FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

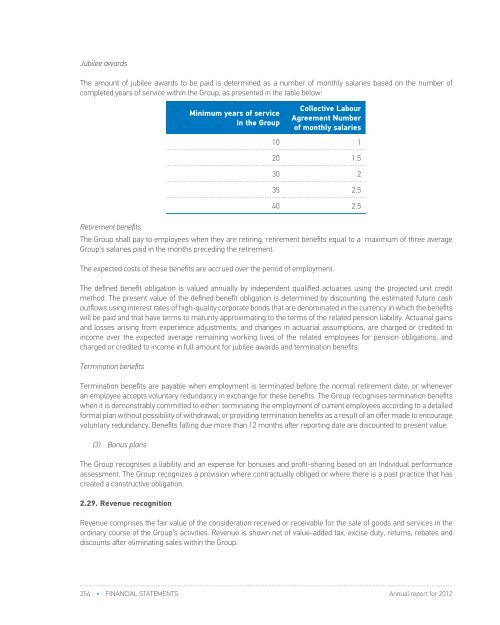

Jubilee awardsThe amount of jubilee awards to be paid is determined as a number of monthly salaries based on the number ofcompleted years of service within the Group, as presented in the table below:Minimum years of servicein the GroupCollective LabourAgreement Numberof monthly salaries10 120 1.530 235 2.540 2.5Retirement benefitsThe Group shall pay to employees when they are retiring, retirement benefits equal to a maximum of three averageGroup’s salaries paid in the months preceding the retirement.The expected costs of these benefits are accrued over the period of employment.The defined benefit obligation is valued annually by independent qualified actuaries using the projected unit creditmethod. The present value of the defined benefit obligation is determined by discounting the estimated future cashoutflows using interest rates of high-quality corporate bonds that are denominated in the currency in which the benefitswill be paid and that have terms to maturity approximating to the terms of the related pension liability. Actuarial gainsand losses arising from experience adjustments, and changes in actuarial assumptions, are charged or credited toincome over the expected average remaining working lives of the related employees for pension obligations, andcharged or credited to income in full amount for jubilee awards and termination benefits.Termination benefitsTermination benefits are payable when employment is terminated before the normal retirement date, or wheneveran employee accepts voluntary redundancy in exchange for these benefits. The Group recognises termination benefitswhen it is demonstrably committed to either: terminating the employment of current employees according to a detailedformal plan without possibility of withdrawal; or providing termination benefits as a result of an offer made to encouragevoluntary redundancy. Benefits falling due more than 12 months after reporting date are discounted to present value.(3) Bonus plansThe Group recognises a liability and an expense for bonuses and profit-sharing based on an Individual performanceassessment. The Group recognizes a provision where contractually obliged or where there is a past practice that hascreated a constructive obligation.2.29. Revenue recognitionRevenue comprises the fair value of the consideration received or receivable for the sale of goods and services in theordinary course of the Group’s activities. Revenue is shown net of value-added tax, excise duty, returns, rebates anddiscounts after eliminating sales within the Group.The Group recognises revenue when the amount of revenue can be reliably measured, it is probable that futureeconomic benefits will flow to the Group and when specific criteria have been met for each of the Group’s activities asdescribe below. The amount of the revenue is not considered to be reliably measurable until all contingences relatingto the sale have been resolved. The Group bases its estimates on historical results, taking into consideration the type ofcustomer, the type of transaction and the specifics of each arrangement.(1) Sales - wholesaleThe Group manufactures and sells oil, petrochemical products and liquified natural gas in the wholesale market. Salesof goods are recognised when the Group has delivered products to the customer. Delivery does not occur until theproducts have been shipped to the specified location, the risks of obsolescence and loss have been transferred to thewholesaler, and either the wholesaler has accepted the products in accordance with the sales contract, the acceptanceprovisions have lapsed, or the Group has objective evidence that all criteria for acceptance have been satisfied.Sales are recorded based on the price specified in the sales contracts, net of the estimated volume discounts andreturns at the time of sale. Accumulated experience is used to estimate and provide for the discounts and returns. Thevolume discounts are assessed based on anticipated annual purchases. No element of financing is deemed present asthe sales are made with a credit term of 90 days for state owned companies and 60 days for other companies, which isconsistent with the market practice.(2) Sales– retailThe Group operates a chain of Petrol Stations. Sales of goods are recognised when the Group sells a product to thecustomer. Retail sales are usually in cash, fuel coupons or by credit card.(3) Sales of servicesThe Group sells oil engineering services. These services are provided on a time and material basis or as a fixed pricecontract, with contract terms generally accepted in the industry.Revenue from time and material contracts, typically from delivering engineering services, is recognised under thepercentage of completion method. Revenue is generally recognized at the contractual rates. For time contracts, thestage of completion is measured on the basis of labour hours determined as a percentage of total hours to be delivered.For material contracts, the stage of completion is measured on the basis of, and direct expenses are incurred as, apercentage of the total expenses to be incurred.Revenue from fixed-price contracts for delivering engineering services is also recognised under the percentage-ofcompletionmethod. Revenue is generally recognised based on the services performed to date as a percentage of thetotal services to be performed.If circumstances arise that may change the original estimates of revenues, costs or extent of progress towardcompletion, estimates are revised. These revisions may result in increases or decreases in estimated revenues orcosts and are reflected in income in the period in which the circumstances that give rise to the revision become knownby management.(4) Interest incomeInterest income is recognised on a time-proportion basis using the effective interest method. When a receivable isimpaired, the Group reduces the carrying amount to its recoverable amount, being the estimated future cash flowdiscounted at original effective interest rate of the instrument, and continues unwinding the discount as interest income.Interest income on impaired loans is recognised using the original effective interest rate.254 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 255