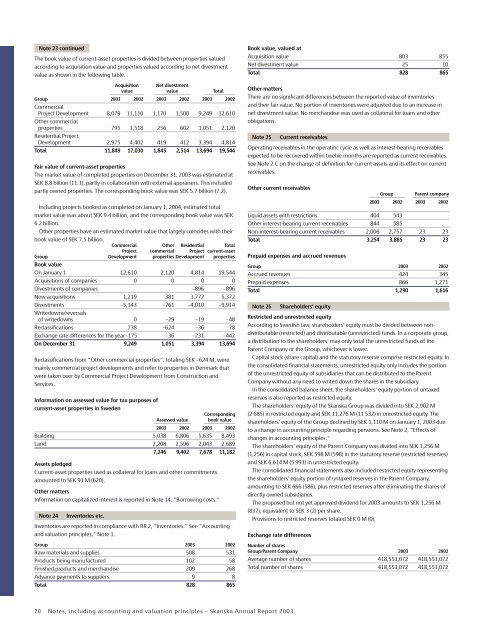

Note 23 continuedThe book value of current-asset properties is divided between properties valuedaccording to acquisition value and properties valued according to net divestmentvalue as shown in the following table.Acquisition Net divestmentvalue value TotalGroup <strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002CommercialProject Development 8,079 11,110 1,170 1,500 9,249 12,610Other commercialproperties 795 1,518 256 602 1,051 2,120Residential ProjectDevelopment 2,975 4,402 419 412 3,394 4,814Total 11,849 17,030 1,845 2,514 13,694 19,544Fair value of current-asset propertiesThe market value of completed properties on December 31, <strong>2003</strong> was estimated atSEK 8.8 billion (11.1), partly in collaboration with external appraisers. This includedpartly owned properties. The corresponding book value was SEK 5.7 billion (7.2).Including projects booked as completed on January 1, 2004, estimated totalmarket value was about SEK 9.4 billion, and the corresponding book value was SEK6.2 billion.Other properties have an estimated market value that largely coincides with theirbook value of SEK 7.5 billion.Commercial Other Residential TotalProject commercial Project current-assetGroup Development properties Development propertiesBook valueOn January 1 12,610 2,120 4,814 19,544Acquisitions of companies 0 0 0 0Divestments of companies –896 –896New acquisitions 1,219 381 3,772 5,372Divestments –5,143 –761 –4,010 –9,914Writedowns/reversalsof writedowns 0 –29 –19 –48Reclassifications 738 –624 –36 78Exchange rate differences for the year–175 –36 –231 –442On December 31 9,249 1,051 3,394 13,694Reclassifications from ”Other commercial properties”, totaling SEK –624 M, weremainly commercial project developments and refer to properties in Denmark thatwere taken over by Commercial Project Development from Construction andServices.Information on assessed value for tax purposes ofcurrent-asset properties in SwedenAssessed valueCorrespondingbook value<strong>2003</strong> 2002 <strong>2003</strong> 2002Building 5,038 6,806 5,635 8,493Land 2,208 2,596 2,043 2,6897,246 9,402 7,678 11,182Assets pledgedCurrent-asset properties used as collateral for loans and other commitmentsamounted to SEK 91 M (620).Other mattersInformation on capitalized interest is reported in Note 14, ”Borrowing costs.”Note 24Inventories etc.Inventories are reported in compliance with RR 2, ”Inventories.” See ”Accountingand valuation principles,” Note 1.Group <strong>2003</strong> 2002Raw materials and supplies 508 531Products being manufactured 102 58Finished products and merchandise 209 268Advance payments to suppliers 9 8Total 828 865Book value, valued atAcquisition value 803 855Net divestment value 25 10Total 828 865Other mattersThere are no significant differences between the reported value of inventoriesand their fair value. No portion of inventories were adjusted due to an increase innet divestment value. No merchandise was used as collateral for loans and otherobligations.Note 25Current receivablesOperating receivables in the operatinc cycle as well as interest-bearing receivablesexpected to be recovered within twelve months are reported as current receivables.See Note 2 C on the change of definition for current assets and its effect on currentreceivables.Other current receivablesGroupParent company<strong>2003</strong> 2002 <strong>2003</strong> 2002Liquid assets with restrictions 404 543Other interest-bearing current receivables 844 585Non-interest-bearing current receivables 2,006 2,757 23 23Total 3,254 3,885 23 23Prepaid expenses and accrued revenuesGroup <strong>2003</strong> 2002Accrued revenues 424 345Prepaid expenses 866 1,271Total 1,290 1,616Note 26Shareholders’ equityRestricted and unrestricted equityAccording to Swedish law, shareholders’ equity must be divided between nondistributable(restricted) and distributable (unrestricted) funds. In a corporate group,a distribution to the shareholders’ may only total the unrestricted funds of theParent Company or the Group, whichever is lower.Capital stock (share capital) and the statutory reserve comprise restricted equity. Inthe consolidated financial statements, unrestricted equity