FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

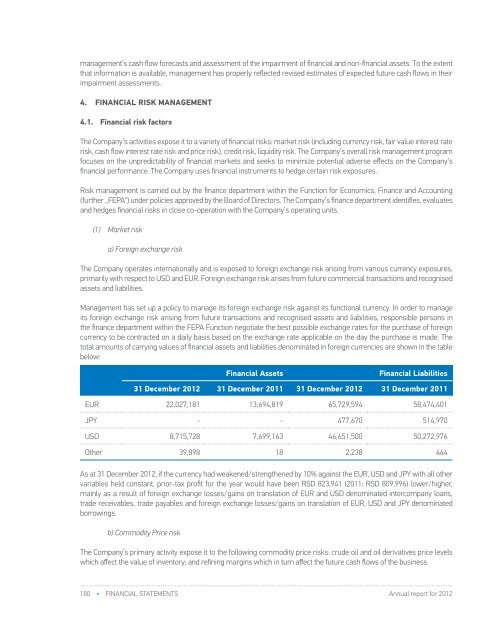

management’s cash flow forecasts and assessment of the impairment of financial and non-financial assets. To the extentthat information is available, management has properly reflected revised estimates of expected future cash flows in theirimpairment assessments.4. FINANCIAL RISK MANAGEMENT4.1. Financial risk factorsThe Company’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest raterisk, cash flow interest rate risk and price risk), credit risk, liquidity risk. The Company’s overall risk management programfocuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Company’sfinancial performance. The Company uses financial instruments to hedge certain risk exposures.Risk management is carried out by the finance department within the Function for Economics, Finance and Accounting(further „FEPA“) under policies approved by the Board of Directors. The Company’s finance department identifies, evaluatesand hedges financial risks in close co-operation with the Company’s operating units.(1) Market riska) Foreign exchange riskThe Company operates internationally and is exposed to foreign exchange risk arising from various currency exposures,primarily with respect to USD and EUR. Foreign exchange risk arises from future commercial transactions and recognisedassets and liabilities.Management has set up a policy to manage its foreign exchange risk against its functional currency. In order to manageits foreign exchange risk arising from future transactions and recognised assets and liabilities, responsible persons inthe finance department within the FEPA Function negotiate the best possible exchange rates for the purchase of foreigncurrency to be contracted on a daily basis based on the exchange rate applicable on the day the purchase is made. Thetotal amounts of carrying values of financial assets and liabilities denominated in foreign currencies are shown in the tablebelow:Financial AssetsFinancial Liabilities31 December <strong>2012</strong> 31 December 2011 31 December <strong>2012</strong> 31 December 2011EUR 22,027,181 13,694,819 65,729,594 58,474,401JPY - - 477,670 514,970USD 8,715,728 7,699,163 46,651,500 50,272,976Other 39,898 18 2,238 464As at 31 December <strong>2012</strong>, if the currency had weakened/strengthened by 10% against the EUR, USD and JPY with all othervariables held constant, prior-tax profit for the year would have been RSD 823,941 (2011: RSD 809,996) lower/higher,mainly as a result of foreign exchange losses/gains on translation of EUR and USD denominated intercompany loans,trade receivables, trade payables and foreign exchange losses/gains on translation of EUR, USD and JPY denominatedborrowings.b) Commodity Price riskThe Company’s primary activity expose it to the following commodity price risks: crude oil and oil derivatives price levelswhich affect the value of inventory; and refining margins which in turn affect the future cash flows of the business.In the case of price risk, the level of exposure is determined by the amount of priced inventory carried at the end of thereporting period. In periods of sharp price decline, as the Company policy is to report its inventory at the lower of historiccost and net realisable value, the results are affected by the reduction in the carrying value of the inventory. The extent ofthe exposure relates directly to the level of stocks and the rate of price decrease.c) Cash flow and fair value interest rate riskAs at 31 December <strong>2012</strong>, the Company had significant amounts of cash and cash equivalents, i.e. significant interestbearingassets. The cash was deposited only in banks with which the Company has passive business relationships i.e.loans and credit/documentary lines. Also, RSD and foreign currency fixed term deposits are short term (up to 60 days) andbear fixed interest rates. Based on the above information, the Company’s revenues and cash flows are to a great extentindependent of changes in market interest rates on fixed term deposits, although the interest rates that the Company canachieve in the market to a great extent depend on the level of basic interest rates at the time when cash has been deposited(Belibor / NBS key policy rate).Furthermore, in <strong>2012</strong> the Company approved to its majority-owned foreign subsidiaries subordinated loans as a meansof financing business activities abroad. These loans were approved with the variable interest rate (Euribor). If the interestrates on approved loans had been 1% higher/lower with all other parameters unchanged, net result before tax for the year<strong>2012</strong> would have been RSD 52,179 (2011: RSD 496) higher/lower.Borrowings issued at variable interest rates expose the Company to cash flow interest rate risk, whilst borrowings issuedat fixed rates expose the Company to fair value interest rate risk. Depending on the levels of net debt at any given periodof time, any change in the base interest rates (EURIBOR or LIBOR) has a proportionate impact on the Company’s results.If interest rates on foreign currency denominated borrowings, with floating interest rate, had been 1% higher/lower withall other variables held constant, pre-tax profit for <strong>2012</strong> would have been RSD 820,669 (2011: RSD 640,891) lower/higher,mainly as a result of higher/lower interest expense on floating rate borrowings.(2) Credit riskCredit risk is managed on the Company’s level basis. Credit risk arises from cash and cash equivalents, deposits withbanks and financial institutions, intercompany loans issued to overseas and to domestic subsidiaries, as well as creditexposures to wholesale and retail customers, including outstanding receivables and committed transactions.Banks are rated only in the case of collateralised receivables on various grounds, as well as based on the banks totalexposure to the Company. For domestic banks, if it is bank with who the Company has passive activities the secondcriterion is applied and if it is a bank with who Company doesn’t have cooperation, credit limits are determined based onthe defined methodology.Sales to retail customers are settled in cash or using credit cards.The Company has provided for receivables from customers who have exceeded their credit limits or are undergoingliquidity problems (note 12).(3) Liquidity riskCash flow forecasting is performed as aggregated at the Company’s level. The Company’s finance function monitorsrolling forecasts of the Company’s liquidity requirements to ensure It has sufficient cash to meet operational needs whilemaintaining sufficient headroom on its undrawn committed borrowing facilities at all times so that the Company doesnot breach borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting takes intoconsideration the Company’s debt financing plans, covenant compliance, compliance with internal balance sheet ratiotargets and, if applicable external regulatory or legal requirements – for example, currency restrictions.180 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 181