Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

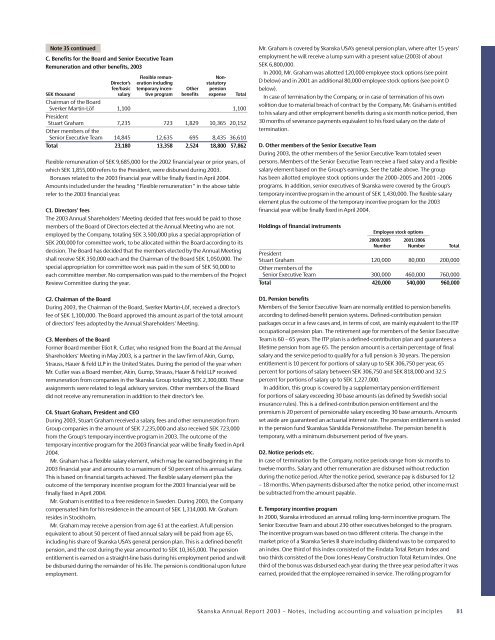

Note 35 continuedC. Benefits for the Board and Senior Executive TeamRemuneration and other benefits, <strong>2003</strong>Flexible remun-Non-Director’s eration including statutoryfee/basic temporary incen- Other pensionSEK thousand salary tive program benefits expense TotalChairman of the BoardSverker Martin-Löf 1,100 1,100PresidentStuart Graham 7,235 723 1,829 10,365 20,152Other members of theSenior Executive Team 14,845 12,635 695 8,435 36,610Total 23,180 13,358 2,524 18,800 57,862Flexible remuneration of SEK 9,685,000 for the 2002 financial year or prior years, ofwhich SEK 1,855,000 refers to the President, were disbursed during <strong>2003</strong>.Bonuses related to the <strong>2003</strong> financial year will be finally fixed in April 2004.Amounts included under the heading “Flexible remuneration” in the above tablerefer to the <strong>2003</strong> financial year.C1. Directors’ feesThe <strong>2003</strong> <strong>Annual</strong> Shareholders’ Meeting decided that fees would be paid to thosemembers of the Board of Directors elected at the <strong>Annual</strong> Meeting who are notemployed by the Company, totaling SEK 3,500,000 plus a special appropriation ofSEK 200,000 for committee work, to be allocated within the Board according to itsdecision. The Board has decided that the members elected by the <strong>Annual</strong> Meetingshall receive SEK 350,000 each and the Chairman of the Board SEK 1,050,000. Thespecial appropriation for committee work was paid in the sum of SEK 50,000 toeach committee member. No compensation was paid to the members of the ProjectReview Committee during the year.C2. Chairman of the BoardDuring <strong>2003</strong>, the Chairman of the Board, Sverker Martin-Löf, received a director’sfee of SEK 1,100,000. The Board approved this amount as part of the total amountof directors’ fees adopted by the <strong>Annual</strong> Shareholders’ Meeting.C3. Members of the BoardFormer Board member Eliot R. Cutler, who resigned from the Board at the <strong>Annual</strong>Shareholders’ Meeting in May <strong>2003</strong>, is a partner in the law firm of Akin, Gump,Strauss, Hauer & Feld LLP in the United States. During the period of the year whenMr. Cutler was a Board member, Akin, Gump, Strauss, Hauer & Feld LLP receivedremuneration from companies in the <strong>Skanska</strong> Group totaling SEK 2,300,000. Theseassignments were related to legal advisory services. Other members of the Boarddid not receive any remuneration in addition to their director’s fee.C4. Stuart Graham, President and CEODuring <strong>2003</strong>, Stuart Graham received a salary, fees and other remuneration fromGroup companies in the amount of SEK 7,235,000 and also received SEK 723,000from the Group’s temporary incentive program in <strong>2003</strong>. The outcome of thetemporary incentive program for the <strong>2003</strong> financial year will be finally fixed in April2004.Mr. Graham has a flexible salary element, which may be earned beginning in the<strong>2003</strong> financial year and amounts to a maximum of 50 percent of his annual salary.This is based on financial targets achieved. The flexible salary element plus theoutcome of the temporary incentive program for the <strong>2003</strong> financial year will befinally fixed in April 2004.Mr. Graham is entitled to a free residence in Sweden. During <strong>2003</strong>, the Companycompensated him for his residence in the amount of SEK 1,314,000. Mr. Grahamresides in Stockholm.Mr. Graham may receive a pension from age 61 at the earliest. A full pensionequivalent to about 50 percent of fixed annual salary will be paid from age 65,including his share of <strong>Skanska</strong> USA’s general pension plan. This is a defined-benefitpension, and the cost during the year amounted to SEK 10,365,000. The pensionentitlement is earned on a straight-line basis during his employment period and willbe disbursed during the remainder of his life. The pension is conditional upon