only includes the portionof the unrestricted equity of subsidiaries that can be distributed to the ParentCompany without any need to writed down the shares in the subsidiary.In the consolidated balance sheet, the shareholders’ equity portion of untaxedreserves is also reported as restricted equity.The shareholders’ equity of the <strong>Skanska</strong> Group was divided into SEK 2,902 M(2 685) in restricted equity and SEK 11,276 M (11 532) in unrestricted equity. Theshareholders’ equity of the Group declined by SEK 1,110 M on January 1, <strong>2003</strong> dueto a change in accounting principle regarding pensions. See Note 2, ”Effects ofchanges in accounting principles.”The shareholders’ equity of the Parent Company was divided into SEK 1,256 M(1,256) in capital stock, SEK 598 M (598) in the statutory reserve (restricted reserves)and SEK 6,614 M (5 993) in unrestricted equity.The consolidated financial statements also included restricted equity representingthe shareholders’ equity portion of untaxed reserves in the Parent Company,amounting to SEK 666 (586), plus restricted reserves after eliminating the shares ofdirectly owned subsidiaries.The proposed but not yet approved dividend for <strong>2003</strong> amounts to SEK 1,256 M(837), equivalent to SEK 3 (2) per share.Provisions to restricted reserves totaled SEK 0 M (0).Exchange rate differencesNumber of sharesGroup/Parent Company <strong>2003</strong> 2002Average number of shares 418,553,072 418,553,072Total number of shares 418,553,072 418,553,07270 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Note 26 continuedThe number of shares amounted to 418,553,072, divided into 30,671,921(35,681,909) Series A shares and 387,881,151 (382,871,163) Series B shares. During<strong>2003</strong>, 5,009,988 Series A shares were redeemed in exchange for a correspondingnumber of Series B shares.The par (nominal) value per share amounts to SEK 3 (3). All shares are fully paidup. One Series A shares carries 10 votes, and each Series B share carries one vote.Otherwise all shares enjoy the same rights.Series B shares are listed on Stockholmsbörsen (formerly the OM Stockholm StockExchange).According to the Articles of Association, <strong>Skanska</strong>’s capital stock may amount to aminimum of SEK 1,200 M and a maximum of SEK 4,800 M.Exchange rate differencesDuring the <strong>2003</strong> financial year, exchange rate differences of SEK –1,710 M (–1,981)were reported directly in shareholders’ equity. The amount consisted mainly ofnegative exchange rate differences in USD, GBP, NOK, HKD and PLN ( in 2002,the amount consisted mainly of negative exchange rate differences in USD, GBP,ARS, CLP, BRL and PLN, plus a positive exchange rate difference in NOK.) The year’sexchange rate differences were reduced by SEK 806 M (445) through currencyhedging measures, primarily against the U.S. dollar but also the British pound.Accumulated exchange rate differences included in shareholders’ equity totaledSEK –1,088 M (–184). During <strong>2003</strong>, accumulated exchange rate differences of SEK+14 M in shareholders’ equity were added to the income statement due to thedivestment of the American subsidiary Spectrum <strong>Skanska</strong>.Other mattersThe shareholders’ equity of the Group did not increase because associatedcompanies and joint ventures were reported according to the equity method ofaccounting.There are no option programs that will result in dilution of shareholders’ equity.Net income per share is calculated by dividing net income for the year by theaverage number of shares. See Note 43, ”Definitions.”Regarding equity swaps for employee stock options, see ”Accounting andvaluation principles,” Note 1, and Note 35, ”Personnel.”Note 27ProvisionsProvisions are reported in compliance with RR 16, ”Provisions, contingent liabilitiesand contingent assets.” See ”Accounting and valuation principles,” Note 1.Provisionsfor pensionsand similar Provisions OtherGroup commitments 1 for taxes 2 provisions 3Provisions according to the 2002financial statements 968 2,340 3,078Change in accounting principle,Gammon <strong>Skanska</strong> 16 -23 0Opening balance, January 1, <strong>2003</strong> 984 2,317 3,078Change in