FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

FY 2012 - Investor Relations - NIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

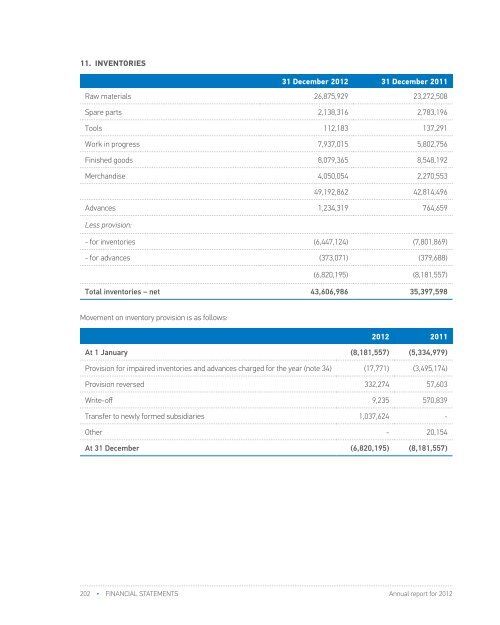

11. INVENTORIES31 December <strong>2012</strong> 31 December 2011Raw materials 26,875,929 23,272,50812. TRADE AND OTHER RECEIVABLESTrade receivables31 December <strong>2012</strong> 31 December 2011Spare parts 2,138,316 2,783,196Tools 112,183 137,291Work in progress 7,937,015 5,802,756Finished goods 8,079,365 8,548,192Merchandise 4,050,054 2,270,55349,192,862 42,814,496Advances 1,234,319 764,659Less provision:- for inventories (6,447,124) (7,801,869)- for advances (373,071) (379,688)(6,820,195) (8,181,557)Total inventories – net 43,606,986 35,397,598Movement on inventory provision is as follows:<strong>2012</strong> 2011At 1 January (8,181,557) (5,334,979)Provision for impaired inventories and advances charged for the year (note 34) (17,771) (3,495,174)Provision reversed 332,274 57,603Write-off 9,235 570,839Transfer to newly formed subsidiaries 1,037,624 -Other - 20,154At 31 December (6,820,195) (8,181,557)- domestic 44,343,991 22,564,614- foreign 1,048,226 1,054,202- related parties 8,127,399 2,096,24253,519,616 25,715,058Receivables from specific operations 8,787,798 7,998,971Receivables from sales of assets to subsidiaries 364,055 -Interest receivables 6,125,320 4,984,235Receivables from employees 82,940 86,656Other receivables 7,444,391 7,428,788Less provision:13,652,651 12,499,67976,324,120 46,213,708- trade receivables (13,141,957) (5,684,020)- receivables from specific operations (8,418,580) (7,978,573)- interest receivables (5,864,441) (4,854,318)- other receivables (7,323,979) (7,323,558)(34,748,957) (25,840,469)Total receivables – net 41,575,163 20,373,239Trade receivables as at 31 December <strong>2012</strong> amounting to RSD 22,741,353 that are more than 90 days overdue areconsidered impaired, except for receivables of RSD 9,621,695 (31 December 2011: RSD 269,440) from a number ofindependent customers for whom there is no recent history of default or they were additionally secured in accordancewith Company credit policy.The ageing of trade receivables is as follows:31 December <strong>2012</strong> 31 December 2011Up to 3 months 30,778,263 19,824,325Over 3 months 22,741,353 5,890,73353,519,616 25,715,058As at 31 December <strong>2012</strong>, trade receivables of RSD 13,141,957 (31 December 2011: RSD 5,684,020) were impaired andfully provided for. The individually impaired receivables mainly relate to customers and are assessed as uncollectable.The ageing of receivables provided for is as follows:202 • FINANCIAL STATEMENTS Annual report for <strong>2012</strong>Annual report for <strong>2012</strong>FINANCIAL STATEMENTS • 203