Skanska Annual Report 2003

Skanska Annual Report 2003

Skanska Annual Report 2003

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

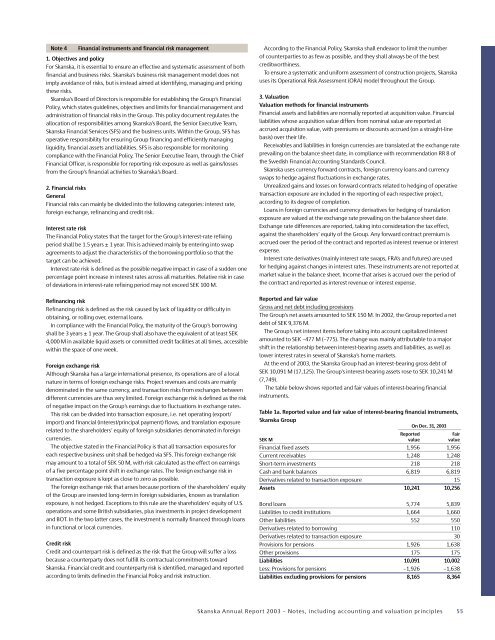

Note 4Financial instruments and financial risk management1. Objectives and policyFor <strong>Skanska</strong>, it is essential to ensure an effective and systematic assessment of bothfinancial and business risks. <strong>Skanska</strong>’s business risk management model does notimply avoidance of risks, but is instead aimed at identifying, managing and pricingthese risks.<strong>Skanska</strong>’s Board of Directors is responsible for establishing the Group’s FinancialPolicy, which states guidelines, objectives and limits for financial management andadministration of financial risks in the Group. This policy document regulates theallocation of responsibilities among <strong>Skanska</strong>’s Board, the Senior Executive Team,<strong>Skanska</strong> Financial Services (SFS) and the business units. Within the Group, SFS hasoperative responsibility for ensuring Group financing and efficiently managingliquidity, financial assets and liabilities. SFS is also responsible for monitoringcompliance with the Financial Policy. The Senior Executive Team, through the ChiefFinancial Officer, is responsible for reporting risk exposure as well as gains/lossesfrom the Group’s financial activities to <strong>Skanska</strong>’s Board.2. Financial risksGeneralFinancial risks can mainly be divided into the following categories: interest rate,foreign exchange, refinancing and credit risk.Interest rate riskThe Financial Policy states that the target for the Group’s interest-rate refixingperiod shall be 1.5 years ± 1 year. This is achieved mainly by entering into swapagreements to adjust the characteristics of the borrowing portfolio so that thetarget can be achieved.Interest rate risk is defined as the possible negative impact in case of a sudden onepercentage point increase in interest rates across all maturities. Relative risk in caseof deviations in interest-rate refixing period may not exceed SEK 100 M.Refinancing riskRefinancing risk is defined as the risk caused by lack of liquidity or difficulty inobtaining, or rolling over, external loans.In compliance with the Financial Policy, the maturity of the Group’s borrowingshall be 3 years ± 1 year. The Group shall also have the equivalent of at least SEK4,000 M in available liquid assets or committed credit facilities at all times, accessiblewithin the space of one week.Foreign exchange riskAlthough <strong>Skanska</strong> has a large international presence, its operations are of a localnature in terms of foreign exchange risks. Project revenues and costs are mainlydenominated in the same currency, and transaction risks from exchanges betweendifferent currencies are thus very limited. Foreign exchange risk is defined as the riskof negative impact on the Group’s earnings due to fluctuations in exchange rates.This risk can be divided into transaction exposure, i.e. net operating (export/import) and financial (interest/principal payment) flows, and translation exposurerelated to the shareholders’ equity of foreign subsidiaries denominated in foreigncurrencies.The objective stated in the Financial Policy is that all transaction exposures foreach respective business unit shall be hedged via SFS. This foreign exchange riskmay amount to a total of SEK 50 M, with risk calculated as the effect on earningsof a five percentage point shift in exchange rates. The foreign exchange risk intransaction exposure is kept as close to zero as possible.The foreign exchange risk that arises because portions of the shareholders’ equityof the Group are invested long-term in foreign subsidiaries, known as translationexposure, is not hedged. Exceptions to this rule are the shareholders’ equity of U.S.operations and some British subsidiaries, plus investments in project developmentand BOT. In the two latter cases, the