futureemployment.Mr. Graham is covered by <strong>Skanska</strong> USA’s general pension plan, where after 15 years’employment he will receive a lump sum with a present value (<strong>2003</strong>) of aboutSEK 6,800,000.In 2000, Mr. Graham was allotted 120,000 employee stock options (see pointD below) and in 2001 an additional 80,000 employee stock options (see point Dbelow).In case of termination by the Company, or in case of termination of his ownvolition due to material breach of contract by the Company, Mr. Graham is entitledto his salary and other employment benefits during a six month notice period, then30 months of severance payments equivalent to his fixed salary on the date oftermination.D. Other members of the Senior Executive TeamDuring <strong>2003</strong>, the other members of the Senior Executive Team totaled sevenpersons. Members of the Senior Executive Team receive a fixed salary and a flexiblesalary element based on the Group’s earnings. See the table above. The grouphas been allotted employee stock options under the 2000–2005 and 2001 –2006programs. In addition, senior executives of <strong>Skanska</strong> were covered by the Group’stemporary incentive program in the amount of SEK 1,430,000. The flexible salaryelement plus the outcome of the temporary incentive program for the <strong>2003</strong>financial year will be finally fixed in April 2004.Holdings of financial instrumentsEmployee stock options2000/2005 2001/2006Number Number TotalPresidentStuart Graham 120,000 80,000 200,000Other members of theSenior Executive Team 300,000 460,000 760,000Total 420,000 540,000 960,000D1. Pension benefitsMembers of the Senior Executive Team are normally entitled to pension benefitsaccording to defined-benefit pension systems. Defined-contribution pensionpackages occur in a few cases and, in terms of cost, are mainly equivalent to the ITPoccupational pension plan. The retirement age for members of the Senior ExecutiveTeam is 60 – 65 years. The ITP plan is a defined-contribution plan and guarantees alifetime pension from age 65. The pension amount is a certain percentage of finalsalary and the service period to qualify for a full pension is 30 years. The pensionentitlement is 10 percent for portions of salary up to SEK 306,750 per year, 65percent for portions of salary between SEK 306,750 and SEK 818,000 and 32.5percent for portions of salary up to SEK 1,227,000.In addition, this group is covered by a supplementary pension entitlementfor portions of salary exceeding 30 base amounts (as defined by Swedish socialinsurance rules). This is a defined-contribution pension entitlement and thepremium is 20 percent of pensionable salary exceeding 30 base amounts. Amountsset aside are guaranteed an actuarial interest rate. The pension entitlement is vestedin the pension fund <strong>Skanska</strong>s Särskilda Pensionsstiftelse. The pension benefit istemporary, with a minimum disbursement period of five years.D2. Notice periods etc.In case of termination by the Company, notice periods range from six months totwelve months. Salary and other remuneration are disbursed without reductionduring the notice period. After the notice period, severance pay is disbursed for 12– 18 months. When payments disbursed after the notice period, other income mustbe subtracted from the amount payable.E. Temporary incentive programIn 2000, <strong>Skanska</strong> introduced an annual rolling long-term incentive program. TheSenior Executive Team and about 230 other executives belonged to the program.The incentive program was based on two different criteria. The change in themarket price of a <strong>Skanska</strong> Series B share including dividend was to be compared toan index. One third of this index consisted of the Findata Total Return Index andtwo thirds consisted of the Dow Jones Heavy Construction Total Return Index. Onethird of the bonus was disbursed each year during the three year period after it wasearned, provided that the employee remained in service. The rolling program for<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 81