Note 33Effects of changes in foreign exchange ratesExchange rates are dealt with in compliance with RR 8, ”Effect of changes in foreign exchange rates.” See ”Accounting and valuation principles,” Note 1.Effective from <strong>2003</strong>, <strong>Skanska</strong> Latin America, based in Argentina, has been reporting in USD. It previous used ARS. Due to this change, the company is included in <strong>Skanska</strong>’sanalyses of USD for <strong>2003</strong> but not for 2002.Exchange ratesExchange rate onbalance sheet dateChange in percentCurrency Country <strong>2003</strong> 2002 2001 2002–<strong>2003</strong> 2001–2002ARS Argentina 2.47 2.60 6.41 –5 –59CZK Czech Republic 0.28 0.29 0.29 –3 0DKK Denmark 1.22 1.23 1.26 –1 –2EUR EU euro zone 9.07 9.15 9.33 –1 –2GBP United Kingdom 12.89 14.12 15.33 –9 –8HKD Hong Kong 0.93 1.13 1.36 –18 –17NOK Norway 1.08 1.25 1.17 –14 7PLN Poland 1.94 2.29 2.67 –15 –14USD United States 7.26 8.83 10.58 –18 –17Average exchange rateChange in percentCurrency Country <strong>2003</strong> 2002 2001 2002–<strong>2003</strong> 2001–2002ARS Argentina 2.75 3.21 10.47 –14 –69CZK Czech Republic 0.29 0.30 0.27 –3 11DKK Denmark 1.23 1.23 1.24 0 –1EUR EU euro zone 9.12 9.16 9.25 0 –1GBP United Kingdom 13.19 14.57 14.87 –9 –2HKD Hong Kong 1.04 1.25 1.32 –17 –5NOK Norway 1.14 1.22 1.15 –7 6PLN Poland 2.08 2.38 2.52 –13 –6USD United States 8.08 9.73 10.33 –17 –6Effects on changes in exchange rates on the income statement compared to previous yearThe appreciation of the Swedish krona compared to other currencies has affected the Group’s net sales and earnings. In the following table, the <strong>2003</strong> income statement istranslated to the exchange rates prevailing in 2002. The change, or currency rate effect, for each currency is stated in SEK.Income statementCurrency rate effect<strong>2003</strong>, at 2002 rates 1 <strong>2003</strong> <strong>2003</strong> 2002Net sales 145,760 132,879 –12,881 –4,910Operating income 4,703 4,532 –171 49Income after financial items 4,243 4,072 –171 167Net profit 2,851 2,761 –90 1821 <strong>2003</strong> figures translated to the exchange rates prevailing in 2002.Effects of changes in exchange rates by currency<strong>2003</strong> USD EUR GBP Others TotalNet sales –9,746 –38 –1,585 –1,512 –12,881Operating income –133 0 –3 –35 –171Income after financial items –134 0 –7 –30 –171Net profit –76 0 –2 –12 –902002 USD EUR GBP Others TotalNet sales –3,525 –95 –5,342 4,052 –4,910Operating income –95 2 51 91 49Income after financial items –97 3 169 92 167Net profit –54 3 187 46 182Effects of changes in exchange rates on the balance sheet compared to previous yearGroup, amounts in SEK billion <strong>2003</strong> 2002AssetsIntangible fixed assets –0.5 –0.4Tangible fixed assets –0.6 –0.6Shares and participations –0.2 –0.3Financial receivables –0.1 –0.1Current-asset properties –0.4 –0.6Inventories, tax claims and operating receivables –3.1 –3.3Liquid assets –0.6 –0.8Total –5.5 –6.1Shareholders’ equity and liabilitiesShareholders’ equity –0.9 –1.5Minority interests 0.0 0.0Interest-bearing provisions and liabilities –1.1 –0.4Non-interest-bearing provisions and liabilities –3.5 –4.2Total –5.5 –6.1Effects of exchange rate differences on the Group’sinterest-bearing net debt 0.4 –0.5Of the total effects on the Group’s assets, SEK –3.1 billion was due to USD, –1.1 toGBP and –0.9 to NOK.76 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