investment is normally financed through loansin functional or local currencies.Credit riskCredit and counterpart risk is defined as the risk that the Group will suffer a lossbecause a counterparty does not fulfill its contractual commitments toward<strong>Skanska</strong>. Financial credit and counterparty risk is identified, managed and reportedaccording to limits defined in the Financial Policy and risk instruction.According to the Financial Policy, <strong>Skanska</strong> shall endeavor to limit the numberof counterparties to as few as possible, and they shall always be of the bestcreditworthiness.To ensure a systematic and uniform assessment of construction projects, <strong>Skanska</strong>uses its Operational Risk Assessment (ORA) model throughout the Group.3. ValuationValuation methods for financial instrumentsFinancial assets and liabilities are normally reported at acquisition value. Financialliabilities whose acquisition value differs from nominal value are reported ataccrued acquisition value, with premiums or discounts accrued (on a straight-linebasis) over their life.Receivables and liabilities in foreign currencies are translated at the exchange rateprevailing on the balance sheet date, in compliance with recommendation RR 8 ofthe Swedish Financial Accounting Standards Council.<strong>Skanska</strong> uses currency forward contracts, foreign currency loans and currencyswaps to hedge against fluctuations in exchange rates.Unrealized gains and losses on forward contracts related to hedging of operativetransaction exposure are included in the reporting of each respective project,according to its degree of completion.Loans in foreign currencies and currency derivatives for hedging of translationexposure are valued at the exchange rate prevailing on the balance sheet date.Exchange rate differences are reported, taking into consideration the tax effect,against the shareholders’ equity of the Group. Any forward contract premium isaccrued over the period of the contract and reported as interest revenue or interestexpense.Interest rate derivatives (mainly interest rate swaps, FRA’s and futures) are usedfor hedging against changes in interest rates. These instruments are not reported atmarket value in the balance sheet. Income that arises is accrued over the period ofthe contract and reported as interest revenue or interest expense.<strong>Report</strong>ed and fair valueGross and net debt including provisionsThe Group’s net assets amounted to SEK 150 M. In 2002, the Group reported a netdebt of SEK 9,376 M.The Group’s net interest items before taking into account capitalized interestamounted to SEK –477 M (–775). The change was mainly attributable to a majorshift in the relationship between interest-bearing assets and liabilities, as well aslower interest rates in several of <strong>Skanska</strong>’s home markets.At the end of <strong>2003</strong>, the <strong>Skanska</strong> Group had an interest-bearing gross debt ofSEK 10,091 M (17,125). The Group’s interest-bearing assets rose to SEK 10,241 M(7,749).The table below shows reported and fair values of interest-bearing financialinstruments.Table 1a. <strong>Report</strong>ed value and fair value of interest-bearing financial instruments,<strong>Skanska</strong> GroupOn Dec. 31, <strong>2003</strong><strong>Report</strong>edFairSEK M value valueFinancial fixed assets 1,956 1,956Current receivables 1,248 1,248Short-term investments 218 218Cash and bank balances 6,819 6,819Derivatives related to transaction exposure 15Assets 10,241 10,256Bond loans 5,774 5,839Liabilities to credit institutions 1,664 1,660Other liabilities 552 550Derivatives related to borrowing 110Derivatives related to transaction exposure 30Provisions for pensions 1,926 1,638Other provisions 175 175Liabilities 10,091 10,002Less: Provisions for pensions –1,926 –1,638Liabilities excluding provisions for pensions 8,165 8,364<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 55