FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

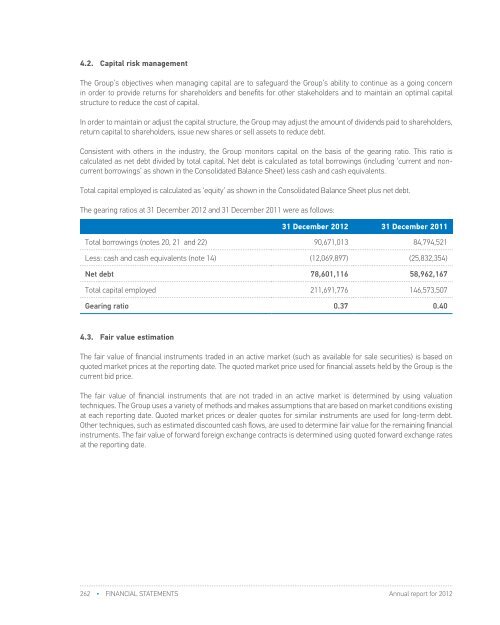

4.2. Capital risk managementThe Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concernin order to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal capitalstructure to reduce the cost of capital.In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders,return capital to shareholders, issue new shares or sell assets to reduce debt.Consistent with others in the industry, the Group monitors capital on the basis of the gearing ratio. This ratio iscalculated as net debt divided by total capital. Net debt is calculated as total borrowings (including ‘current and noncurrentborrowings’ as shown in the Consolidated Balance Sheet) less cash and cash equivalents.Total capital employed is calculated as ‘equity’ as shown in the Consolidated Balance Sheet plus net debt.The gearing ratios at 31 December <strong>2012</strong> and 31 December 2011 were as follows:31 December <strong>2012</strong> 31 December 2011Total borrowings (notes 20, 21 and 22) 90,671,013 84,794,521Less: cash and cash equivalents (note 14) (12,069,897) (25,832,354)Net debt 78,601,116 58,962,167Total capital employed 211,691,776 146,573,507Gearing ratio 0.37 0.405. SEGMENT INFORMATIONOperating segments, are segments whose operating results are regularly reviewed by the Chief Operating DecisionMaker („CODM“) of the Parent. During <strong>2012</strong>, the Parent has adopted new governance structure in compliance with thenew Company law of the Republic of Serbia. The Parent’s Board of Directors and the General Manager Advisory Boardrepresent the CODM according to newly adopted structure.As at 31 December <strong>2012</strong> business activities of the Group are organized into five operating segments :(1) Exploration and production of Oil and Natural gas,(2) Oil Field Services,(3) Refining,(4) Oil and Oil Products Trading,(5) Other – Administration and Energy.The reportable segments derive their revenue from the following activities:(1) Exploration and Production of Oil and Natural Gas – production and sale of crude oil and natural gas,(2) Oil Field Services – drilling services, construction works and geophysical measurement and transportationservices,(3) Refining – refining of crude oil and sale of petroleum products to <strong>NIS</strong> trade segment,(4) Trading Oil and Petroleum Products – retail and wholesale activities consistent with the policy.4.3. Fair value estimationThe fair value of financial instruments traded in an active market (such as available for sale securities) is based onquoted market prices at the reporting date. The quoted market price used for financial assets held by the Group is thecurrent bid price.The fair value of financial instruments that are not traded in an active market is determined by using valuationtechniques. The Group uses a variety of methods and makes assumptions that are based on market conditions existingat each reporting date. Quoted market prices or dealer quotes for similar instruments are used for long-term debt.Other techniques, such as estimated discounted cash flows, are used to determine fair value for the remaining financialinstruments. The fair value of forward foreign exchange contracts is determined using quoted forward exchange ratesat the reporting date.262 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 263