Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

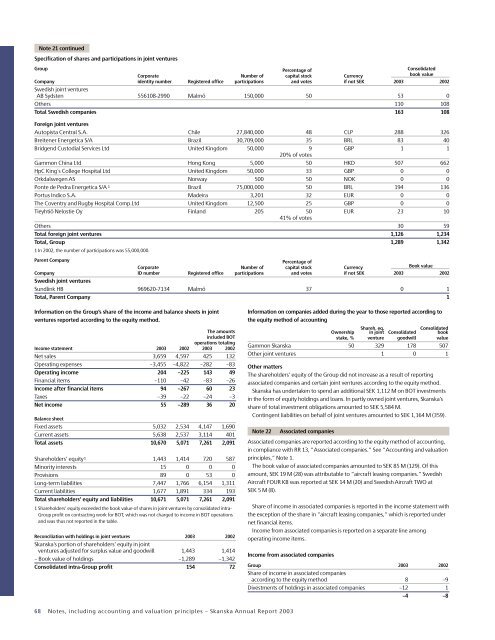

Note 21 continuedSpecification of shares and participations in joint venturesGroup Percentage of ConsolidatedCorporate Number of capital stock Currency book valueCompany identity number Registered office participations and votes if not SEK <strong>2003</strong> 2002Swedish joint venturesAB Sydsten 556108-2990 Malmö 150,000 50 53 0Others 110 108Total Swedish companies 163 108Foreign joint venturesAutopista Central S.A. Chile 27,840,000 48 CLP 288 326Breitener Energetica S/A Brazil 30,709,000 35 BRL 83 40Bridgend Custodial Services Ltd United Kingdom 50,000 9 GBP 1 120% of votesGammon China Ltd Hong Kong 5,000 50 HKD 507 662HpC King´s College Hospital Ltd United Kingdom 50,000 33 GBP 0 0Orkdalsvegen AS Norway 500 50 NOK 0 0Ponte de Pedra Energetica S/A 1 Brazil 75,000,000 50 BRL 194 136Portus Indico S.A. Madeira 3,201 32 EUR 0 0The Coventry and Rugby Hospital Comp.Ltd United Kingdom 12,500 25 GBP 0 0Tieyhtiö Nelostie Oy Finland 205 50 EUR 23 1041% of votesOthers 30 59Total foreign joint ventures 1,126 1,234Total, Group 1,289 1,3421 In 2002, the number of participations was 55,000,000.Parent CompanyPercentage ofCorporate Number of capital stock Currency Book valueCompany ID number Registered office participations and votes if not SEK <strong>2003</strong> 2002Swedish joint venturesSundlink HB 969620-7134 Malmö 37 0 1Total, Parent Company 1Information on the Group’s share of the income and balance sheets in jointventures reported according to the equity method.The amountsincluded BOToperations totalingIncome statement <strong>2003</strong> 2002 <strong>2003</strong> 2002Net sales 3,659 4,597 425 132Operating expenses –3,455 –4,822 –282 –83Operating income 204 –225 143 49Financial items –110 –42 –83 –26Income after financial items 94 –267 60 23Taxes –39 –22 –24 –3Net income 55 –289 36 20Balance sheetFixed assets 5,032 2,534 4,147 1,690Current assets 5,638 2,537 3,114 401Total assets 10,670 5,071 7,261 2,091Shareholders’ equity 1 1,443 1,414 720 587Minority interests 15 0 0 0Provisions 89 0 53 0Long-term liabilities 7,447 1,766 6,154 1,311Current liabilities 1,677 1,891 334 193Total shareholders’ equity and liabilities 10,671 5,071 7,261 2,0911 Shareholders’ equity exceeded the book value of shares in joint ventures by consolidated intra-Group profit on contracting work for BOT, which was not charged to income in BOT operationsand was thus not reported in the table.Reconciliation with holdings in joint ventures <strong>2003</strong> 2002<strong>Skanska</strong>’s portion of shareholders’ equity in jointventures adjusted for surplus value and goodwill 1,443 1,414– Book value of holdings –1,289 –1,342Consolidated intra-Group profit 154 72Information on companies added during the year to those reported according tothe equity method of accountingOwnershipShareh. eq.Consolidatedin joint Consolidated bookstake, % venture goodwill valueGammon <strong>Skanska</strong> 50 329 178 507Other joint ventures 1 0 1Other mattersThe shareholders’ equity of the Group did not increase as a result of reportingassociated companies and certain joint ventures according to the equity method.<strong>Skanska</strong> has undertaken to spend an additional SEK 1,112 M on BOT investmentsin the form of equity holdings and loans. In partly owned joint ventures, <strong>Skanska</strong>’sshare of total investment obligations amounted to SEK 5,584 M.Contingent liabilities on behalf of joint ventures amounted to SEK 1,164 M (359).Note 22Associated companiesAssociated companies are reported according to the equity method of accounting,in compliance with RR 13, ”Associated companies.” See ”Accounting and valuationprinciples,” Note 1.The book value of associated companies amounted to SEK 85 M (129). Of thisamount, SEK 19 M (28) was attributable to ”aircraft leasing companies.” SwedishAircraft FOUR KB was reported at SEK 14 M (20) and Swedish Aircraft TWO atSEK 5 M (8).Share of income in associated companies is reported in the income statement withthe exception of the share in ”aircraft leasing companies,” which is reported undernet financial items.Income from associated companies is reported on a separate line amongoperating income items.Income from associated companiesGroup <strong>2003</strong> 2002Share of income in associated companiesaccording to the equity method 8 –9Divestments of holdings in associated companies –12 1–4 –868 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>