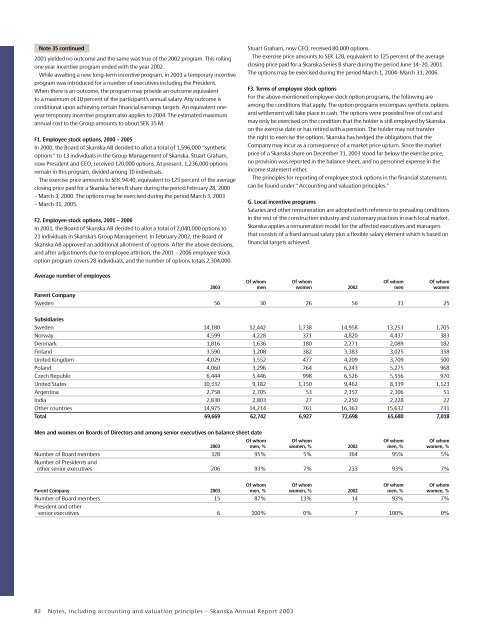

Note 35 continued2001 yielded no outcome and the same was true of the 2002 program. This rollingone year incentive program ended with the year 2002.While awaiting a new long-term incentive program, in <strong>2003</strong> a temporary incentiveprogram was introduced for a number of executives including the President.When there is an outcome, the program may provide an outcome equivalentto a maximum of 10 percent of the participant’s annual salary. Any outcome isconditional upon achieving certain financial earnings targets. An equivalent oneyeartemporary incentive program also applies to 2004. The estimated maximumannual cost to the Group amounts to about SEK 35 M.F1. Employee stock options, 2000 – 2005In 2000, the Board of <strong>Skanska</strong> AB decided to allot a total of 1,596,000 “syntheticoptions” to 13 individuals in the Group Management of <strong>Skanska</strong>. Stuart Graham,now President and CEO, received 120,000 options. At present, 1,236,000 optionsremain in this program, divided among 10 individuals.The exercise price amounts to SEK 94.40, equivalent to 125 percent of the averageclosing price paid for a <strong>Skanska</strong> Series B share during the period February 28, 2000– March 3, 2000. The options may be exercised during the period March 3, <strong>2003</strong>– March 31, 2005.F2. Employee stock options, 2001 – 2006In 2001, the Board of <strong>Skanska</strong> AB decided to allot a total of 2,040,000 options to21 individuals in <strong>Skanska</strong>’s Group Management. In February 2002, the Board of<strong>Skanska</strong> AB approved an additional allotment of options. After the above decisions,and after adjustments due to employee attrition, the 2001 – 2006 employee stockoption program covers 28 individuals, and the number of options totals 2,304,000.Stuart Graham, now CEO, received 80,000 options.The exercise price amounts to SEK 128, equivalent to 125 percent of the averageclosing price paid for a <strong>Skanska</strong> Series B share during the period June 14–20, 2001.The options may be exercised during the period March 1, 2004–March 31, 2006.F3. Terms of employee stock optionsFor the above-mentioned employee stock option programs, the following areamong the conditions that apply. The option programs encompass synthetic optionsand settlement will take place in cash. The options were provided free of cost andmay only be exercised on the condition that the holder is still employed by <strong>Skanska</strong>on the exercise date or has retired with a pension. The holder may not transferthe right to exercise the options. <strong>Skanska</strong> has hedged the obligations that theCompany may incur as a consequence of a market price upturn. Since the marketprice of a <strong>Skanska</strong> share on December 31, <strong>2003</strong> stood far below the exercise price,no provision was reported in the balance sheet, and no personnel expense in theincome statement either.The principles for reporting of employee stock options in the financial statementscan be found under “Accounting and valuation principles.”G. Local incentive programsSalaries and other remuneration are adopted with reference to prevailing conditionsin the rest of the construction industry and customary practices in each local market.<strong>Skanska</strong> applies a remuneration model for the affected executives and managersthat consists of a fixed annual salary plus a flexible salary element which is based onfinancial targets achieved.Average number of employeesOf whom Of whom Of whom Of whom<strong>2003</strong> men women 2002 men womenParent CompanySweden 56 30 26 56 31 25SubsidiariesSweden 14,180 12,442 1,738 14,958 13,253 1,705Norway 4,599 4,228 371 4,820 4,437 383Denmark 1,816 1,636 180 2,271 2,089 182Finland 3,590 3,208 382 3,383 3,025 358United Kingdom 4,029 3,552 477 4,209 3,709 500Poland 4,060 3,296 764 6,243 5,275 968Czech Republic 6,444 5,446 998 6,526 5,556 970United States 10,332 9,182 1,150 9,462 8,339 1,123Argentina 2,758 2,705 53 2,157 2,106 51India 2,830 2,803 27 2,250 2,228 22Other countries 14,975 14,214 761 16,363 15,632 731Total 69,669 62,742 6,927 72,698 65,680 7,018Men and women on Boards of Directors and among senior executives on balance sheet dateOf whom Of whom Of whom Of whom<strong>2003</strong> men, % women, % 2002 men, % women, %Number of Board members 328 95% 5% 364 95% 5%Number of Presidents andother senior executives 206 93% 7% 233 93% 7%Of whom Of whom Of whom Of whomParent Company <strong>2003</strong> men, % women, % 2002 men, % women, %Number of Board members 15 87% 13% 14 93% 7%President and othersenior executives 6 100% 0% 7 100% 0%82 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Note 35 continuedAbsence from work due to illnessFigures on absence from work due to illness are based on just over 50 employees.July 1, <strong>2003</strong>–Parent company December 31, <strong>2003</strong>Total absence from work due to illness asa