FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

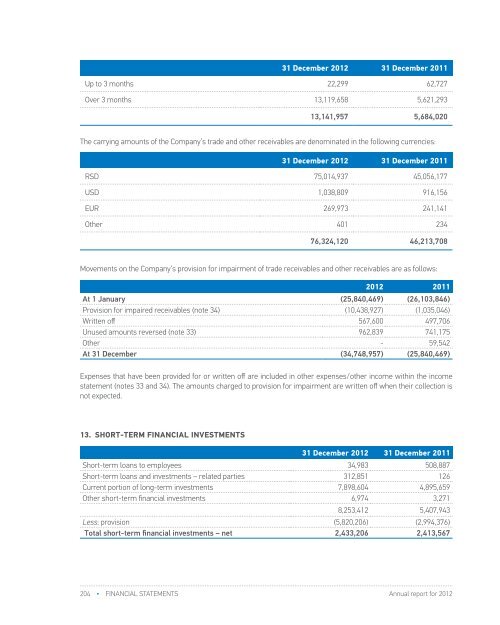

31 December <strong>2012</strong> 31 December 2011Up to 3 months 22,299 62,727Over 3 months 13,119,658 5,621,29313,141,957 5,684,020The carrying amounts of the Company’s trade and other receivables are denominated in the following currencies:31 December <strong>2012</strong> 31 December 2011RSD 75,014,937 45,056,177USD 1,038,809 916,156EUR 269,973 241,141Other 401 23476,324,120 46,213,708Movements on the Company’s provision for impairment of trade receivables and other receivables are as follows:<strong>2012</strong> 2011At 1 January (25,840,469) (26,103,846)Provision for impaired receivables (note 34) (10,438,927) (1,035,046)Written off 567,600 497,706Unused amounts reversed (note 33) 962,839 741,175Other - 59,542At 31 December (34,748,957) (25,840,469)Expenses that have been provided for or written off are included in other expenses/other income within the incomestatement (notes 33 and 34). The amounts charged to provision for impairment are written off when their collection isnot expected.13. SHORT-TERM FINANCIAL INVESTMENTS31 December <strong>2012</strong> 31 December 2011Short-term loans to employees 34,983 508,887Short-term loans and investments – related parties 312,851 126Current portion of long-term investments 7,898,604 4,895,659Other short-term financial investments 6,974 3,2718,253,412 5,407,943Less: provision (5,820,206) (2,994,376)Total short-term financial investments – net 2,433,206 2,413,567Current portions of long-term investments as at 31 December <strong>2012</strong> amounting to RSD 7,898,604 (31 December 2011:RSD 4,895,659) mainly relate to current portion of rescheduled receivables of RSD 7,799,629. They are provided for inthe amount of RSD 5,820,065 (2011: RSD 2,994,376) (note 10).Movements on the provision for short-term financial investments:<strong>2012</strong> 2011At 1 January (2,994,376) (706,158)Provision for impairment - (57,123)Unused amounts reversed (note 33) 26,668 145,180Transfer from other long-term investments (note10a)(2,121,961) (2,121,961)Foreign exchange differences and other movements (730,537) (254,314)At 31 December (5,820,206) (2,994,376)14. VAT AND PREPAID EXPENSES31 December <strong>2012</strong> 31 December 2011Deferred input VAT 3,715,739 1,746,469Prepaid expenses 135,363 55,361Accrued revenue 2,342,103 483,920Prepaid excise duty 1,319,866 1,119,985Housing loans and other prepayments 1,265,187 1,221,1868,778,258 4,626,921Deferred input VAT as at 31 December <strong>2012</strong> amounting to RSD 3,715,739 (31 December 2011: RSD 1,746,469) representsVAT inputs claimed on invoices received and accounted for in the current period, whilst inputs will be allowed in thefollowing accounting period.Prepaid excise duty amounting to RSD 1,319,866 (31 December 2011: RSD 1,119,985) relates to the excise paid to thestate for finished products stored in non-excise warehouse.Accrued revenue as at 31 December <strong>2012</strong> amounting to RSD 2,342,103 (31 December 2011: RSD 483,920) mostlyrelates to receivables for current period sales of gasoline components in the of amount RSD 1,433,617 and for sales ofcrude oil in the amount RSD 836,904, that have not been invoiced by the year end.15. CASH AND CASH EQUIVALENTS31 December <strong>2012</strong> 31 December 2011Cash at bank 7,949,139 24,793,781Cash in hand 287,180 391,896Other cash equivalents 74,945 43,0498,311,264 25,228,726As at 31 December <strong>2012</strong>, short term bank deposits amounting to RSD 1,081,515 (31 December 2011: RSD 16,473,646)relate to cash deposits with commercial banks with maturity of up to 30 days and are stated as Cash at bank.204 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 205