Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

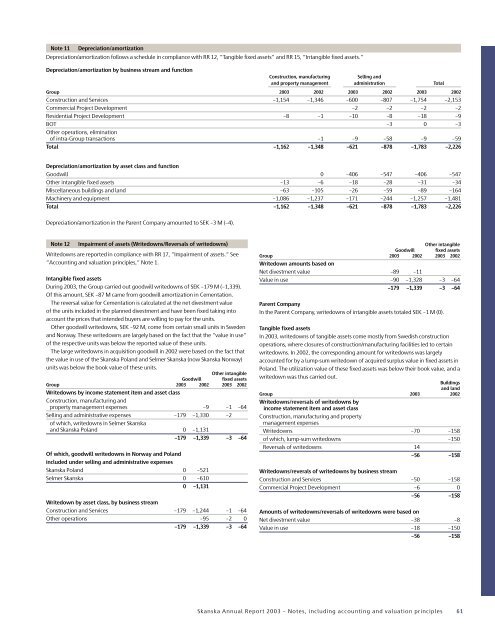

Note 11Depreciation/amortizationDepreciation/amortization follows a schedule in compliance with RR 12, ”Tangible fixed assets” and RR 15, ”Intangible fixed assets.”Depreciation/amortization by business stream and functionConstruction, manufacturingSelling andand property management administration TotalGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002Construction and Services –1,154 –1,346 –600 –807 –1,754 –2,153Commercial Project Development –2 –2 –2 –2Residential Project Development –8 –1 –10 –8 –18 –9BOT –3 0 –3Other operations, eliminationof intra-Group transactions –1 –9 –58 –9 –59Total –1,162 –1,348 –621 –878 –1,783 –2,226Depreciation/amortization by asset class and functionGoodwill 0 –406 –547 –406 –547Other intangible fixed assets –13 –6 –18 –28 –31 –34Miscellaneous buildings and land –63 –105 –26 –59 –89 –164Machinery and equipment –1,086 –1,237 –171 –244 –1,257 –1,481Total –1,162 –1,348 –621 –878 –1,783 –2,226Depreciation/amortization in the Parent Company amounted to SEK –3 M (–4).Note 12Impairment of assets (Writedowns/Reversals of writedowns)Writedowns are reported in compliance with RR 17, ”Impairment of assets.” See”Accounting and valuation principles,” Note 1.Intangible fixed assetsDuring <strong>2003</strong>, the Group carried out goodwill writedowns of SEK –179 M (–1,339).Of this amount, SEK –87 M came from goodwill amortization in Cementation.The reversal value for Cementation is calculated at the net divestment valueof the units included in the planned divestment and have been fixed taking intoaccount the prices that intended buyers are willing to pay for the units.Other goodwill writedowns, SEK –92 M, come from certain small units in Swedenand Norway. These writedowns are largely based on the fact that the ”value in use”of the respective units was below the reported value of these units.The large writedowns in acquisition goodwill in 2002 were based on the fact thatthe value in use of the <strong>Skanska</strong> Poland and Selmer <strong>Skanska</strong> (now <strong>Skanska</strong> Norway)units was below the book value of these units.Other intangibleGoodwill fixed assetsGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002Writedowns by income statement item and asset classConstruction, manufacturing andproperty management expenses –9 –1 –64Selling and administrative expenses –179 –1,330 –2of which, writedowns in Selmer <strong>Skanska</strong>and <strong>Skanska</strong> Poland 0 –1,131–179 –1,339 –3 –64Of which, goodwill writedowns in Norway and Polandincluded under selling and administrative expenses<strong>Skanska</strong> Poland 0 –521Selmer <strong>Skanska</strong> 0 –6100 –1,131Writedown by asset class, by business streamConstruction and Services –179 –1,244 –1 –64Other operations –95 –2 0–179 –1,339 –3 –64Other intangibleGoodwill fixed assetsGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002Writedown amounts based onNet divestment value –89 –11Value in use –90 –1,328 –3 –64–179 –1,339 –3 –64Parent CompanyIn the Parent Company, writedowns of intangible assets totaled SEK –1 M (0).Tangible fixed assetsIn <strong>2003</strong>, writedowns of tangible assets come mostly from Swedish constructionoperations, where closures of construction/manufacturing facilities led to certainwritedowns. In 2002, the corresponding amount for writedowns was largelyaccounted for by a lump-sum writedown of acquired surplus value in fixed assets inPoland. The utilization value of these fixed assets was below their book value, and awritedown was thus carried out.Buildingsand landGroup <strong>2003</strong> 2002Writedowns/reversals of writedowns byincome statement item and asset classConstruction, manufacturing and propertymanagement expensesWritedowns –70 –158of which, lump-sum writedowns –150Reversals of writedowns 14–56 –158Writedowns/reverals of writedowns by business streamConstruction and Services –50 –158Commercial Project Development –6 0–56 –158Amounts of writedowns/reversals of writedowns were based onNet divestment value –38 –8Value in use –18 –150–56 –158<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 61