Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

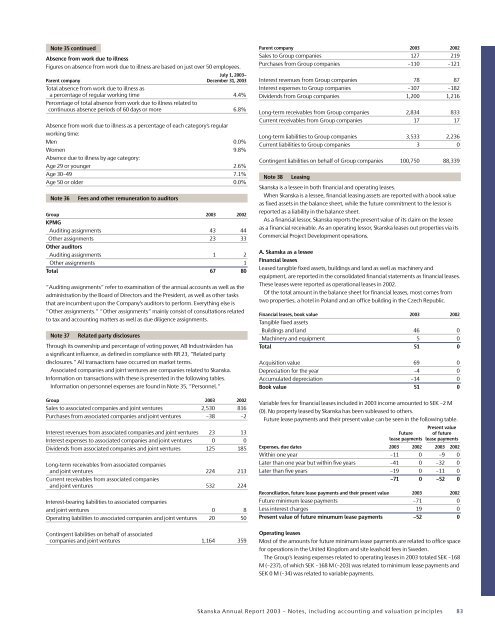

Note 35 continuedAbsence from work due to illnessFigures on absence from work due to illness are based on just over 50 employees.July 1, <strong>2003</strong>–Parent company December 31, <strong>2003</strong>Total absence from work due to illness asa percentage of regular working time 4.4%Percentage of total absence from work due to illness related tocontinuous absence periods of 60 days or more 6.8%Absence from work due to illness as a percentage of each category’s regularworking time:Men 0.0%Women 9.8%Absence due to illness by age category:Age 29 or younger 2.6%Age 30–49 7.1%Age 50 or older 0.0%Note 36Fees and other remuneration to auditorsGroup <strong>2003</strong> 2002KPMGAuditing assignments 43 44Other assignments 23 33Other auditorsAuditing assignments 1 2Other assignments 1Total 67 80”Auditing assignments” refer to examination of the annual accounts as well as theadministration by the Board of Directors and the President, as well as other tasksthat are incumbent upon the Company’s auditors to perform. Everything else is”Other assignments.” ”Other assignments” mainly consist of consultations relatedto tax and accounting matters as well as due diligence assignments.Note 37Related party disclosuresThrough its ownership and percentage of voting power, AB Industrivärden hasa significant influence, as defined in compliance with RR 23, ”Related partydisclosures.” All transactions have occurred on market terms.Associated companies and joint ventures are companies related to <strong>Skanska</strong>.Information on transactions with these is presented in the following tables.Information on personnel expenses are found in Note 35, ”Personnel.”Group <strong>2003</strong> 2002Sales to associated companies and joint ventures 2,530 816Purchases from associated companies and joint ventures –38 –2Interest revenues from associated companies and joint ventures 23 13Interest expenses to associated companies and joint ventures 0 0Dividends from associated companies and joint ventures 125 185Long-term receivables from associated companiesand joint ventures 224 213Current receivables from associated companiesand joint ventures 532 224Interest-bearing liabilities to associated companiesand joint ventures 0 8Operating liabilities to associated companies and joint ventures 20 50Contingent liabilities on behalf of associatedcompanies and joint ventures 1,164 359Parent company <strong>2003</strong> 2002Sales to Group companies 127 219Purchases from Group companies –110 –121Interest revenues from Group companies 78 87Interest expenses to Group companies –107 –182Dividends from Group companies 1,200 1,216Long-term receivables from Group companies 2,834 833Current receivables from Group companies 17 17Long-term liabilities to Group companies 3,533 2,236Current liabilities to Group companies 3 0Contingent liabilities on behalf of Group companies 100,750 88,339Note 38Leasing<strong>Skanska</strong> is a lessee in both financial and operating leases.When <strong>Skanska</strong> is a lessee, financial leasing assets are reported with a book valueas fixed assets in the balance sheet, while the future commitment to the lessor isreported as a liability in the balance sheet.As a financial lessor, <strong>Skanska</strong> reports the present value of its claim on the lesseeas a financial receivable. As an operating lessor, <strong>Skanska</strong> leases out properties via itsCommercial Project Development operations.A. <strong>Skanska</strong> as a lesseeFinancial leasesLeased tangible fixed assets, buildings and land as well as machinery andequipment, are reported in the consolidated financial statements as financial leases.These leases were reported as operational leases in 2002.Of the total amount in the balance sheet for financial leases, most comes fromtwo properties, a hotel in Poland and an office building in the Czech Republic.Financial leases, book value <strong>2003</strong> 2002Tangible fixed assetsBuildings and land 46 0Machinery and equipment 5 0Total 51 0Acquisition value 69 0Depreciation for the year –4 0Accumulated depreciation –14 0Book value 51 0Variable fees for financial leases included in <strong>2003</strong> income amounted to SEK –2 M(0). No property leased by <strong>Skanska</strong> has been subleased to others.Future lease payments and their present value can be seen in the following table.Present valueFuture of futurelease payments lease paymentsExpenses, due dates <strong>2003</strong> 2002 <strong>2003</strong> 2002Within one year –11 0 –9 0Later than one year but within five years –41 0 –32 0Later than five years –19 0 –11 0–71 0 –52 0Reconciliation, future lease payments and their present value <strong>2003</strong> 2002Future minimum lease payments –71 0Less interest charges 19 0Present value of future minumum lease payments –52 0Operating leasesMost of the amounts for future minimum lease payments are related to office spacefor operations in the United Kingdom and site leashold fees in Sweden.The Group’s leasing expenses related to operating leases in <strong>2003</strong> totaled SEK –168M (–237), of which SEK –168 M (–203) was related to minimum lease payments andSEK 0 M (–34) was related to variable payments.<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 83