FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

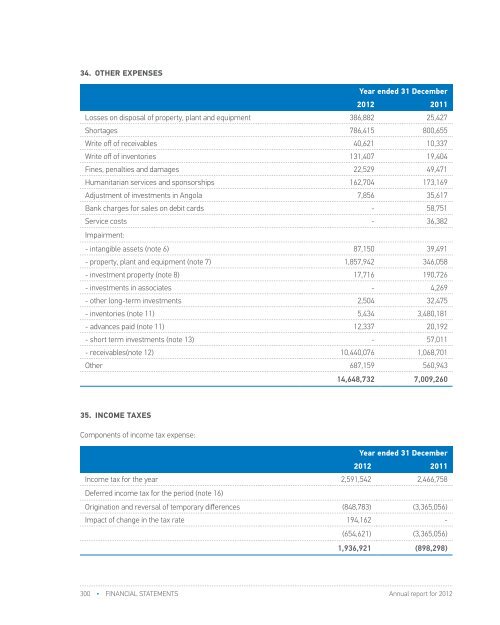

34. OTHER EXPENSESYear ended 31 December<strong>2012</strong> 2011Losses on disposal of property, plant and equipment 386,882 25,427Shortages 786,415 800,655Write off of receivables 40,621 10,337Write off of inventories 131,407 19,404Fines, penalties and damages 22,529 49,471Humanitarian services and sponsorships 162,704 173,169Adjustment of investments in Angola 7,856 35,617Bank charges for sales on debit cards - 58,751Service costs - 36,382Impairment:- intangible assets (note 6) 87,150 39,491- property, plant and equipment (note 7) 1,857,942 346,058- investment property (note 8) 17,716 190,726- investments in associates - 4,269- other long-term investments 2,504 32,475- inventories (note 11) 5,434 3,480,181- advances paid (note 11) 12,337 20,192- short term investments (note 13) - 57,011- receivables(note 12) 10,440,076 1,068,701Other 687,159 560,94314,648,732 7,009,26035. INCOME TAXESComponents of income tax expense:Year ended 31 December<strong>2012</strong> 2011Income tax for the year 2,591,542 2,466,758Deferred income tax for the period (note 16)Origination and reversal of temporary differences (848,783) (3,365,056)Impact of change in the tax rate 194,162 -(654,621) (3,365,056)1,936,921 (898,298)The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted averagetax rate as follows:Year ended 31 December<strong>2012</strong> 2011Profit before tax 47,469,532 39,717,466Tax calculated at statutory tax rate – 10% 4,746,953 3,971,747Tax effect on:Expenses not deductible for tax purposes 966,676 (499,186)Deferred tax credits (1,634,556) (2,298,387)Tax losses for which no deferred income tax asset was recognised 240,728 -Utilized tax credits (2,577,042) (2,257,868)Impact of change in the tax rate 194,162 -Adjustment in respect of prior years - 185,3961,936,921 (898,298)Аverage income tax rate 4.08% -2.26%36. EARNING PER SHAREYear ended 31 December<strong>2012</strong> 2011Profit 45,552,345 40,637,770Weighted average number of ordinary shares in issue 163,060,400 163,060,400Basic Earnings per share 0.279 0.249300 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 301