6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

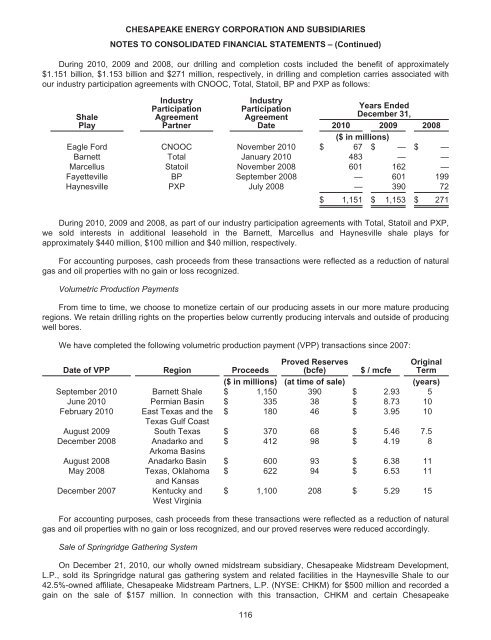

During 2010, 2009 and 2008, our drilling and completion costs included the benefit of approximately<br />

$1.151 billion, $1.153 billion and $271 million, respectively, in drilling and completion carries associated with<br />

our industry participation agreements with CNOOC, Total, Statoil, BP and PXP as follows:<br />

Shale<br />

Play<br />

Industry<br />

Participation<br />

Agreement<br />

Partner<br />

Industry<br />

Participation<br />

Agreement<br />

Date<br />

Years Ended<br />

December 31,<br />

2010 2009 2008<br />

($ in millions)<br />

Eagle Ford CNOOC November 2010 $ 67 $ — $ —<br />

Barnett Total January 2010 483 — —<br />

Marcellus Statoil November 2008 601 162 —<br />

Fayetteville BP September 2008 — 601 199<br />

Haynesville PXP July 2008 — 390 72<br />

$ 1,151 $ 1,153 $ 271<br />

During 2010, 2009 and 2008, as part of our industry participation agreements with Total, Statoil and PXP,<br />

we sold interests in additional leasehold in the Barnett, Marcellus and Haynesville shale plays for<br />

approximately $440 million, $100 million and $40 million, respectively.<br />

For accounting purposes, cash proceeds from these transactions were reflected as a reduction of natural<br />

gas and oil properties with no gain or loss recognized.<br />

Volumetric Production Payments<br />

From time to time, we choose to monetize certain of our producing assets in our more mature producing<br />

regions. We retain drilling rights on the properties below currently producing intervals and outside of producing<br />

well bores.<br />

We have completed the following volumetric production payment (VPP) transactions since 2007:<br />

Proved Reserves<br />

Original<br />

Date of VPP Region Proceeds (bcfe) $ / mcfe Term<br />

($ in millions) (at time of sale) (years)<br />

September 2010 Barnett Shale $ 1,150 390 $ 2.93 5<br />

June 2010 Permian Basin $ 335 38 $ 8.73 10<br />

February 2010 East Texas and the<br />

Texas Gulf Coast<br />

$ 180 46 $ 3.95 10<br />

August 2009 South Texas $ 370 68 $ 5.46 7.5<br />

December 2008 Anadarko and<br />

Arkoma Basins<br />

$ 412 98 $ 4.19 8<br />

August 2008 Anadarko Basin $ 600 93 $ 6.38 11<br />

May 2008 Texas, Oklahoma<br />

and Kansas<br />

$ 622 94 $ 6.53 11<br />

December 2007 Kentucky and<br />

West Virginia<br />

$ 1,100 208 $ 5.29 15<br />

For accounting purposes, cash proceeds from these transactions were reflected as a reduction of natural<br />

gas and oil properties with no gain or loss recognized, and our proved reserves were reduced accordingly.<br />

Sale of Springridge Gathering System<br />

On December 21, 2010, our wholly owned midstream subsidiary, Chesapeake Midstream Development,<br />

L.P., sold its Springridge natural gas gathering system and related facilities in the Haynesville Shale to our<br />

42.5%-owned affiliate, Chesapeake Midstream Partners, L.P. (NYSE: CHKM) for $500 million and recorded a<br />

gain on the sale of $157 million. In connection with this transaction, CHKM and certain Chesapeake<br />

116