FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

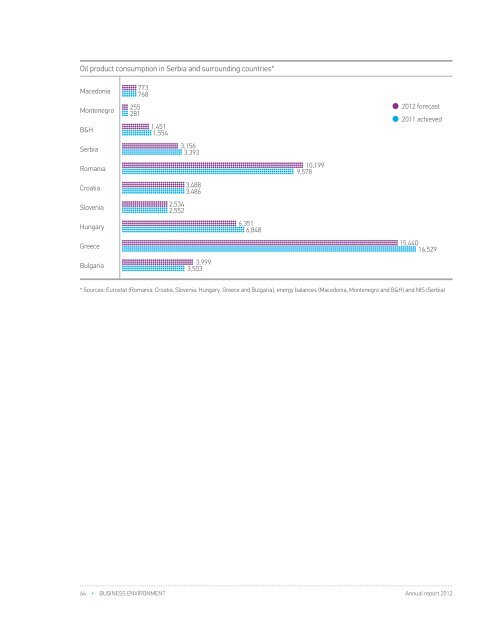

Oil product consumption in Serbia and surrounding countries*MacedoniaMontenegroB&HSerbiaRomaniaCroatiaSloveniaHungaryGreeceBulgaria7737682552811,4511,5543,1563,3933,4883,4862,5342,5523,9993,5036,3516,84810,1999,578<strong>2012</strong> forecast2011 achieved15,44016,529* Sources: Eurostat (Romania, Croatia, Slovenia, Hungary, Greece and Bulgaria), energy balances (Macedonia, Montenegro and B&H) and <strong>NIS</strong> (Serbia)Risk ManagementCompany’s objectives in the field ofrisk managementIn 2010 the Company defined objectives in the fieldof risk management and established an Integrated RiskManagement System (IRMS). IRMS is a system, orderly,unified, continuous and on-going process of identification,assessment, defining and monitoring of the implementationof the risk management measures. The basic principleof this system is that the responsibility for managingthe various risks was assigned to different managementlevels depending on the estimated financial impact of therisk. In 2011 the Standard of "Risk Management" wasadopted. It defines the principles of risk management inorder to increase the efficiency and effectiveness of theCompany's activities in the short and long term perspective.The objective of the Company in the field of riskmanagement is to provide additional guarantees for theachievement of the strategic objectives of the Companythrough timely identification / risk prevention, definition ofeffective measures and the provision of maximum effectivenessof risk management.Risk management has become an integral part of theCompany's internal environment, by the implementationof the following processes.• adopting the risk-oriented approach in all aspectsof production and management activities;• a systematic analysis of the identified risks;• establishing the risk control system andmonitoring the effectiveness of risk managementmeasures;• informing all employees of the Company aboutthe basic principles and approaches to riskmanagement adopted by the Company;• providing the necessary regulatory andmethodological support;• the distribution of authorities and responsibilitiesfor risk management between the organizationalunits of the Company.Industrial risksThe main areas of the Company's business operationsinclude the oil and gas production, oil refiningand the sale of petroleum products, which makes theCompany exposed to the risks specific to the oil and gasindustry. As the main business activity of the Companyis production, refining and sales and distribution of petroleumproducts - The Company is particularly exposedto the risks caused by:• potential changes in prices of oil and petroleumproducts;• risks in the area of exploration and production ofoil.Risks associated with potential changes in prices ofoil and petroleum productsDue to its primary activity, the Company is exposedto risks of changes in prices of crude oil and petroleumproducts which affect the value of the stock; and the marginsin oil refining, which further affect the future cashflows. Fluctuations in the prices of oil and petroleumproducts are not under the control of the Company butdepend on external factors such as global and changesin RS and the balance of supply and demand, the volumeof consumption of these markets and the activities of theregulatory authorities.In order to reduce the potential negative impact ofthese risks the Company implements the following activities:• annual planning scenario-based approach,monitoring of plans and timely correction of crudeoil procurement plans;• regular sessions of the Commission for theprocurement of crude oil;• daily monitoring of publications for crude oil"URAL (RCMB) and Brent DTD, as well as thecontacts with international partners.The above measures allow the Company to reducethese risks to the acceptable level.64 • Business environment Annual report <strong>2012</strong>Annual report <strong>2012</strong>Risk Management • 65