FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

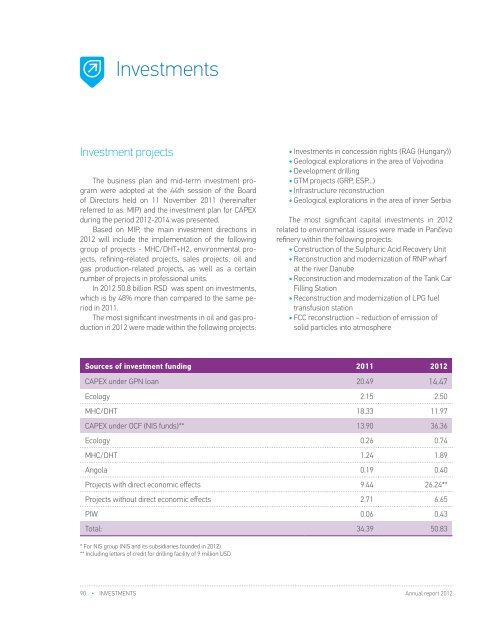

InvestmentsCAPEX from GPN loan andCAPEX from OCF in <strong>2012</strong>, in bln. RSDInvestment projectsThe business plan and mid-term investment programwere adopted at the 44th session of the Boardof Directors held on 11 November 2011 (hereinafterreferred to as: MIP) and the investment plan for CAPEXduring the period <strong>2012</strong>-2014 was presented.Based on MIP, the main investment directions in<strong>2012</strong> will include the implementation of the followinggroup of projects - MHC/DHT+H2, environmental projects,refining-related projects, sales projects, oil andgas production-related projects, as well as a certainnumber of projects in professional units.In <strong>2012</strong> 50.8 billion RSD was spent on investments,which is by 48% more than compared to the same periodin 2011.The most significant investments in oil and gas productionin <strong>2012</strong> were made within the following projects:• Investments in concession rights (RAG (Hungary))• Geological explorations in the area of Vojvodina• Development drilling• GTM projects (GRP, ESP...)• Infrastructure reconstruction• Geological explorations in the area of inner SerbiaThe most significant capital investments in <strong>2012</strong>related to environmental issues were made in Pančevorefinery within the following projects:• Construction of the Sulphuric Acid Recovery Unit• Reconstruction and modernization of RNP wharfat the river Danube• Reconstruction and modernization of the Tank CarFilling Station• Reconstruction and modernization of LPG fueltransfusion station• FCC reconstruction – reduction of emission ofsolid particles into atmospherebillions RSD for investmentsCAPEX by investment projects, in bln. RSD0.062.719.440.1919.5734.4X6145%178%40%-29%50.80.436.6526.240.4013.86CAPEXfrom GPNloanCAPEXfrom OCFPIWProjects without direct economics effect2Projects with direct economics effectAngola PSA*MHC/DHTEcology14.536.4+48%Sources of investment funding 2011 <strong>2012</strong>CAPEX under GPN loan 20.49 14.47Ecology 2.15 2.50MHC/DHT 18.33 11.97CAPEX under OCF (<strong>NIS</strong> funds)** 13.90 36.36Ecology 0.26 0.74MHC/DHT 1.24 1.89Angola 0.19 0.40Projects with direct economic effects 9.44 26.24**Projects without direct economic effects 2.71 6.65PIW 0.06 0.43Total: 34.39 50.83* For <strong>NIS</strong> group (<strong>NIS</strong> and its subsidiaries founded in <strong>2012</strong>)** Including letters of credit for drilling facility of 9 million USD2.41 35%3.252011*PSA - Production Sharing Agreement<strong>2012</strong>Investments in other significantprojectsApart from investments in capacities for performingbusiness activities, <strong>NIS</strong> made significant investments indevelopment and improvements of the information systemduring <strong>2012</strong>.The greatest investments were made in the improvementof server and storage - Cloud infrastructure worth of149 million RSD, in view of improving the performance ofall systems whose operation relies on the existing ЕVA4400storage system for the purpose of preventing performancedegradation in case of faults on system parts and ensuringminute response.The SAP solution has been implemented in subsidiaries.The data and reporting among countries and entities inthe region have been consolidated and standard businessprocesses and procedures have been implemented for thepurpose of achieving operational efficiency, integration withthe parent company and compliance with the regulations ofcountries in which the said solution is implemented. Theseinvestments are worth of 73.4 million RSD.The modernization of Oilfield Services has been initiatedby making investments in procurement of equipmentfor drilling platforms, procurement of a new drilling platformand modernization of car fleet.The Energy Block has taken over 50% of share in theproject for construction of the wind park in Plandište.Investments in security equipment have also been increasedin the amount of 0.15 billion RSD.90 • Investments Annual report <strong>2012</strong>Annual report <strong>2012</strong>Investments • 91