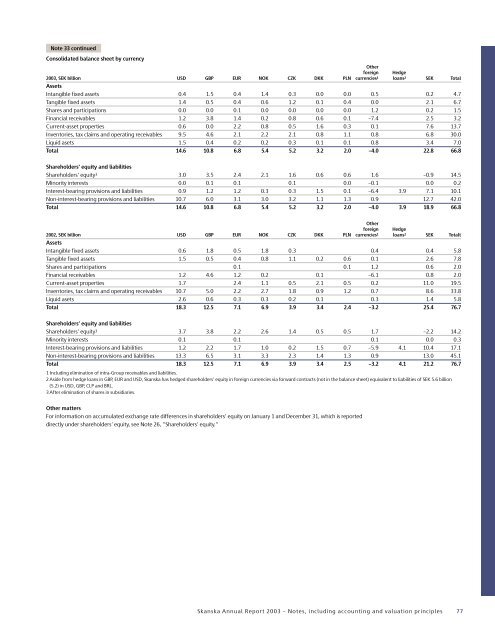

Note 33 continuedConsolidated balance sheet by currencyOtherforeign Hedge<strong>2003</strong>, SEK billion USD GBP EUR NOK CZK DKK PLN currencies 1 loans 2 SEK TotalAssetsIntangible fixed assets 0.4 1.5 0.4 1.4 0.3 0.0 0.0 0.5 0.2 4.7Tangible fixed assets 1.4 0.5 0.4 0.6 1.2 0.1 0.4 0.0 2.1 6.7Shares and participations 0.0 0.0 0.1 0.0 0.0 0.0 0.0 1.2 0.2 1.5Financial receivables 1.2 3.8 1.4 0.2 0.8 0.6 0.1 –7.4 2.5 3.2Current-asset properties 0.6 0.0 2.2 0.8 0.5 1.6 0.3 0.1 7.6 13.7Inventories, tax claims and operating receivables 9.5 4.6 2.1 2.2 2.1 0.8 1.1 0.8 6.8 30.0Liquid asets 1.5 0.4 0.2 0.2 0.3 0.1 0.1 0.8 3.4 7.0Total 14.6 10.8 6.8 5.4 5.2 3.2 2.0 –4.0 22.8 66.8Shareholders’ equity and liabilitiesShareholders’ equity 3 3.0 3.5 2.4 2.1 1.6 0.6 0.6 1.6 –0.9 14.5Minority interests 0.0 0.1 0.1 0.1 0.0 –0.1 0.0 0.2Interest-bearing provisions and liabilities 0.9 1.2 1.2 0.3 0.3 1.5 0.1 –6.4 3.9 7.1 10.1Non-interest-bearing provisions and liabilities 10.7 6.0 3.1 3.0 3.2 1.1 1.3 0.9 12.7 42.0Total 14.6 10.8 6.8 5.4 5.2 3.2 2.0 –4.0 3.9 18.9 66.8Otherforeign Hedge2002, SEK billion USD GBP EUR NOK CZK DKK PLN currencies 1 loans 2 SEK TotaltAssetsIntangible fixed assets 0.6 1.8 0.5 1.8 0.3 0.4 0.4 5.8Tangible fixed assets 1.5 0.5 0.4 0.8 1.1 0.2 0.6 0.1 2.6 7.8Shares and participations 0.1 0.1 1.2 0.6 2.0Financial receivables 1.2 4.6 1.2 0.2 0.1 –6.1 0.8 2.0Current-asset properties 1.7 2.4 1.1 0.5 2.1 0.5 0.2 11.0 19.5Inventories, tax claims and operating receivables 10.7 5.0 2.2 2.7 1.8 0.9 1.2 0.7 8.6 33.8Liquid asets 2.6 0.6 0.3 0.3 0.2 0.1 0.3 1.4 5.8Total 18.3 12.5 7.1 6.9 3.9 3.4 2.4 –3.2 25.4 76.7Shareholders’ equity and liabilitiesShareholders’ equity 3 3.7 3.8 2.2 2.6 1.4 0.5 0.5 1.7 –2.2 14.2Minority interests 0.1 0.1 0.1 0.0 0.3Interest-bearing provisions and liabilities 1.2 2.2 1.7 1.0 0.2 1.5 0.7 –5.9 4.1 10.4 17.1Non-interest-bearing provisions and liabilities 13.3 6.5 3.1 3.3 2.3 1.4 1.3 0.9 13.0 45.1Total 18.3 12.5 7.1 6.9 3.9 3.4 2.5 –3.2 4.1 21.2 76.71 Including elimination of intra-Group receivables and liabilities.2 Aside from hedge loans in GBP, EUR and USD, <strong>Skanska</strong> has hedged shareholders’ equity in foreign currencies via forward contracts (not in the balance sheet) equivalent to liabilities of SEK 5.6 billion(5.2) in USD, GBP, CLP and BRL.3 After elimination of shares in subsidiaries.Other mattersFor information on accumulated exchange rate differences in shareholders’ equity on January 1 and December 31, which is reporteddirectly under shareholders’ equity, see Note 26, ”Shareholders’ equity.”<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 77