FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

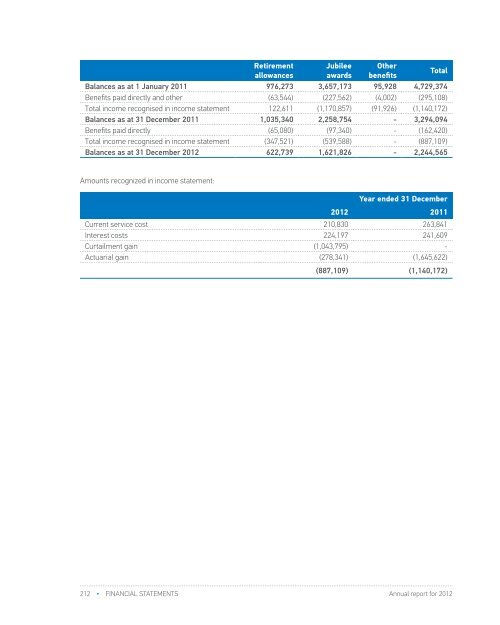

Retirement Jubilee Otherallowances awards benefitsTotalBalances as at 1 January 2011 976,273 3,657,173 95,928 4,729,374Benefits paid directly and other (63,544) (227,562) (4,002) (295,108)Total income recognised in income statement 122,611 (1,170,857) (91,926) (1,140,172)Balances as at 31 December 2011 1,035,340 2,258,754 - 3,294,094Benefits paid directly (65,080) (97,340) - (162,420)Total income recognised in income statement (347,521) (539,588) - (887,109)Balances as at 31 December <strong>2012</strong> 622,739 1,621,826 - 2,244,565Amounts recognized in income statement:Year ended 31 December<strong>2012</strong> 2011Current service cost 210,830 263,841Interest costs 224,197 241,609Curtailment gain (1,043,795) -Actuarial gain (278,341) (1,645,622)(887,109) (1,140,172)20. LONG-TERM BORROWINGS31 December <strong>2012</strong> 31 December 2011Domestic 14,627,940 17,997,065Foreign 16,626,865 18,052,13031,254,805 36,049,195Current portion of long-term borrowings (note 22) (533,466) (2,274,652)Total 30,721,339 33,774,543The maturity of non-current borrowings was as follows31 December <strong>2012</strong> 31 December 2011Between 1 and 2 years 22,184,094 4,538,604Between 2 and 5 years 2,405,694 22,487,295Over 5 years 6,131,551 6,748,64430,721,339 33,774,543The fair value of non-current borrowings and their carrying amounts are equal.31 December <strong>2012</strong> 31 December 2011USD 19,607,409 25,352,982EUR 8,889,704 8,900,998RSD 2,281,108 1,281,436JPY 476,584 513,779The fair value of non-current borrowings and their carrying amounts are equal.31,254,805 36,049,195The Company repays borrowings in accordance with agreed dynamics, i.e. determined annuity plans. The Companyagreed both fixed and floating interest rates with the creditors. Floating interest rates are connected with Euribor andLibor.Management expects that the Company will be able to fulfil its obligations within agreed timeframe.212 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 213