FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

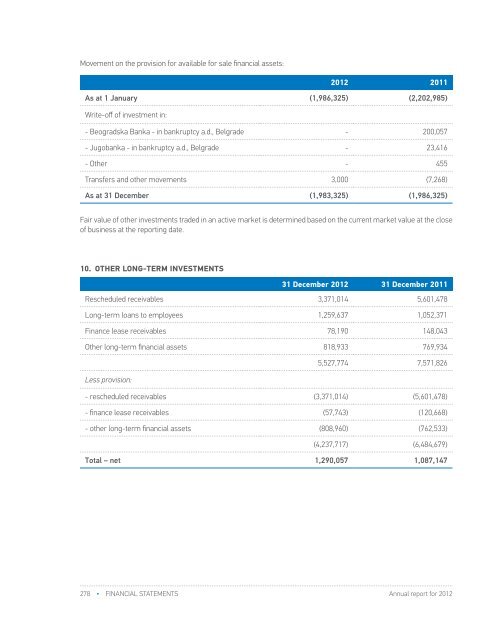

Movement on the provision for available for sale financial assets:<strong>2012</strong> 2011As at 1 January (1,986,325) (2,202,985)Write-off of investment in:(1) Rescheduled receivablesRescheduled receivables as at 31 December <strong>2012</strong> fully relate to:Rescheduled receivablesTotal Long-term Current portion- Beogradska Banka - in bankruptcy a.d., Belgrade - 200,057- Jugobanka - in bankruptcy a.d., Belgrade - 23,416- Other - 455Transfers and other movements 3,000 (7,268)As at 31 December (1,983,325) (1,986,325)Fair value of other investments traded in an active market is determined based on the current market value at the closeof business at the reporting date.10. OTHER LONG-TERM INVESTMENTS31 December <strong>2012</strong> 31 December 2011Rescheduled receivables 3,371,014 5,601,478Long-term loans to employees 1,259,637 1,052,371Finance lease receivables 78,190 148,043Other long-term financial assets 818,933 769,934Less provision:5,527,774 7,571,826- rescheduled receivables (3,371,014) (5,601,478)- finance lease receivables (57,743) (120,668)- other long-term financial assets (808,960) (762,533)(4,237,717) (6,484,679)Total – net 1,290,057 1,087,147- HIP Petrohemija 9,643,993 1,944,474 7,699,519- RTB Bor 1,426,540 1,426,540 -- ЈАТ 100,110 - 100,11011,170,643 3,371,014 7,799,629Less: provision (9,191,079) (3,371,014) (5,820,065)Total – net 1,979,564 - 1,979,564Current portion of rescheduled receivables amounting to RSD 1,979,564 relates to HIP Petrohemija Pancevo currentreceivables that are secured by a mortgage right over debtor’s fixed assets.Movements on rescheduled receivables provision:<strong>2012</strong> 2011As at 1 January (5,601,478) (8,040,906)Foreign exchange gains /losses 108,503 317,467Transfer to short-term financial investments (note 13) 2,121,961 2,121,961As at 31 December (3,371,014) (5,601,478)(2) Long-term loans to employeesLoans to employees as at 31 December <strong>2012</strong> amounting to RSD 1,259,637 (31 December 2011: RSD 1,052,371)represent interest-free loans or loans at the interest rate of 0.5% and 1.5% given to employees for housing purposes.These loans are repaid through monthly installments.The fair value of loans to employees is based on the cash flows discounted at market interest rate at which the Groupcould obtain long-term borrowings and which corresponds to market interest rate for similar financial instruments inthe current reporting period of 5.56% (2011: 5.46% p.a.).The maximum exposure to credit risk at the reporting date is the nominal value of loans given to employees. This creditrisk exposure is limited, as the monthly installments of these loans are withheld from employees’ salaries. None of theloans are overdue or impaired.278 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 279