6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

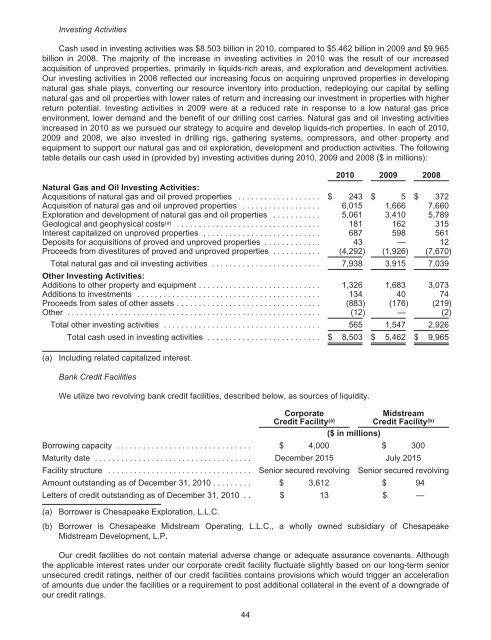

Investing Activities<br />

Cash used in investing activities was $8.503 billion in 2010, compared to $5.462 billion in 2009 and $9.965<br />

billion in 2008. The majority of the increase in investing activities in 2010 was the result of our increased<br />

acquisition of unproved properties, primarily in liquids-rich areas, and exploration and development activities.<br />

Our investing activities in 2008 reflected our increasing focus on acquiring unproved properties in developing<br />

natural gas shale plays, converting our resource inventory into production, redeploying our capital by selling<br />

natural gas and oil properties with lower rates of return and increasing our investment in properties with higher<br />

return potential. Investing activities in 2009 were at a reduced rate in response to a low natural gas price<br />

environment, lower demand and the benefit of our drilling cost carries. Natural gas and oil investing activities<br />

increased in 2010 as we pursued our strategy to acquire and develop liquids-rich properties. In each of 2010,<br />

2009 and 2008, we also invested in drilling rigs, gathering systems, compressors, and other property and<br />

equipment to support our natural gas and oil exploration, development and production activities. The following<br />

table details our cash used in (provided by) investing activities during 2010, 2009 and 2008 ($ in millions):<br />

2010 2009 2008<br />

Natural Gas and Oil Investing Activities:<br />

Acquisitions of natural gas and oil proved properties ................... $ 243 $ 5 $ 372<br />

Acquisition of natural gas and oil unproved properties .................. 6,015 1,666 7,660<br />

Exploration and development of natural gas and oil properties ........... 5,061 3,410 5,789<br />

Geological and geophysical costs (a) ................................. 181 162 315<br />

Interest capitalized on unproved properties ........................... 687 598 561<br />

Deposits for acquisitions of proved and unproved properties ............. 43 — 12<br />

Proceeds from divestitures of proved and unproved properties ........... (4,292) (1,926) (7,670)<br />

Total natural gas and oil investing activities ......................... 7,938 3,915 7,039<br />

Other Investing Activities:<br />

Additions to other property and equipment ............................ 1,326 1,683 3,073<br />

Additions to investments .......................................... 134 40 74<br />

Proceeds from sales of other assets ................................. (883) (176) (219)<br />

Other .......................................................... (12) — (2)<br />

Total other investing activities .................................... 565 1,547 2,926<br />

Total cash used in investing activities .......................... $ 8,503 $ 5,462 $ 9,965<br />

(a) Including related capitalized interest.<br />

Bank Credit Facilities<br />

We utilize two revolving bank credit facilities, described below, as sources of liquidity.<br />

Corporate<br />

Credit Facility (a)<br />

Midstream<br />

Credit Facility (b)<br />

Borrowing capacity ............................... $<br />

($ in millions)<br />

4,000 $ 300<br />

Maturity date .................................... December 2015 July 2015<br />

Facility structure ................................. Senior secured revolving Senior secured revolving<br />

Amount outstanding as of December 31, 2010 ......... $ 3,612 $ 94<br />

Letters of credit outstanding as of December 31, 2010 . . $ 13 $ —<br />

(a) Borrower is Chesapeake Exploration, L.L.C.<br />

(b) Borrower is Chesapeake Midstream Operating, L.L.C., a wholly owned subsidiary of Chesapeake<br />

Midstream Development, L.P.<br />

Our credit facilities do not contain material adverse change or adequate assurance covenants. Although<br />

the applicable interest rates under our corporate credit facility fluctuate slightly based on our long-term senior<br />

unsecured credit ratings, neither of our credit facilities contains provisions which would trigger an acceleration<br />

of amounts due under the facilities or a requirement to post additional collateral in the event of a downgrade of<br />

our credit ratings.<br />

44