Note 16 continuedTemporary differences that are not reported as deferred tax claimsGroup <strong>2003</strong> 2002Loss carry-forwards with a maturity date within one year 25 25Loss carry-forwards with a maturity date inmore than one year but within three years 774 277Loss carry-forwards with a maturity datein more than three years 803 1,403Other temporary differences 185 75Provisions for taxesGroup <strong>2003</strong> 2002Deferred tax liabilities on consolidated surplus values 57 46Deferred tax liabilities on other assets 1,051 720Deferred tax liabilities on untaxed reserves 1,395 1,343Other deferred tax liabilities 601 208Total 3,104 2,317Deferred tax liabilities on other assets and other deferred tax liabilities refer totemporary differences between values for tax purposes and values reported inthe balance sheet. These differences arise, among other things, when the Group’svaluation principles differ from those applied locally by a subsidiary. These deferredtax liabilities are mostly realized within five years.For example, deferred tax liabilities arise when depreciation/amortization in thecurrent period is larger than the required economic depreciation/amortization andwhen recognized profits in ongoing projects are taxed only when the project iscompleted.Temporary differences attributable to investments in subsidiaries, branches,associated companies and joint ventures for which deferred tax liabilities were notreported totaled just over SEK 1 M (0). Due to a change in tax legislation in Sweden,mandating a tax exemption when divesting shares that meet certain conditionsspecified by law (among others, shares held for business purposes) temporarydifferences do not normally exist for shareholdings by the Group’s Swedishcompanies.Net change in deferred taxes in the balance sheetGroup <strong>2003</strong> 2002Deferred taxes (net liability) according toprevious year’s financial statements 696 815Change in accounting principle, Gammon <strong>Skanska</strong> 0 –6Deferred taxes (net liability) on January 1 696 809Change in accounting principle, pensions –540 0Deferred tax expenses 1 1,283 –361Acquisitions of companies 0 185Exchange rate differences 126 63Amount on December 31 (net liability) 1,565 6961 Deferred tax expenses according to the income statement was reduced by SEK 166 M (82),which was reported directly against shareholders’ equity.Parent Company <strong>2003</strong> 2002Current taxes –99 –30Deferred tax revenue from changein temporary differences 9 1–90 –29Note 17Intangible fixed assetsIntangible fixed assets are reported in compliance with RR 15, ”Intangible fixedassets.” See ”Accounting and valuation principles,” Note 1.Intangible fixed assets are divided into goodwill and other intangible fixed asets.Goodwill according to the balance sheet amounted to SEK 4,259 M (5,360) andwas mainly attributable to acquisitions in 2000. See the table below.The amount for ”Other intangible fixed assets” mainly consisted of a highwayconcession in Chile. Amortization of this concession has not yet begun, since theconstruction project is still underway and is expected to last until 2005. Estimateduseful life is 25 years.Of the total amount for ”Other intangible assets,” SEK 459 M (481), SEK 387 M(372) was from the highway concession. Other intangible fixed assets, SEK 72 M(109) include extraction rights for gravel pits in Sweden, plus computer software.Goodwill value allocated by amortization periodThe following table shows the book value of goodwill allocated by business unitand amortization period.Amortization period<strong>2003</strong> 20 yrs 15 yrs 10 yrs 5 yrs TotalSelmer <strong>Skanska</strong> 1,368 0 38 4 1,410<strong>Skanska</strong> CZ 310 13 323<strong>Skanska</strong> OY 103 254 34 391<strong>Skanska</strong> UK 1,477 8 40 1,525Sweden 1 13 14USA Building 295 295USA Civil 139 139Services 142 5 147Other business units 15 15Total 3,258 0 877 124 4,259Amortization period2002 20 yrs 15 yrs 10 yrs 5 yrs TotalSelmer <strong>Skanska</strong> 1,689 41 77 8 1,815<strong>Skanska</strong> CZ 342 16 358<strong>Skanska</strong> OY 59 193 230 482<strong>Skanska</strong> UK 1,820 11 63 1,894Sweden 75 75USA Building 358 358USA Civil 180 180Services 133 7 140Other business units 34 24 58Total 3,910 41 1,061 348 5,360The amount that is being amortized over 20 years mainly consists of the corporateacquisitions of goodwill that occurred in 2000 when companies and holdings incompanies were acquired in Norway, Poland, the Czech Republic and the UnitedKingdom. The remaining amortization period for this goodwill is about 16.5 years.Aside from the above goodwill, <strong>Skanska</strong> has goodwill in Gammon <strong>Skanska</strong>,which is now reported according to the equity method of accounting. This goodwillamounted to SEK 178 M (230) and was reported together with the book value ofGammon <strong>Skanska</strong>, SEK 507 M (662).The connection between the Swedish tax rate of 28 percent and reported taxes isexplained in the table below.