percentage of regular working time 4.4%Percentage of total absence from work due to illness related tocontinuous absence periods of 60 days or more 6.8%Absence from work due to illness as a percentage of each category’s regularworking time:Men 0.0%Women 9.8%Absence due to illness by age category:Age 29 or younger 2.6%Age 30–49 7.1%Age 50 or older 0.0%Note 36Fees and other remuneration to auditorsGroup <strong>2003</strong> 2002KPMGAuditing assignments 43 44Other assignments 23 33Other auditorsAuditing assignments 1 2Other assignments 1Total 67 80”Auditing assignments” refer to examination of the annual accounts as well as theadministration by the Board of Directors and the President, as well as other tasksthat are incumbent upon the Company’s auditors to perform. Everything else is”Other assignments.” ”Other assignments” mainly consist of consultations relatedto tax and accounting matters as well as due diligence assignments.Note 37Related party disclosuresThrough its ownership and percentage of voting power, AB Industrivärden hasa significant influence, as defined in compliance with RR 23, ”Related partydisclosures.” All transactions have occurred on market terms.Associated companies and joint ventures are companies related to <strong>Skanska</strong>.Information on transactions with these is presented in the following tables.Information on personnel expenses are found in Note 35, ”Personnel.”Group <strong>2003</strong> 2002Sales to associated companies and joint ventures 2,530 816Purchases from associated companies and joint ventures –38 –2Interest revenues from associated companies and joint ventures 23 13Interest expenses to associated companies and joint ventures 0 0Dividends from associated companies and joint ventures 125 185Long-term receivables from associated companiesand joint ventures 224 213Current receivables from associated companiesand joint ventures 532 224Interest-bearing liabilities to associated companiesand joint ventures 0 8Operating liabilities to associated companies and joint ventures 20 50Contingent liabilities on behalf of associatedcompanies and joint ventures 1,164 359Parent company <strong>2003</strong> 2002Sales to Group companies 127 219Purchases from Group companies –110 –121Interest revenues from Group companies 78 87Interest expenses to Group companies –107 –182Dividends from Group companies 1,200 1,216Long-term receivables from Group companies 2,834 833Current receivables from Group companies 17 17Long-term liabilities to Group companies 3,533 2,236Current liabilities to Group companies 3 0Contingent liabilities on behalf of Group companies 100,750 88,339Note 38Leasing<strong>Skanska</strong> is a lessee in both financial and operating leases.When <strong>Skanska</strong> is a lessee, financial leasing assets are reported with a book valueas fixed assets in the balance sheet, while the future commitment to the lessor isreported as a liability in the balance sheet.As a financial lessor, <strong>Skanska</strong> reports the present value of its claim on the lesseeas a financial receivable. As an operating lessor, <strong>Skanska</strong> leases out properties via itsCommercial Project Development operations.A. <strong>Skanska</strong> as a lesseeFinancial leasesLeased tangible fixed assets, buildings and land as well as machinery andequipment, are reported in the consolidated financial statements as financial leases.These leases were reported as operational leases in 2002.Of the total amount in the balance sheet for financial leases, most comes fromtwo properties, a hotel in Poland and an office building in the Czech Republic.Financial leases, book value <strong>2003</strong> 2002Tangible fixed assetsBuildings and land 46 0Machinery and equipment 5 0Total 51 0Acquisition value 69 0Depreciation for the year –4 0Accumulated depreciation –14 0Book value 51 0Variable fees for financial leases included in <strong>2003</strong> income amounted to SEK –2 M(0). No property leased by <strong>Skanska</strong> has been subleased to others.Future lease payments and their present value can be seen in the following table.Present valueFuture of futurelease payments lease paymentsExpenses, due dates <strong>2003</strong> 2002 <strong>2003</strong> 2002Within one year –11 0 –9 0Later than one year but within five years –41 0 –32 0Later than five years –19 0 –11 0–71 0 –52 0Reconciliation, future lease payments and their present value <strong>2003</strong> 2002Future minimum lease payments –71 0Less interest charges 19 0Present value of future minumum lease payments –52 0Operating leasesMost of the amounts for future minimum lease payments are related to office spacefor operations in the United Kingdom and site leashold fees in Sweden.The Group’s leasing expenses related to operating leases in <strong>2003</strong> totaled SEK –168M (–237), of which SEK –168 M (–203) was related to minimum lease payments andSEK 0 M (–34) was related to variable payments.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 83