 1,298 24,460403020100-10 equity of foreign subsidiaries, taking intoaccount currency hedging measures, totaledabout SEK 900 M.Return on shareholders’ equity amountedto 19.5 (–5.2) percent.Equity/assets and debt/equity ratioThe visible equity/assets ratio rose from 18.9percent to 21.5 percent. One contributingreason for the increase in the equity/ assetsratio was the Group’s systematic effortduring the year to reduce capital employedand thereby total assets.Because of the reduction in net debt, thedebt/equity ratio declined from 0.6 to 0.0.Equity/assets and debt/equity ratio Changes in the Board andmanagementAt the <strong>Annual</strong> Shareholders’ Meeting inMay <strong>2003</strong>, Board members Per-Olof Erikssonand Eliot Cutler resigned. Elected asnew members were Ulrika Francke and Jane Garvey as well as Stuart Graham, Presidentand CEO. Among the Board members appointedby employee organizations, no changes occurred.In April, Daniel Johannesson, Executive Vice President, left the Senior ExecutiveTeam.In August, Keith Clarke, Executive VicePresident, resigned from the Senior ExecutiveTeam. In June, Tor Krusell was appointedSenior Vice President Human Resources anda member of the Senior Executive Team.After this, the Senior Executive Team has thefollowing structure and allocation ofchiefresponsibility for the business units reportingdirectly to it:Stuart Graham, President and CEO, isresponsible in the Group’s Senior ExecutiveTeam for <strong>Skanska</strong> USA Building, <strong>Skanska</strong>USA Civil och <strong>Skanska</strong> Services.32 <strong>Report</strong> of the Directors – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Hans Biörck is Executive Vice Presidentand Chief Financial Officer (CFO).Thomas Alm, Executive Vice President,is responsible in the Senior Executive Teamfor the operations of <strong>Skanska</strong> UK, <strong>Skanska</strong>Latin America, <strong>Skanska</strong> International and<strong>Skanska</strong> BOT.Johan Bergman, Executive Vice President,is responsible in the Senior Executive Teamfor the operations of <strong>Skanska</strong> Poland as wellas for <strong>Skanska</strong> Project Development Swedenand <strong>Skanska</strong> Project Development Europe.Johan Karlström, Executive Vice President,is responsible in the Senior Executive Teamfor <strong>Skanska</strong> Sweden, <strong>Skanska</strong> Denmark,<strong>Skanska</strong> Norway, <strong>Skanska</strong> Finland and<strong>Skanska</strong> CZ (Czech Republic).Tor Krusell is Senior Vice PresidentHuman Resources.The work of the Board of DirectorsThe work of the Board follows a yearlyagenda, which is established in the Board’srules of procedure. In preparation for eachBoard meeting, the Board receives carefullycompiled information in a format establishedby the Board. These procedures areaimed at ensuring that the Board receivesrelevant information in preparation for allBoard meetings. All information is formulatedin the English language.The Board of Directors consists of ninemembers elected by the <strong>Annual</strong> Shareholders’Meeting plus three members andthree deputies for these, appointed by theemployees. During the year, the Board heldeight meetings. At its October <strong>2003</strong> meeting,the Board visited the Group’s operations inthe United States, including a work site visitto view <strong>Skanska</strong>’s construction of the newhigh-speed rail connection to John F. KennedyAirport in New York City.Among the more important issues thatthe Board dealt with were strategic issues,financial reporting and governance of theGroup’s operations.The Board has appointed from amongits own members a Compensation Committeeand an Audit Committee. During <strong>2003</strong>the Board also established a special ProjectReview Committee, which has the Board’smandate to make decisions on majorconstruction projects, purchases and divestmentsof properties and investments in BOTprojects. The Project Review Committee,like the Compensation and Audit Committees,routinely reports to the Board at eachmeeting, in accordance with the mechanismsspecified in the Board’s rules of procedure.The Company’s auditors are present at themeeting each February dealing with theannual financial statements, in order toreport their observations from the auditingtask directly to the Board.The company’s