6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

2010, 2009 and 2008, respectively, to fund the match. The company’s non-employee directors are able to defer<br />

up to 100% of director fees into the DC Plan.<br />

Any assets placed in trust by Chesapeake to fund future obligations of the company’s nonqualified<br />

deferred compensation plans are subject to the claims of creditors in the event of insolvency or bankruptcy,<br />

and participants are general creditors of the company as to their deferred compensation in the plans.<br />

Chesapeake maintains no post-employment benefit plans except those sponsored by its wholly owned<br />

subsidiary, Chesapeake Appalachia, L.L.C. Participation in these plans is limited to existing employees who<br />

are union members and former employees who were union members. The Chesapeake Appalachia, L.L.C.<br />

benefit plans provide health care and life insurance benefits to eligible employees upon retirement. We account<br />

for these benefits on an accrual basis. As of December 31, 2010, the company had accrued approximately $2<br />

million in accumulated post-employment benefit liability.<br />

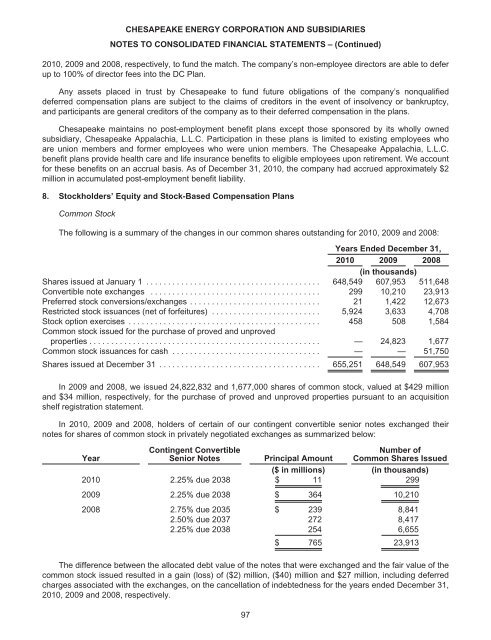

8. Stockholders’ Equity and Stock-Based Compensation Plans<br />

Common Stock<br />

The following is a summary of the changes in our common shares outstanding for 2010, 2009 and 2008:<br />

Years Ended December 31,<br />

2010 2009 2008<br />

(in thousands)<br />

Shares issued at January 1 ........................................ 648,549 607,953 511,648<br />

Convertible note exchanges ....................................... 299 10,210 23,913<br />

Preferred stock conversions/exchanges .............................. 21 1,422 12,673<br />

Restricted stock issuances (net of forfeitures) ......................... 5,924 3,633 4,708<br />

Stock option exercises ............................................ 458 508 1,584<br />

Common stock issued for the purchase of proved and unproved<br />

properties ..................................................... — 24,823 1,677<br />

Common stock issuances for cash .................................. — — 51,750<br />

Shares issued at December 31 ..................................... 655,251 648,549 607,953<br />

In 2009 and 2008, we issued 24,822,832 and 1,677,000 shares of common stock, valued at $429 million<br />

and $34 million, respectively, for the purchase of proved and unproved properties pursuant to an acquisition<br />

shelf registration statement.<br />

In 2010, 2009 and 2008, holders of certain of our contingent convertible senior notes exchanged their<br />

notes for shares of common stock in privately negotiated exchanges as summarized below:<br />

Contingent Convertible<br />

Number of<br />

Year<br />

Senior Notes Principal Amount Common Shares Issued<br />

($ in millions) (in thousands)<br />

2010 2.25% due 2038 $ 11 299<br />

2009 2.25% due 2038 $ 364 10,210<br />

2008 2.75% due 2035 $ 239 8,841<br />

2.50% due 2037 272 8,417<br />

2.25% due 2038 254 6,655<br />

$ 765 23,913<br />

The difference between the allocated debt value of the notes that were exchanged and the fair value of the<br />

common stock issued resulted in a gain (loss) of ($2) million, ($40) million and $27 million, including deferred<br />

charges associated with the exchanges, on the cancellation of indebtedness for the years ended December 31,<br />

2010, 2009 and 2008, respectively.<br />

97