<strong>2003</strong> 2002Income after financial items 1,618 1,253Taxes at tax rate of 28 percent –453 –351Tax effect of:Allocations 31 –10Liquidation of subsidiaries 46Writedowns in shares of subsidiaries –40Dividends from subsidiaries 336 341Other –4 –15<strong>Report</strong>ed tax expenses –90 –2964 Notes, including accounting and valuation principles – <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

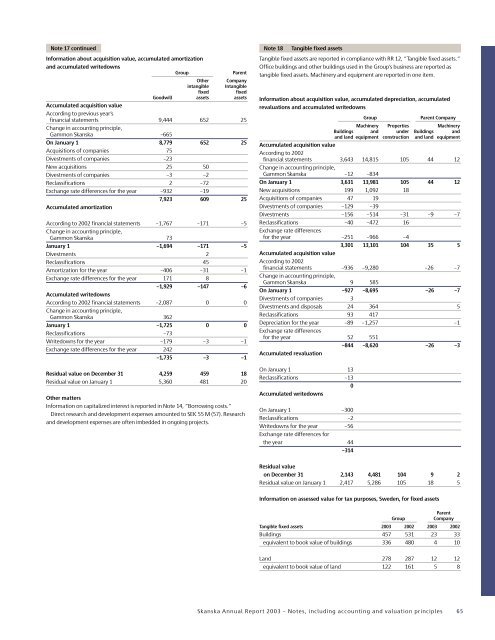

Note 17 continuedInformation about acquisition value, accumulated amortizationand accumulated writedownsGroupParentOther Companyintangible IntangiblefixedfixedGoodwill assets assetsAccumulated acquisition valueAccording to previous year’sfinancial statements 9,444 652 25Change in accounting principle,Gammon <strong>Skanska</strong> –665On January 1 8,779 652 25Acquisitions of companies 75Divestments of companies –23New acquisitions 25 50Divestments of companies –3 –2Reclassifications 2 –72Exchange rate differences for the year –932 –197,923 609 25Accumulated amortizationAccording to 2002 financial statements –1,767 –171 –5Change in accounting principle,Gammon <strong>Skanska</strong> 73January 1 –1,694 –171 –5Divestments 2Reclassifications 45Amortization for the year –406 –31 –1Exchange rate differences for the year 171 8–1,929 –147 –6Accumulated writedownsAccording to 2002 financial statements –2,087 0 0Change in accounting principle,Gammon <strong>Skanska</strong> 362January 1 –1,725 0 0Reclassifications –73Writedowns for the year –179 –3 –1Exchange rate differences for the year 242–1,735 –3 –1Residual value on December 31 4,259 459 18Residual value on January 1 5,360 481 20Other mattersInformation on capitalized interest is reported in Note 14, ”Borrowing costs.”Direct research and development expenses amounted to SEK 55 M (57). Researchand development expenses are often imbedded in ongoing projects.Note 18Tangible fixed assetsTangible fixed assets are reported in compliance with RR 12, ”Tangible fixed assets.”Office buildings and other buildings used in the Group’s business are reported astangible fixed assets. Machinery and equipment are reported in one item.Information about acquisition value, accumulated depreciation, accumulatedrevaluations and accumulated writedownsGroupParent CompanyMachinery Properties MachineryBuildings and under Buildings andand land equipment construction and land equipmentAccumulated acquisition valueAccording to 2002financial statements 3,643 14,815 105 44 12Change in accounting principle,Gammon <strong>Skanska</strong> –12 –834On January 1 3,631 13,981 105 44 12New acquisitions 199 1,092 18Acquisitions of companies 47 19Divestments of companies –129 –39Divestments –156 –514 –31 –9 –7Reclassifications –40 –472 16Exchange rate differencesfor the year –251 –966 –43,301 13,101 104 35 5Accumulated acquisition valueAccording to 2002financial statements –936 –9,280 –26 –7Change in accounting principle,Gammon <strong>Skanska</strong> 9 585On January 1 –927 –8,695 –26 –7Divestments of companies 3Divestments and disposals 24 364 5Reclassifications 93 417Depreciation for the year –89 –1,257 –1Exchange rate differencesfor the year 52 551–844 –8,620 –26 –3Accumulated revaluationOn January 1 13Reclassifications –130Accumulated writedownsOn January 1 –300Reclassifications –2Writedowns for the year –56Exchange rate differences forthe year 44–314Residual valueon December 31 2,143 4,481 104 9 2Residual value on January 1 2,417 5,286 105 18 5Information on assessed value for tax purposes, Sweden, for fixed assetsGroupParentCompanyTangible fixed assets <strong>2003</strong> 2002 <strong>2003</strong> 2002Buildings 457 531 23 33equivalent to book value of buildings 336 480 4 10Land 278 287 12 12equivalent to book value of land 122 161 5 8<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> – Notes, including accounting and valuation principles 65