Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

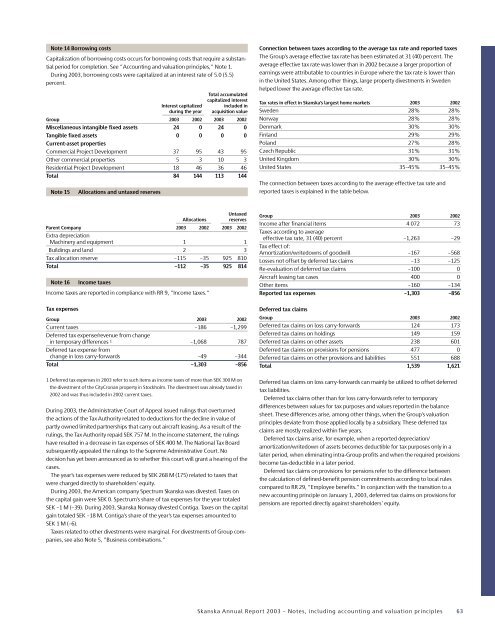

Note 14 Borrowing costsCapitalization of borrowing costs occurs for borrowing costs that require a substantialperiod for completion. See ”Accounting and valuation principles,” Note 1.During <strong>2003</strong>, borrowing costs were capitalized at an interest rate of 5.0 (5.5)percent.Interest capitalizedduring the yearTotal accumulatedcapitalized interestincluded inacquisition valueGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002Miscellaneous intangible fixed assets 24 0 24 0Tangible fixed assets 0 0 0 0Current-asset propertiesCommercial Project Development 37 95 43 95Other commercial properties 5 3 10 3Residential Project Development 18 46 36 46Total 84 144 113 144Note 15Allocations and untaxed reservesConnection between taxes according to the average tax rate and reported taxesThe Group’s average effective tax rate has been estimated at 31 (40) percent. Theaverage effective tax rate was lower than in 2002 because a larger proportion ofearnings were attributable to countries in Europe where the tax rate is lower thanin the United States. Among other things, large property divestments in Swedenhelped lower the average effective tax rate.Tax rates in effect in <strong>Skanska</strong>’s largest home markets <strong>2003</strong> 2002Sweden 28% 28%Norway 28% 28%Denmark 30% 30%Finland 29% 29%Poland 27% 28%Czech Republic 31% 31%United Kingdom 30% 30%United States 35–45% 35–45%The connection between taxes according to the average effective tax rate andreported taxes is explained in the table below.AllocationsUntaxedreservesParent Company <strong>2003</strong> 2002 <strong>2003</strong> 2002Extra depreciationMachinery and equipment 1 1Buildings and land 2 3Tax allocation reserve –115 –35 925 810Total –112 –35 925 814Note 16Income taxesIncome taxes are reported in compliance with RR 9, ”Income taxes.”Tax expensesGroup <strong>2003</strong> 2002Current taxes –186 –1,299Deferred tax expense/revenue from changein temporary differences 1 –1,068 787Deferred tax expense fromchange in loss carry-forwards –49 –344Total –1,303 –8561 Deferred tax expenses in <strong>2003</strong> refer to such items as income taxes of more than SEK 300 M onthe divestment of the CityCronan property in Stockholm. The divestment was already taxed in2002 and was thus included in 2002 current taxes.During <strong>2003</strong>, the Administrative Court of Appeal issued rulings that overturnedthe actions of the Tax Authority related to deductions for the decline in value ofpartly owned limited partnerships that carry out aircraft leasing. As a result of therulings, the Tax Authority repaid SEK 757 M. In the income statement, the rulingshave resulted in a decrease in tax expenses of SEK 400 M. The National Tax Boardsubsequently appealed the rulings to the Supreme Administrative Court. Nodecision has yet been announced as to whether this court will grant a hearing of thecases.The year’s tax expenses were reduced by SEK 268 M (175) related to taxes thatwere charged directly to shareholders’ equity.During <strong>2003</strong>, the American company Spectrum <strong>Skanska</strong> was divested. Taxes onthe capital gain were SEK 0. Spectrum’s share of tax expenses for the year totaledSEK –1 M (–39). During <strong>2003</strong>, <strong>Skanska</strong> Norway divested Contiga. Taxes on the capitalgain totaled SEK –18 M. Contiga’s share of the year’s tax expenses amounted toSEK 1 M (–6).Taxes related to other divestments were marginal. For divestments of Group companies,see also Note 5, ”Business combinations.”Group <strong>2003</strong> 2002Income after financial items 4 072 73Taxes according to averageeffective tax rate, 31 (40) percent –1,263 –29Tax effect of:Amortization/writedowns of goodwill –167 –568Losses not offset by deferred tax claims –13 –125Re-evaluation of deferred tax claims –100 0Aircraft leasing tax cases 400 0Other items –160 –134<strong>Report</strong>ed tax expenses –1,303 –856Deferred tax claimsGroup <strong>2003</strong> 2002Deferred tax claims on loss carry-forwards 124 173Deferred tax claims on holdings 149 159Deferred tax claims on other assets 238 601Deferred tax claims on provisions for pensions 477 0Deferred tax claims on other provisions and liabilities 551 688Total 1,539 1,621Deferred tax claims on loss carry-forwards can mainly be utilized to offset deferredtax liabilities.Deferred tax claims other than for loss carry-forwards refer to temporarydifferences between values for tax purposes and values reported in the balancesheet. These differences arise, among other things, when the Group’s valuationprinciples deviate from those applied locally by a subsidiary. These deferred taxclaims are mostly realized within five years.Deferred tax claims arise, for example, when a reported depreciation/amortization/writedown of assets becomes deductible for tax purposes only in alater period, when eliminating intra-Group profits and when the required provisionsbecome tax-deductible in a later period.Deferred tax claims on provisions for pensions refer to the difference betweenthe calculation of defined-benefit pension commitments according to local rulescompared to RR 29, ”Employee benefits.” In conjunction with the transition to anew accounting principle on January 1, <strong>2003</strong>, deferred tax claims on provisions forpensions are reported directly against shareholders’ equity.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 63