6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

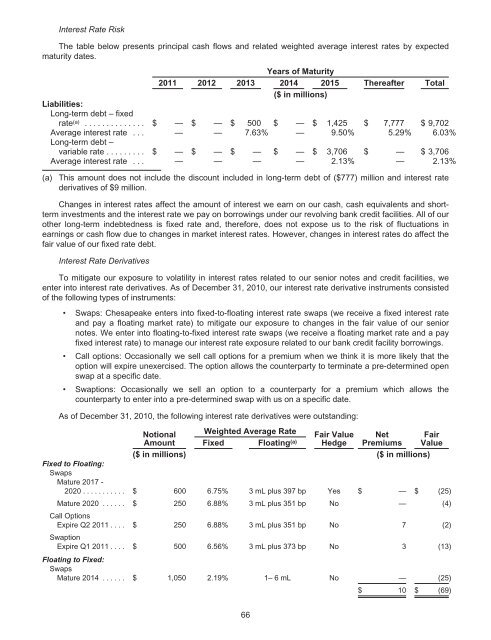

Interest Rate Risk<br />

The table below presents principal cash flows and related weighted average interest rates by expected<br />

maturity dates.<br />

Years of Maturity<br />

2011 2012 2013 2014 2015 Thereafter Total<br />

($ in millions)<br />

Liabilities:<br />

Long-term debt – fixed<br />

rate (a) .............. $ — $ — $ 500 $ — $ 1,425 $ 7,777 $ 9,702<br />

Average interest rate . . .<br />

Long-term debt –<br />

— — 7.63% — 9.50% 5.29% 6.03%<br />

variable rate ......... $ — $ — $ — $ — $ 3,706 $ — $ 3,706<br />

Average interest rate . . . — — — — 2.13% — 2.13%<br />

(a) This amount does not include the discount included in long-term debt of ($777) million and interest rate<br />

derivatives of $9 million.<br />

Changes in interest rates affect the amount of interest we earn on our cash, cash equivalents and shortterm<br />

investments and the interest rate we pay on borrowings under our revolving bank credit facilities. All of our<br />

other long-term indebtedness is fixed rate and, therefore, does not expose us to the risk of fluctuations in<br />

earnings or cash flow due to changes in market interest rates. However, changes in interest rates do affect the<br />

fair value of our fixed rate debt.<br />

Interest Rate Derivatives<br />

To mitigate our exposure to volatility in interest rates related to our senior notes and credit facilities, we<br />

enter into interest rate derivatives. As of December 31, 2010, our interest rate derivative instruments consisted<br />

of the following types of instruments:<br />

Swaps: Chesapeake enters into fixed-to-floating interest rate swaps (we receive a fixed interest rate<br />

and pay a floating market rate) to mitigate our exposure to changes in the fair value of our senior<br />

notes. We enter into floating-to-fixed interest rate swaps (we receive a floating market rate and a pay<br />

fixed interest rate) to manage our interest rate exposure related to our bank credit facility borrowings.<br />

Call options: Occasionally we sell call options for a premium when we think it is more likely that the<br />

option will expire unexercised. The option allows the counterparty to terminate a pre-determined open<br />

swap at a specific date.<br />

Swaptions: Occasionally we sell an option to a counterparty for a premium which allows the<br />

counterparty to enter into a pre-determined swap with us on a specific date.<br />

As of December 31, 2010, the following interest rate derivatives were outstanding:<br />

Notional<br />

Weighted Average Rate<br />

Fair Value Net Fair<br />

Amount Fixed Floating Hedge Premiums Value<br />

(a)<br />

($ in millions) ($ in millions)<br />

Fixed to Floating:<br />

Swaps<br />

Mature 2017 -<br />

2020 ........... $ 600 6.75% 3 mL plus 397 bp Yes $ — $ (25)<br />

Mature 2020 ......<br />

Call Options<br />

$ 250 6.88% 3 mL plus 351 bp No — (4)<br />

Expire Q2 2011 ....<br />

Swaption<br />

$ 250 6.88% 3 mL plus 351 bp No 7 (2)<br />

Expire Q1 2011 ....<br />

Floating to Fixed:<br />

Swaps<br />

$ 500 6.56% 3 mL plus 373 bp No 3 (13)<br />

Mature 2014 ...... $ 1,050 2.19% 1– 6 mL No — (25)<br />

66<br />

$ 10 $ (69)