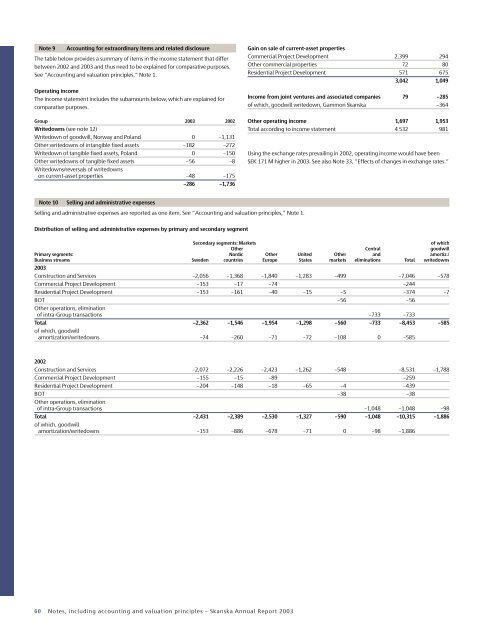

Note 9Accounting for extraordinary items and related disclosureThe table below provides a summary of items in the income statement that differbetween 2002 and <strong>2003</strong> and thus need to be explained for comparative purposes.See ”Accounting and valuation principles,” Note 1.Operating incomeThe income statement includes the subamounts below, which are explained forcomparative purposes.Group <strong>2003</strong> 2002Writedowns (see note 12)Writedown of goodwill, Norway and Poland 0 –1,131Other writedowns of intangible fixed assets –182 –272Writedown of tangible fixed assets, Poland 0 –150Other writedowns of tangible fixed assets –56 –8Writedowns/reversals of writedownson current-asset properties –48 –175–286 –1,736Gain on sale of current-asset propertiesCommercial Project Development 2,399 294Other commercial properties 72 80Residential Project Development 571 6753,042 1,049Income from joint ventures and associated companies 79 –285of which, goodwill writedown, Gammon <strong>Skanska</strong> –364Other operating income 1,697 1,953Total according to income statement 4 532 981Using the exchange rates prevailing in 2002, operating income would have beenSEK 171 M higher in <strong>2003</strong>. See also Note 33, ”Effects of changes in exchange rates.”Note 10Selling and administrative expensesSelling and administrative expenses are reported as one item. See ”Accounting and valuation principles,” Note 1.Distribution of selling and administrative expenses by primary and secondary segmentSecondary segments: Marketsof whichOther Central goodwillPrimary segments: Nordic Other United Other and amortiz./Business streams Sweden countries Europe States markets eliminations Total writedowns<strong>2003</strong>Construction and Services –2,056 –1,368 –1,840 –1,283 –499 –7,046 –578Commercial Project Development –153 –17 –74 –244Residential Project Development –153 –161 –40 –15 –5 –374 –7BOT –56 –56Other operations, eliminationof intra-Group transactions –733 –733Total –2,362 –1,546 –1,954 –1,298 –560 –733 –8,453 –585of which, goodwillamortization/writedowns –74 –260 –71 –72 –108 0 –5852002Construction and Services –2,072 –2,226 –2,423 –1,262 –548 –8,531 –1,788Commercial Project Development –155 –15 –89 –259Residential Project Development –204 –148 –18 –65 –4 –439BOT –38 –38Other operations, eliminationof intra-Group transactions –1,048 –1,048 –98Total –2,431 –2,389 –2,530 –1,327 –590 –1,048 –10,315 –1,886of which, goodwillamortization/writedowns –153 –886 –678 –71 0 –98 –1,88660 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Note 11Depreciation/amortizationDepreciation/amortization follows a schedule in compliance with RR 12, ”Tangible fixed assets” and RR 15, ”Intangible fixed assets.”Depreciation/amortization by business stream and functionConstruction, manufacturingSelling andand property management administration TotalGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002Construction and Services –1,154 –1,346 –600 –807 –1,754 –2,153Commercial Project Development –2 –2 –2 –2Residential Project Development –8 –1 –10 –8 –18 –9BOT –3 0 –3Other operations, eliminationof intra-Group transactions –1 –9 –58 –9 –59Total –1,162 –1,348 –621 –878 –1,783 –2,226Depreciation/amortization by asset class and functionGoodwill 0 –406 –547 –406 –547Other intangible fixed assets –13 –6 –18 –28 –31 –34Miscellaneous buildings and land –63 –105 –26 –59 –89 –164Machinery and equipment –1,086 –1,237 –171 –244 –1,257 –1,481Total –1,162 –1,348 –621 –878 –1,783 –2,226Depreciation/amortization in the Parent Company amounted to SEK –3 M (–4).Note 12Impairment of assets (Writedowns/Reversals of writedowns)Writedowns are reported in compliance with RR 17, ”Impairment of assets.” See”Accounting and valuation principles,” Note 1.Intangible fixed assetsDuring <strong>2003</strong>, the Group carried out goodwill writedowns of SEK –179 M (–1,339).Of this amount, SEK –87 M came from goodwill amortization in Cementation.The reversal value for Cementation is calculated at the net divestment valueof the units included in the planned divestment and have been fixed taking intoaccount the prices that intended buyers are willing to pay for the units.Other goodwill writedowns, SEK –92 M, come from certain small units in Swedenand Norway. These writedowns are largely based on the fact that the ”value in use”of the respective units was below the reported value of these units.The large writedowns in acquisition goodwill in 2002 were based on the fact thatthe value in use of the <strong>Skanska</strong> Poland and Selmer <strong>Skanska</strong> (now <strong>Skanska</strong> Norway)units was below the book value of these units.Other intangibleGoodwill fixed assetsGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002Writedowns by income statement item and asset classConstruction, manufacturing andproperty management expenses –9 –1 –64Selling and administrative expenses –179 –1,330 –2of which, writedowns in Selmer <strong>Skanska</strong>and <strong>Skanska</strong> Poland 0 –1,131–179 –1,339 –3 –64Of which, goodwill writedowns in Norway and Polandincluded under selling and administrative expenses<strong>Skanska</strong> Poland 0 –521Selmer <strong>Skanska</strong> 0 –6100 –1,131Writedown by asset class, by business streamConstruction and Services –179 –1,244 –1 –64Other operations –95 –2 0–179 –1,339 –3 –64Other intangibleGoodwill fixed assetsGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002Writedown amounts based onNet divestment value –89 –11Value in use –90 –1,328 –3 –64–179 –1,339 –3 –64Parent CompanyIn the Parent Company, writedowns of intangible assets totaled SEK –1 M (0).Tangible fixed assetsIn <strong>2003</strong>, writedowns of tangible assets come mostly from Swedish constructionoperations, where closures of construction/manufacturing facilities led to certainwritedowns. In 2002, the corresponding amount for writedowns was largelyaccounted for by a lump-sum writedown of acquired surplus value in fixed assets inPoland. The utilization value of these fixed assets was below their book value, and awritedown was thus carried out.Buildingsand landGroup <strong>2003</strong> 2002Writedowns/reversals of writedowns byincome statement item and asset classConstruction, manufacturing and propertymanagement expensesWritedowns –70 –158of which, lump-sum writedowns –150Reversals of writedowns 14–56 –158Writedowns/reverals of writedowns by business streamConstruction and Services –50 –158Commercial Project Development –6 0–56 –158Amounts of writedowns/reversals of writedowns were based onNet divestment value –38 –8Value in use –18 –150–56 –158<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 61