Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

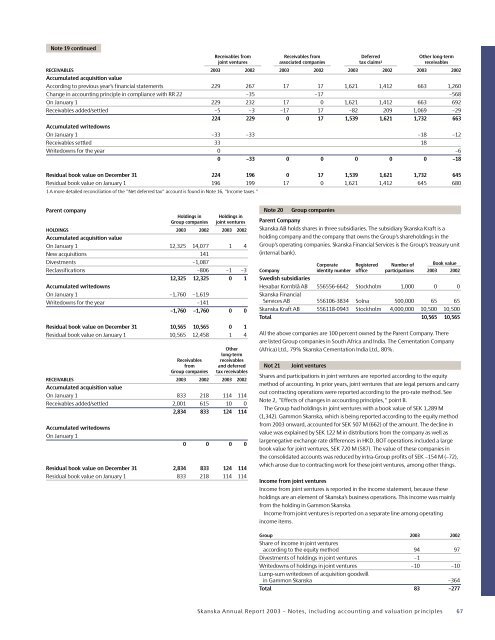

Note 19 continuedReceivables from Receivables from Deferred Other long-termjoint ventures associated companies tax claims 1 receivablesRECEIVABLES <strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002Accumulated acquisition valueAccording to previous year’s financial statements 229 267 17 17 1,621 1,412 663 1,260Change in accounting principle in compliance with RR 22 –35 –17 –568On January 1 229 232 17 0 1,621 1,412 663 692Receivables added/settled –5 –3 –17 17 –82 209 1,069 –29224 229 0 17 1,539 1,621 1,732 663Accumulated writedownsOn January 1 –33 –33 –18 –12Receivables settled 33 18Writedowns for the year 0 –60 –33 0 0 0 0 0 –18Residual book value on December 31 224 196 0 17 1,539 1,621 1,732 645Residual book value on January 1 196 199 17 0 1,621 1,412 645 6801 A more detailed reconciliation of the ”Net deferred tax” account is found in Note 16, ”Income taxes.”Parent companyHoldings inGroup companiesHoldings injoint venturesHOLDINGS <strong>2003</strong> 2002 <strong>2003</strong> 2002Accumulated acquisition valueOn January 1 12,325 14,077 1 4New acquisitions 141Divestments –1,087Reclassifications –806 –1 –312,325 12,325 0 1Accumulated writedownsOn January 1 –1,760 –1,619Writedowns for the year –141–1,760 –1,760 0 0Residual book value on December 31 10,565 10,565 0 1Residual book value on January 1 10,565 12,458 1 4ReceivablesfromGroup companiesOtherlong-termreceivablesand deferredtax receivablesRECEIVABLES <strong>2003</strong> 2002 <strong>2003</strong> 2002Accumulated acquisition valueOn January 1 833 218 114 114Receivables added/settled 2,001 615 10 02,834 833 124 114Accumulated writedownsOn January 10 0 0 0Residual book value on December 31 2,834 833 124 114Residual book value on January 1 833 218 114 114Note 20Group companiesParent Company<strong>Skanska</strong> AB holds shares in three subsidiaries. The subsidiary <strong>Skanska</strong> Kraft is aholding company and the company that owns the Group’s shareholdings in theGroup’s operating companies. <strong>Skanska</strong> Financial Services is the Group’s treasury unit(internal bank).Corporate Registered Number of Book valueCompany identity number office participations <strong>2003</strong> 2002Swedish subsidiariesHexabar Kornblå AB 556556-6642 Stockholm 1,000 0 0<strong>Skanska</strong> FinancialServices AB 556106-3834 Solna 500,000 65 65<strong>Skanska</strong> Kraft AB 556118-0943 Stockholm 4,000,000 10,500 10,500Total 10,565 10,565All the above companies are 100 percent owned by the Parent Company. Thereare listed Group companies in South Africa and India. The Cementation Company(Africa) Ltd., 79% <strong>Skanska</strong> Cementation India Ltd., 80%.Not 21Joint venturesShares and participations in joint ventures are reported according to the equitymethod of accounting. In prior years, joint ventures that are legal persons and carryout contracting operations were reported according to the pro-rate method. SeeNote 2, ”Effects of changes in accounting principles,” point B.The Group had holdings in joint ventures with a book value of SEK 1,289 M(1,342). Gammon <strong>Skanska</strong>, which is being reported according to the equity methodfrom <strong>2003</strong> onward, accounted for SEK 507 M (662) of the amount. The decline invalue was explained by SEK 122 M in distributions from the company as well aslargenegative exchange rate differences in HKD. BOT operations included a largebook value for joint ventures, SEK 720 M (587). The value of these companies inthe consolidated accounts was reduced by intra-Group profits of SEK –154 M (–72),which arose due to contracting work for these joint ventures, among other things.Income from joint venturesIncome from joint ventures is reported in the income statement, because theseholdings are an element of <strong>Skanska</strong>’s business operations. This income was mainlyfrom the holding in Gammon <strong>Skanska</strong>.Income from joint ventures is reported on a separate line among operatingincome items.Group <strong>2003</strong> 2002Share of income in joint venturesaccording to the equity method 94 97Divestments of holdings in joint ventures –1Writedowns of holdings in joint ventures –10 –10Lump-sum writedown of acquisition goodwillin Gammon <strong>Skanska</strong> –364Total 83 –277<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 67