Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

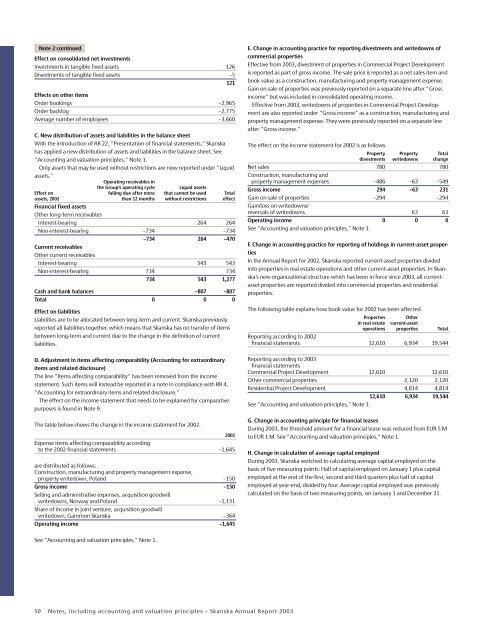

Note 2 continuedEffect on consolidated net investmentsInvestments in tangible fixed assets 126Divestments of tangible fixed assets –5121Effects on other itemsOrder bookings –2,965Order backlog –2,775Average number of employees –3,660C. New distribution of assets and liabilities in the balance sheetWith the introduction of RR 22, ”Presentation of financial statements,” <strong>Skanska</strong>has applied a new distribution of assets and liabilities in the balance sheet. See”Accounting and valuation principles,” Note 1.Only assets that may be used without restrictions are now reported under ”Liquidassets.”Operating receivables inthe Group’s operating cycleLiquid assetsEffect on falling due after more that cannot be used Totalassets, 2002 than 12 months without restrictions effectFinancial fixed assetsOther long-term receivablesInterest-bearing 264 264Non-interest-bearing –734 –734–734 264 –470Current receivablesOther current receivablesInterest-bearing 543 543Non-interest-bearing 734 734734 543 1,277Cash and bank balances –807 –807Total 0 0 0Effect on liabilitiesLiabilities are to be allocated between long-term and current. <strong>Skanska</strong> previouslyreported all liabilities together, which means that <strong>Skanska</strong> has no transfer of itemsbetween long-term and current due to the change in the definition of currentliabilities.D. Adjustment in items affecting comparability (Accounting for extraordinaryitems and related disclosure)The line ”Items affecting comparability” has been removed from the incomestatement. Such items will instead be reported in a note in compliance with RR 4,”Accounting for extraordinary items and related disclosure.”The effect on the income statement that needs to be explained for comparativepurposes is found in Note 9.The table below shows the change in the income statement for 2002.2002Expense items affecting comparability accordingto the 2002 financial statements –1,645are distributed as follows:Construction, manufacturing and property management expense,property writedown, Poland –150Gross income –150Selling and administrative expenses, acquisition goodwillwritedowns, Norway and Poland –1,131Share of income in joint venture, acquisition goodwillwritedown, Gammon <strong>Skanska</strong> –364Operating income –1,645E. Change in accounting practice for reporting divestments and writedowns ofcommercial propertiesEffective from <strong>2003</strong>, divestment of properties in Commercial Project Developmentis reported as part of gross income. The sale price is reported as a net sales item andbook value as a construction, manufacturing and property management expense.Gain on sale of properties was previously reported on a separate line after ”Grossincome” but was included in consolidated operating income.Effective from <strong>2003</strong>, writedowns of properties in Commercial Project Developmentare also reported under ”Gross income” as a construction, manufacturing andproperty management expense. They were previously reported on a separate lineafter ”Gross income.”The effect on the income statement for 2002 is as follows.Property Property Totaldivestments writedowns changeNet sales 780 780Construction, manufacturing andproperty management expenses –486 –63 –549Gross income 294 –63 231Gain on sale of properties –294 –294Gain/loss on writedowns/reversals of writedowns 63 63Operating income 0 0 0See ”Accounting and valuation principles,” Note 1.F. Change in accounting practice for reporting of holdings in current-asset propertiesIn the <strong>Annual</strong> <strong>Report</strong> for 2002, <strong>Skanska</strong> reported current-asset properties dividedinto properties in real estate operations and other current-asset properties. In <strong>Skanska</strong>’snew organizational structure which has been in force since <strong>2003</strong>, all currentassetproperties are reported divided into commercial properties and residentialproperties.The following table explains how book value for 2002 has been affected.Properties Otherin real estate current-assetoperations properties Total<strong>Report</strong>ing according to 2002financial statements 12,610 6,934 19,544<strong>Report</strong>ing according to <strong>2003</strong>financial statementsCommercial Project Development 12,610 12,610Other commercial properties 2,120 2,120Residential Project Development 4,814 4,81412,610 6,934 19,544See ”Accounting and valuation principles,” Note 1.G. Change in accounting principle for financial leasesDuring <strong>2003</strong>, the threshold amount for a financial lease was reduced from EUR 5 Mto EUR 1 M. See ”Accounting and valuation principles,” Note 1.H. Change in calculation of average capital employedDuring <strong>2003</strong>, <strong>Skanska</strong> switched to calculating average capital employed on thebasis of five measuring points: Half of capital employed on January 1 plus capitalemployed at the end of the first, second and third quarters plus half of capitalemployed at year-end, divided by four. Average capital employed was previouslycalculated on the basis of two measuring points, on January 1 and December 31.See ”Accounting and valuation principles,” Note 1.50 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>