auditors were present atall meetings of the Audit Committee.The committees of the Board have thefollowing composition: The CompensationCommittee consists of Sverker Martin-Löf,Chairman, and Arne Mårtensson, with thePresident and CEO as rapporteur. The AuditCommittee consists of Anders Nyrén, Chairman,and Finn Johnsson, with the ChiefFinancial Officer (CFO) as rapporteur.The Project Review Committee consistsof Sverker Martin-Löf, Chairman, RogerFlanagan, Anders Nyrén and Nils-ErikPettersson, with the President and CEO asrapporteur.Research and developmentDuring the <strong>2003</strong> financial year, the Group’sscientific research shifted toward implementationof earlier research findings in itsbusiness units.Total development work is difficult toquantify, since such expenses are oftenincluded in ongoing projects.To reinforce and enhance <strong>Skanska</strong>’s positionas a leading international constructioncompany, access to knowledge plays anincreasingly large role. Research and developmentmay be regarded as an advancedknowledge bank, which can give <strong>Skanska</strong>an advantage over its competitors if properlyutilized. In an organization containingmany geographic home markets on fourcontinents, effective transfer of knowledgebetween the various business units is ofstrategic importance. <strong>Skanska</strong> is thereforedevoting ever greater resources to buildingup knowledge and knowledge networks,including the implementation of bestpractices in its projects.Some interesting projects that havebenefited from <strong>Skanska</strong>’s research anddevelopment program are:• Minimization of moisture risks in developmentof buildings – 4M (moisture, mold,materials & methods) – including analysisof construction processes in the Nordicmarkets and in the United States and thedevelopment of methods and systems thatwill reduce the risks of future moisturerelatedproblems.• Further development of <strong>Skanska</strong>’sOperational Risk Assessment (ORA)system – whose methodology has beendeveloped with the aid of scientificexperts.• Second opinions in technically complicatedprojects, aided by scientific experts.• Establishment of a major Europeanresearch project with 32 partners onanalysis and reinforcement of bridgestructures, in which <strong>Skanska</strong> has beenassigned responsibility for projectmanagement.The environmentMore than one third of the Group’s projectsmaintain higher environment standardsthan required by law in each respectivecountry. Foresighted customers often takethe initiative for such projects, but equallyoften <strong>Skanska</strong> does so.Much of this trend is attributable to theISO 14001-certified environmental managementsystems that cover more than 95 percentof the Group’s operations. Follow-upsoccurred during <strong>2003</strong> by means of more than1,500 internal and 140 external environmentalaudits, a deliberate reduction comparedto the previous year due to greaterefficiency. No significant non-conformitieswere reported by the external auditors.Operations in Sweden include a fewfacilities that are required to obtain permitsand submit registration documents.Their environmental impact is relativelyminor and does not cause more than smallquantities of atmospheric emissions anddischarges to water.For a more detailed description of<strong>Skanska</strong>’s sustainability work, see the <strong>2003</strong>Sustainability <strong>Report</strong> and the related informationposted on <strong>Skanska</strong>’s Internet website, www.skanska.com.EthicsDuring <strong>2003</strong>, the introduction of <strong>Skanska</strong>’sCode of Conduct and its principles continuedat all levels. This work included the publicationof a Code of Conduct Guideline, largescaletraining programs as well as a followupand reporting system.The Guideline document has twopurposes: providing further informationon interpreting the Code of Conduct andproviding back-up for the process of introducingthe Code of Conduct at <strong>Skanska</strong>’sbusiness units.A number of business units have carriedout employee training programs. During<strong>2003</strong>, for example, <strong>Skanska</strong>’s units in Swedenimplemented business ethics training forabout 2,500 managers, mainly focusing on<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – <strong>Report</strong> of the Directors 33