6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Daily production for 2010 averaged 2.836 bcfe, an increase of 355 million cubic feet of natural gas<br />

equivalent (mmcfe) or 14%, over the 2.481 bcfe of daily production for 2009 and consisted of 2.534 billion cubic<br />

feet of natural gas (bcf) (89% on a natural gas equivalent basis) and 50,397 bbls (11% on a natural gas<br />

equivalent basis). This was our 21st consecutive year of sequential production growth.<br />

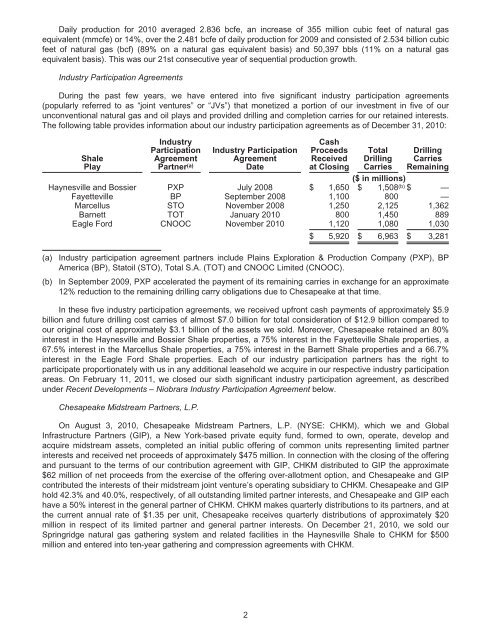

Industry Participation Agreements<br />

During the past few years, we have entered into five significant industry participation agreements<br />

(popularly referred to as “joint ventures” or “JVs”) that monetized a portion of our investment in five of our<br />

unconventional natural gas and oil plays and provided drilling and completion carries for our retained interests.<br />

The following table provides information about our industry participation agreements as of December 31, 2010:<br />

Shale<br />

Play<br />

Industry<br />

Participation<br />

Agreement<br />

Partner (a)<br />

Industry Participation<br />

Agreement<br />

Date<br />

Cash<br />

Proceeds<br />

Received<br />

at Closing<br />

Total<br />

Drilling<br />

Carries<br />

Drilling<br />

Carries<br />

Remaining<br />

($ in millions)<br />

Haynesville and Bossier PXP July 2008 $ 1,650 $ 1,508 (b) $ —<br />

Fayetteville BP September 2008 1,100 800 —<br />

Marcellus STO November 2008 1,250 2,125 1,362<br />

Barnett TOT January 2010 800 1,450 889<br />

Eagle Ford CNOOC November 2010 1,120 1,080 1,030<br />

$ 5,920 $ 6,963 $ 3,281<br />

(a) Industry participation agreement partners include Plains Exploration & Production Company (PXP), BP<br />

America (BP), Statoil (STO), Total S.A. (TOT) and CNOOC Limited (CNOOC).<br />

(b) In September 2009, PXP accelerated the payment of its remaining carries in exchange for an approximate<br />

12% reduction to the remaining drilling carry obligations due to Chesapeake at that time.<br />

In these five industry participation agreements, we received upfront cash payments of approximately $5.9<br />

billion and future drilling cost carries of almost $7.0 billion for total consideration of $12.9 billion compared to<br />

our original cost of approximately $3.1 billion of the assets we sold. Moreover, Chesapeake retained an 80%<br />

interest in the Haynesville and Bossier Shale properties, a 75% interest in the Fayetteville Shale properties, a<br />

67.5% interest in the Marcellus Shale properties, a 75% interest in the Barnett Shale properties and a 66.7%<br />

interest in the Eagle Ford Shale properties. Each of our industry participation partners has the right to<br />

participate proportionately with us in any additional leasehold we acquire in our respective industry participation<br />

areas. On February 11, 2011, we closed our sixth significant industry participation agreement, as described<br />

under Recent Developments – Niobrara Industry Participation Agreement below.<br />

Chesapeake Midstream Partners, L.P.<br />

On August 3, 2010, Chesapeake Midstream Partners, L.P. (NYSE: CHKM), which we and Global<br />

Infrastructure Partners (GIP), a New York-based private equity fund, formed to own, operate, develop and<br />

acquire midstream assets, completed an initial public offering of common units representing limited partner<br />

interests and received net proceeds of approximately $475 million. In connection with the closing of the offering<br />

and pursuant to the terms of our contribution agreement with GIP, CHKM distributed to GIP the approximate<br />

$62 million of net proceeds from the exercise of the offering over-allotment option, and Chesapeake and GIP<br />

contributed the interests of their midstream joint venture’s operating subsidiary to CHKM. Chesapeake and GIP<br />

hold 42.3% and 40.0%, respectively, of all outstanding limited partner interests, and Chesapeake and GIP each<br />

have a 50% interest in the general partner of CHKM. CHKM makes quarterly distributions to its partners, and at<br />

the current annual rate of $1.35 per unit, Chesapeake receives quarterly distributions of approximately $20<br />

million in respect of its limited partner and general partner interests. On December 21, 2010, we sold our<br />

Springridge natural gas gathering system and related facilities in the Haynesville Shale to CHKM for $500<br />

million and entered into ten-year gathering and compression agreements with CHKM.<br />

2