accounting principle, pensions 1,635Provisions for the year 397 946 1,036Provisions withdrawn -182 -127 -688Funds provided -240Unutilized amounts that were reversed,change in value -19 -154Increase in discounted amount 6Exchange rate differences -140 -64 -112Reclassifications -396 51 64Closing balance, December 31, <strong>2003</strong> 2,058 3,104 3,2301 Provision for pension commitments is further described in Note 28, ”Provisions for pensions andsimilar commitments.”2 Provisions for taxes are further described in Note 16, ”Income taxes.”3 Of the amount for ”Other provisions,” SEK 175 M (16) was interest-bearing. Of this amount, SEK162 M came from a provision to the employee foundation, which was not treated in the 2002financial statements as interest-bearing, in the amount of SEK 150 M.Provisionsfor pensionsand similar Provisions OtherParent Company commitments 1 for taxes 2 provisions 3Opening balance, January 1, <strong>2003</strong> 363 11 98Provisions for the year 21 33Provisions withdrawn -30 -9Unutilized amounts that were reversed -83 -45Reclassifications 10Closing balance, December 31, <strong>2003</strong> 281 11 77Specification of ”Other provisions”GroupParent company<strong>2003</strong> 2002 <strong>2003</strong> 2002Warranty obligations 724 362Reserve for legal disputes 751 737Restructuring measures 560 475Insurance business 428 675Employee foundation, Sweden 162 150Equity swaps for employee stock options 44 89 44 89Employee-related provisions 174 71 33 9Environmental obligations 44 53Provision for unsold housing units, Sweden 58Miscellaneous provisions 285 466Total 3,230 3,078 77 98Normal circulation time for ”Other provisions” is about one to three years.Provisions for warranty obligations are related to expenses that may arise duringthe warranty period. Such provisions in Construction and Services is based mainlyon experience and expressed as average expenses as a percentage of sales during afive-year period. The expenses are charged to each project on a continuous basis.Provisions for warranty obligations in other business streams are based onindividual assessments of each project.The increase in the provision amount was partly related to Commercial ProjectDevelopment.Provisions for legal disputes were related to provisions in Construction andServices for completed projects.Provisions for insurance business were related to expenses paid for damagerelated to <strong>Skanska</strong>’s operations. The Group’s insurance operations deal with damagethat arises in operations and re-insures a portion of the risks.The provision to the employee foundation in Sweden was related to a refundof surplus funds from the retirement insurance company SPP. The provision isused in consultation with trade union representatives to enable employees withreduced work capacity to remain employed on a part-time basis. The employee iscompensated for loss of income and loss of future pension benefits.Employee-related provisions include such items as the costs of profit-sharing,certain bonus programs and other obligations to employees.Among provisions for environmental obligations were the costs of restoringgravel pits to their natural state in Swedish operations.Restructuring provisions are related to the expenses of adapting operations to theprojected market and in keeping with the Group’s strategic plan. Expenses were paidfor such items as closing down operations and phasing out employees.The net amount for the restructuring reserve rose during <strong>2003</strong>. The provisionfor restructuring expenses made during 2002 was partly withdrawn during <strong>2003</strong>,while new provisions for phasing out and closing down operations increase the netamount in the reserve during the year.Information about provisions for each individual company acquisitionIn the <strong>2003</strong> balance sheet, there were no remaining reserves for restructuring.Which arose from company acquisitions. The amount for 2002 was SEK 68 M andwas allocated among company acquisitions according to the following table.<strong>2003</strong> 2002Selmer <strong>Skanska</strong> 0 10<strong>Skanska</strong> CZ 0 58Total 0 68<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 71