Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

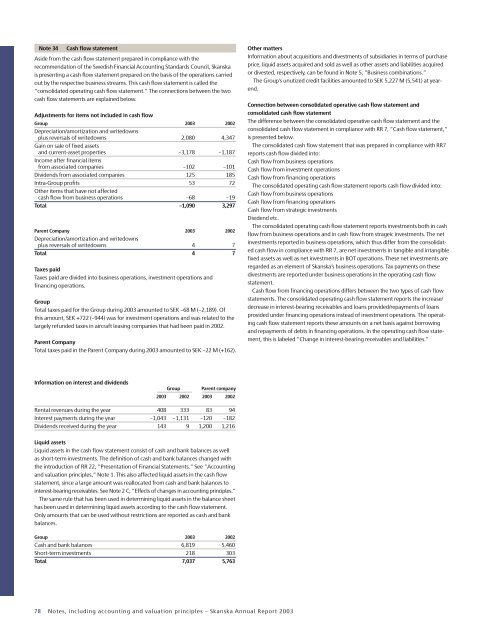

Note 34Cash flow statementAside from the cash flow statement prepared in compliance with therecommendation of the Swedish Financial Accounting Standards Council, <strong>Skanska</strong>is presenting a cash flow statement prepared on the basis of the operations carriedout by the respective business streams. This cash flow statement is called the”consolidated operating cash flow statement.” The connections between the twocash flow statements are explained below.Adjustments for items not included in cash flowGroup <strong>2003</strong> 2002Depreciation/amortization and writedownsplus reversals of writedowns 2,080 4,347Gain on sale of fixed assetsand current-asset properties –3,178 –1,187Income after financial itemsfrom associated companies –102 –101Dividends from associated companies 125 185Intra-Group profits 53 72Other items that have not affectedcash flow from business operations –68 –19Total –1,090 3,297Parent Company <strong>2003</strong> 2002Depreciation/amortization and writedownsplus reversals of writedowns 4 7Total 4 7Taxes paidTaxes paid are divided into business operations, investment operations andfinancing operations.GroupTotal taxes paid for the Group during <strong>2003</strong> amounted to SEK –68 M (–2,189). Ofthis amount, SEK +722 (–944) was for investment operations and was related to thelargely refunded taxes in aircraft leasing companies that had been paid in 2002.Parent CompanyTotal taxes paid in the Parent Company during <strong>2003</strong> amounted to SEK –22 M (+162).Other mattersInformation about acquisitions and divestments of subsidiaries in terms of purchaseprice, liquid assets acquired and sold as well as other assets and liabilities acquiredor divested, respectively, can be found in Note 5, ”Business combinations.”The Group’s unutized credit facilities amounted to SEK 5,227 M (5,541) at yearend.Connection between consolidated operative cash flow statement andconsolidated cash flow statementThe difference between the consolidated operative cash flow statement and theconsolidated cash flow statement in compliance with RR 7, ”Cash flow statement,”is presented below.The consolidated cash flow statement that was prepared in compliance with RR7reports cash flow divided into:Cash flow from business operationsCash flow from investment operationsCash flow from financing operationsThe consolidated operating cash flow statement reports cash flow divided into:Cash flow from business operationsCash flow from financing operationsCash flow from strategic investmentsDividend etc.The consolidated operating cash flow statement reports investments both in cashflow from business operations and in cash flow from strageic investments. The netinvestments reported in business operations, which thus differ from the consolidatedcash flow in compliance with RR 7, are net investments in tangible and intangiblefixed assets as well as net investments in BOT operations. These net investments areregarded as an element of <strong>Skanska</strong>’s business operations. Tax payments on thesedivestments are reported under business operations in the operating cash flowstatement.Cash flow from financing operations differs between the two types of cash flowstatements. The consolidated operating cash flow statement reports the increase/decrease in interest-bearing receivables and loans provided/repayments of loansprovided under financing operations instead of investment operations. The operatingcash flow statement reports these amounts on a net basis against borrowingand repayments of debts in financing operations. In the operating cash flow statement,this is labeled ”Change in interest-bearing receivables and liabilities.”Information on interest and dividendsGroupParent company<strong>2003</strong> 2002 <strong>2003</strong> 2002Rental revenues during the year 408 333 83 94Interest payments during the year –1,043 –1,131 –120 –182Dividends received during the year 143 9 1,200 1,216Liquid assetsLiquid assets in the cash flow statement consist of cash and bank balances as wellas short-term investments. The definition of cash and bank balances changed withthe introduction of RR 22, ”Presentation of Financial Statements.” See ”Accountingand valuation principles,” Note 1. This also affected liquid assets in the cash flowstatement, since a large amount was reallocated from cash and bank balances tointerest-bearing receivables. See Note 2 C, ”Effects of changes in accounting principles.”The same rule that has been used in determining liquid assets in the balance sheethas been used in determining liquid assets according to the cash flow statement.Only amounts that can be used without restrictions are reported as cash and bankbalances.Group <strong>2003</strong> 2002Cash and bank balances 6,819 5,460Short-term investments 218 303Total 7,037 5,76378 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>