6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

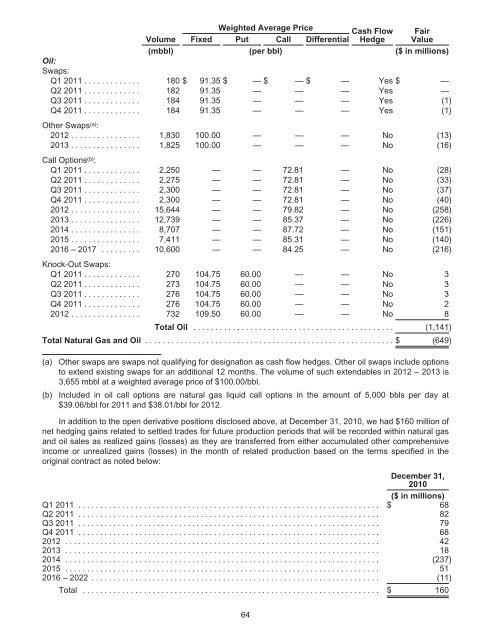

Weighted Average Price Cash Flow Fair<br />

Volume Fixed Put Call Differential Hedge Value<br />

(mbbl) (per bbl) ($ in millions)<br />

Oil:<br />

Swaps:<br />

Q1 2011 ............. 180$ 91.35 $ — $ — $ — Yes $ —<br />

Q2 2011 ............. 182 91.35 — — — Yes —<br />

Q3 2011 ............. 184 91.35 — — — Yes (1)<br />

Q4 2011 .............<br />

Other Swaps<br />

184 91.35 — — — Yes (1)<br />

(a) :<br />

2012 ................ 1,830 100.00 — — — No (13)<br />

2013 ................<br />

Call Options<br />

1,825 100.00 — — — No (16)<br />

(b) :<br />

Q1 2011 ............. 2,250 — — 72.81 — No (28)<br />

Q2 2011 ............. 2,275 — — 72.81 — No (33)<br />

Q3 2011 ............. 2,300 — — 72.81 — No (37)<br />

Q4 2011 ............. 2,300 — — 72.81 — No (40)<br />

2012 ................ 15,644 — — 79.82 — No (258)<br />

2013 ................ 12,739 — — 85.37 — No (226)<br />

2014 ................ 8,707 — — 87.72 — No (151)<br />

2015 ................ 7,411 — — 85.31 — No (140)<br />

2016 – 2017 .........<br />

Knock-Out Swaps:<br />

10,600 — — 84.25 — No (216)<br />

Q1 2011 ............. 270 104.75 60.00 — — No 3<br />

Q2 2011 ............. 273 104.75 60.00 — — No 3<br />

Q3 2011 ............. 276 104.75 60.00 — — No 3<br />

Q4 2011 ............. 276 104.75 60.00 — — No 2<br />

2012 ................ 732 109.50 60.00 — — No 8<br />

Total Oil .............................................. (1,141)<br />

Total Natural Gas and Oil .........................................................$ (649)<br />

(a) Other swaps are swaps not qualifying for designation as cash flow hedges. Other oil swaps include options<br />

to extend existing swaps for an additional 12 months. The volume of such extendables in 2012 – 2013 is<br />

3,655 mbbl at a weighted average price of $100.00/bbl.<br />

(b) Included in oil call options are natural gas liquid call options in the amount of 5,000 bbls per day at<br />

$39.06/bbl for 2011 and $38.01/bbl for 2012.<br />

In addition to the open derivative positions disclosed above, at December 31, 2010, we had $160 million of<br />

net hedging gains related to settled trades for future production periods that will be recorded within natural gas<br />

and oil sales as realized gains (losses) as they are transferred from either accumulated other comprehensive<br />

income or unrealized gains (losses) in the month of related production based on the terms specified in the<br />

original contract as noted below:<br />

December 31,<br />

2010<br />

($ in millions)<br />

Q1 2011 ..................................................................... $ 68<br />

Q2 2011 ..................................................................... 82<br />

Q3 2011 ..................................................................... 79<br />

Q4 2011 ..................................................................... 68<br />

2012 ........................................................................ 42<br />

2013 ........................................................................ 18<br />

2014 ........................................................................ (237)<br />

2015 ........................................................................ 51<br />

2016 – 2022 .................................................................. (11)<br />

Total .................................................................... $ 160<br />

64