6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

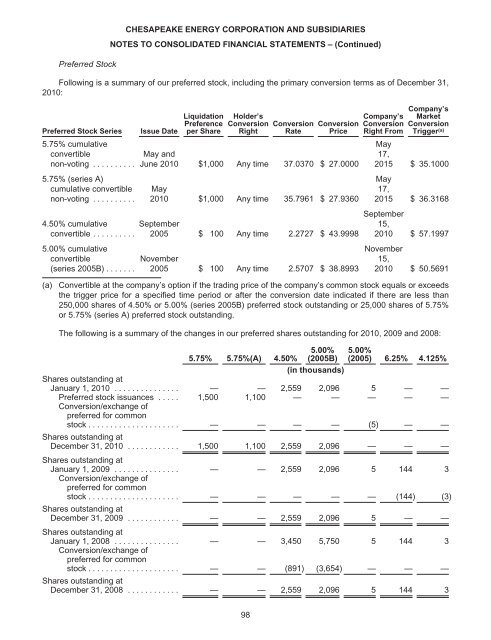

Preferred Stock<br />

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

Following is a summary of our preferred stock, including the primary conversion terms as of December 31,<br />

2010:<br />

Preferred Stock Series Issue Date<br />

5.75% cumulative<br />

convertible<br />

non-voting ..........<br />

5.75% (series A)<br />

cumulative convertible<br />

non-voting ..........<br />

4.50% cumulative<br />

convertible ..........<br />

5.00% cumulative<br />

convertible<br />

(series 2005B) .......<br />

Liquidation<br />

Preference<br />

per Share<br />

Holder’s<br />

Conversion<br />

Right<br />

Conversion<br />

Rate<br />

Conversion<br />

Price<br />

May and<br />

June 2010 $1,000 Any time 37.0370 $ 27.0000<br />

May<br />

2010 $1,000 Any time 35.7961 $ 27.9360<br />

September<br />

2005 $ 100 Any time 2.2727 $ 43.9998<br />

November<br />

2005 $ 100 Any time 2.5707 $ 38.8993<br />

Company’s<br />

Conversion<br />

Right From<br />

Company’s<br />

Market<br />

Conversion<br />

Trigger (a)<br />

May<br />

17,<br />

2015 $ 35.1000<br />

May<br />

17,<br />

2015 $ 36.3168<br />

September<br />

15,<br />

2010 $ 57.1997<br />

November<br />

15,<br />

2010 $ 50.5691<br />

(a) Convertible at the company’s option if the trading price of the company’s common stock equals or exceeds<br />

the trigger price for a specified time period or after the conversion date indicated if there are less than<br />

250,000 shares of 4.50% or 5.00% (series 2005B) preferred stock outstanding or 25,000 shares of 5.75%<br />

or 5.75% (series A) preferred stock outstanding.<br />

The following is a summary of the changes in our preferred shares outstanding for 2010, 2009 and 2008:<br />

5.75% 5.75%(A) 4.50% 5.00% 5.00%<br />

(2005B) (2005) 6.25% 4.125%<br />

(in thousands)<br />

Shares outstanding at<br />

January 1, 2010 ............... — — 2,559 2,096 5 — —<br />

Preferred stock issuances .....<br />

Conversion/exchange of<br />

preferred for common<br />

1,500 1,100 — — — — —<br />

stock ..................... — — — — (5) — —<br />

Shares outstanding at<br />

December 31, 2010 ............ 1,500 1,100 2,559 2,096 — — —<br />

Shares outstanding at<br />

January 1, 2009 ............... — — 2,559 2,096 5 144 3<br />

Conversion/exchange of<br />

preferred for common<br />

stock ..................... — — — — — (144) (3)<br />

Shares outstanding at<br />

December 31, 2009 ............ — — 2,559 2,096 5 — —<br />

Shares outstanding at<br />

January 1, 2008 ............... — — 3,450 5,750 5 144 3<br />

Conversion/exchange of<br />

preferred for common<br />

stock ..................... — — (891) (3,654) — — —<br />

Shares outstanding at<br />

December 31, 2008 ............ — — 2,559 2,096 5 144 3<br />

98