Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

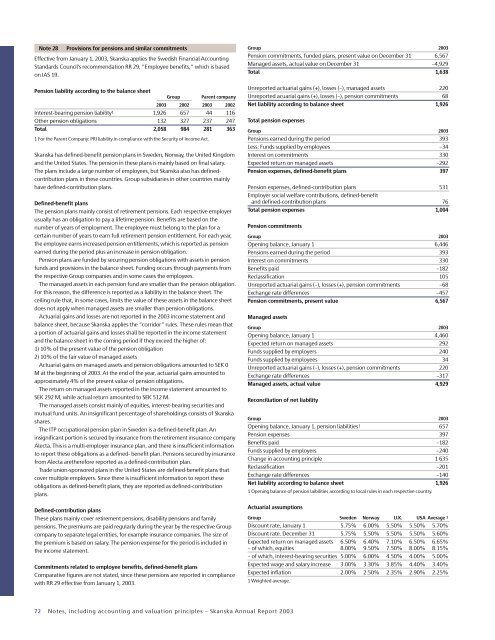

Note 28Provisions for pensions and similar commitmentsEffective from January 1, <strong>2003</strong>, <strong>Skanska</strong> applies the Swedish Financial AccountingStandards Council’s recommendation RR 29, ”Employee benefits,” which is basedon IAS 19.Pension liability according to the balance sheetGroupParent company<strong>2003</strong> 2002 <strong>2003</strong> 2002Interest-bearing pension liability 1 1,926 657 44 116Other pension obligations 132 327 237 247Total 2,058 984 281 3631 For the Parent Company: PRI liability in compliance with the Security of Income Act.<strong>Skanska</strong> has defined-benefit pension plans in Sweden, Norway, the United Kingdomand the United States. The pension in these plans is mainly based on final salary.The plans include a large number of employees, but <strong>Skanska</strong> also has definedcontributionplans in these countries. Group subsidiaries in other countries mainlyhave defined-contribution plans.Defined-benefit plansThe pension plans mainly consist of retirement pensions. Each respective employerusually has an obligation to pay a lifetime pension. Benefits are based on thenumber of years of employment. The employee must belong to the plan for acertain number of years to earn full retirement pension entitlement. For each year,the employee earns increased pension entitlements, which is reported as pensionearned during the period plus an increase in pension obligation.Pension plans are funded by securing pension obligations with assets in pensionfunds and provisions in the balance sheet. Funding occurs through payments fromthe respective Group companies and in some cases the employees.The managed assets in each pension fund are smaller than the pension obligation.For this reason, the difference is reported as a liability in the balance sheet. Theceiling rule that, in some cases, limits the value of these assets in the balance sheetdoes not apply when managed assets are smaller than pension obligations.Actuarial gains and losses are not reported in the <strong>2003</strong> income statement andbalance sheet, because <strong>Skanska</strong> applies the ”corridor” rules. These rules mean thata portion of actuarial gains and losses shall be reported in the income statementand the balance sheet in the coming period if they exceed the higher of:1) 10% of the present value of the pension obligation2) 10% of the fair value of managed assetsActuarial gains on managed assets and pension obligations amounted to SEK 0M at the beginning of <strong>2003</strong>. At the end of the year, actuarial gains amounted toapproximately 4% of the present value of pension obligations.The return on managed assets reported in the income statement amounted toSEK 292 M, while actual return amounted to SEK 512 M.The managed assets consist mainly of equities, interest-bearing securities andmutual fund units. An insignificant percentage of shareholdings consists of <strong>Skanska</strong>shares.The ITP occupational pension plan in Sweden is a defined-benefit plan. Aninsignificant portion is secured by insurance from the retirement insurance companyAlecta. This is a multi-employer insurance plan, and there is insufficient informationto report these obligations as a defined- benefit plan. Pensions secured by insurancefrom Alecta aretherefore reported as a defined-contribution plan.Trade union-sponsored plans in the United States are defined-benefit plans thatcover multiple employers. Since there is insufficient information to report theseobligations as defined-benefit plans, they are reported as defined-contributionplans.Defined-contribution plansThese plans mainly cover retirement pensions, disability pensions and familypensions. The premiums are paid regularly during the year by the respective Groupcompany to separate legal entities, for example insurance companies. The size ofthe premium is based on salary. The pension expense for the period is included inthe income statement.Commitments related to employee benefits, defined-benefit plansComparative figures are not stated, since these pensions are reported in compliancewith RR 29 effective from January 1, <strong>2003</strong>.Group <strong>2003</strong>Pension commitments, funded plans, present value on December 31 6,567Managed assets, actual value on December 31 –4,929Total 1,638Unreported actuarial gains (+), losses (–), managed assets 220Unreported acuarial gains (+), losses (–), pension commitments 68Net liability according to balance sheet 1,926Total pension expensesGroup <strong>2003</strong>Pensions earned during the period 393Less: Funds supplied by employees –34Interest on commitments 330Expected return on managed assets –292Pension expenses, defined-benefit plans 397Pension expenses, defined-contribution plans 531Employer social welfare contributions, defined-benefitand defined-contribution plans 76Total pension expenses 1,004Pension commitmentsGroup <strong>2003</strong>Opening balance, January 1 6,446Pensions earned during the period 393Interest on commitments 330Benefits paid –182Reclassification 105Unreported actuarial gains (–), losses (+), pension commitments –68Exchange rate differences –457Pension commitments, present value 6,567Managed assetsGroup <strong>2003</strong>Opening balance, January 1 4,460Expected return on managed assets 292Funds supplied by employers 240Funds supplied by employees 34Unreported actuarial gains (–), losses (+), pension commitments 220Exchange rate differences –317Managed assets, actual value 4,929Reconciliation of net liabilityGroup <strong>2003</strong>Opening balance, January 1, pension liabilities 1 657Pension expenses 397Benefits paid –182Funds supplied by employers –240Change in accounting principle 1 635Reclassification –201Exchange rate differences –140Net liability according to balance sheet 1,9261 Opening balance of pension laibilities according to local rules in each respective country.Actuarial assumptionsGroup Sweden Norway U.K. USA Average 1Discount rate, January 1 5.75% 6.00% 5.50% 5.50% 5.70%Discount rate. December 31 5.75% 5.50% 5.50% 5.50% 5.60%Expected return on managed assets 6.50% 6.40% 7.10% 6.50% 6.65%– of which, equities 8.00% 9.50% 7.50% 8.00% 8.15%– of which, interest-bearing securities 5.00% 6.00% 4.50% 4.00% 5.00%Expected wage and salary increase 3.00% 3.30% 3.85% 4.40% 3.40%Expected inflation 2.00% 2.50% 2.35% 2.90% 2.25%1 Weighted average.72 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>