6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

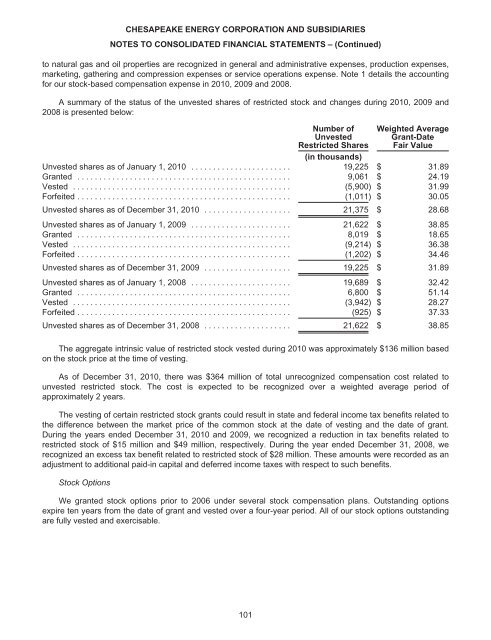

to natural gas and oil properties are recognized in general and administrative expenses, production expenses,<br />

marketing, gathering and compression expenses or service operations expense. Note 1 details the accounting<br />

for our stock-based compensation expense in 2010, 2009 and 2008.<br />

A summary of the status of the unvested shares of restricted stock and changes during 2010, 2009 and<br />

2008 is presented below:<br />

Number of<br />

Unvested<br />

Restricted Shares<br />

Weighted Average<br />

Grant-Date<br />

Fair Value<br />

(in thousands)<br />

Unvested shares as of January 1, 2010 ....................... 19,225 $ 31.89<br />

Granted ................................................. 9,061 $ 24.19<br />

Vested .................................................. (5,900) $ 31.99<br />

Forfeited ................................................. (1,011) $ 30.05<br />

Unvested shares as of December 31, 2010 .................... 21,375 $ 28.68<br />

Unvested shares as of January 1, 2009 ....................... 21,622 $ 38.85<br />

Granted ................................................. 8,019 $ 18.65<br />

Vested .................................................. (9,214) $ 36.38<br />

Forfeited ................................................. (1,202) $ 34.46<br />

Unvested shares as of December 31, 2009 .................... 19,225 $ 31.89<br />

Unvested shares as of January 1, 2008 ....................... 19,689 $ 32.42<br />

Granted ................................................. 6,800 $ 51.14<br />

Vested .................................................. (3,942) $ 28.27<br />

Forfeited ................................................. (925) $ 37.33<br />

Unvested shares as of December 31, 2008 .................... 21,622 $ 38.85<br />

The aggregate intrinsic value of restricted stock vested during 2010 was approximately $136 million based<br />

on the stock price at the time of vesting.<br />

As of December 31, 2010, there was $364 million of total unrecognized compensation cost related to<br />

unvested restricted stock. The cost is expected to be recognized over a weighted average period of<br />

approximately 2 years.<br />

The vesting of certain restricted stock grants could result in state and federal income tax benefits related to<br />

the difference between the market price of the common stock at the date of vesting and the date of grant.<br />

During the years ended December 31, 2010 and 2009, we recognized a reduction in tax benefits related to<br />

restricted stock of $15 million and $49 million, respectively. During the year ended December 31, 2008, we<br />

recognized an excess tax benefit related to restricted stock of $28 million. These amounts were recorded as an<br />

adjustment to additional paid-in capital and deferred income taxes with respect to such benefits.<br />

Stock Options<br />

We granted stock options prior to 2006 under several stock compensation plans. Outstanding options<br />

expire ten years from the date of grant and vested over a four-year period. All of our stock options outstanding<br />

are fully vested and exercisable.<br />

101