6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS – (Continued)<br />

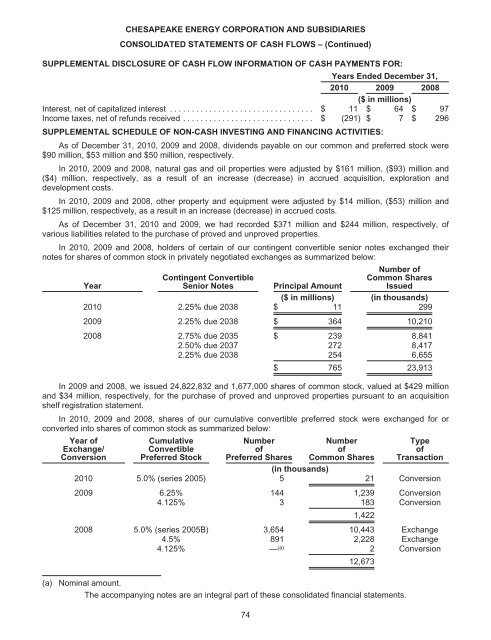

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION OF CASH PAYMENTS FOR:<br />

Years Ended December 31,<br />

2010 2009 2008<br />

($ in millions)<br />

Interest, net of capitalized interest ................................. $ 11 $ 64 $ 97<br />

Income taxes, net of refunds received .............................. $ (291) $ 7 $ 296<br />

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES:<br />

As of December 31, 2010, 2009 and 2008, dividends payable on our common and preferred stock were<br />

$90 million, $53 million and $50 million, respectively.<br />

In 2010, 2009 and 2008, natural gas and oil properties were adjusted by $161 million, ($93) million and<br />

($4) million, respectively, as a result of an increase (decrease) in accrued acquisition, exploration and<br />

development costs.<br />

In 2010, 2009 and 2008, other property and equipment were adjusted by $14 million, ($53) million and<br />

$125 million, respectively, as a result in an increase (decrease) in accrued costs.<br />

As of December 31, 2010 and 2009, we had recorded $371 million and $244 million, respectively, of<br />

various liabilities related to the purchase of proved and unproved properties.<br />

In 2010, 2009 and 2008, holders of certain of our contingent convertible senior notes exchanged their<br />

notes for shares of common stock in privately negotiated exchanges as summarized below:<br />

Number of<br />

Contingent Convertible<br />

Common Shares<br />

Year<br />

Senior Notes Principal Amount<br />

Issued<br />

($ in millions) (in thousands)<br />

2010 2.25% due 2038 $ 11 299<br />

2009 2.25% due 2038 $ 364 10,210<br />

2008 2.75% due 2035 $ 239 8,841<br />

2.50% due 2037 272 8,417<br />

2.25% due 2038 254 6,655<br />

$ 765 23,913<br />

In 2009 and 2008, we issued 24,822,832 and 1,677,000 shares of common stock, valued at $429 million<br />

and $34 million, respectively, for the purchase of proved and unproved properties pursuant to an acquisition<br />

shelf registration statement.<br />

In 2010, 2009 and 2008, shares of our cumulative convertible preferred stock were exchanged for or<br />

converted into shares of common stock as summarized below:<br />

Year of<br />

Exchange/<br />

Conversion<br />

Cumulative<br />

Convertible<br />

Preferred Stock<br />

Number<br />

of<br />

Preferred Shares<br />

Number<br />

of<br />

Common Shares<br />

Type<br />

of<br />

Transaction<br />

(in thousands)<br />

2010 5.0% (series 2005) 5 21 Conversion<br />

2009 6.25% 144 1,239 Conversion<br />

4.125% 3 183<br />

1,422<br />

Conversion<br />

2008 5.0% (series 2005B) 3,654 10,443 Exchange<br />

4.5% 891 2,228 Exchange<br />

4.125% — (a) 2<br />

12,673<br />

Conversion<br />

(a) Nominal amount.<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

74