6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

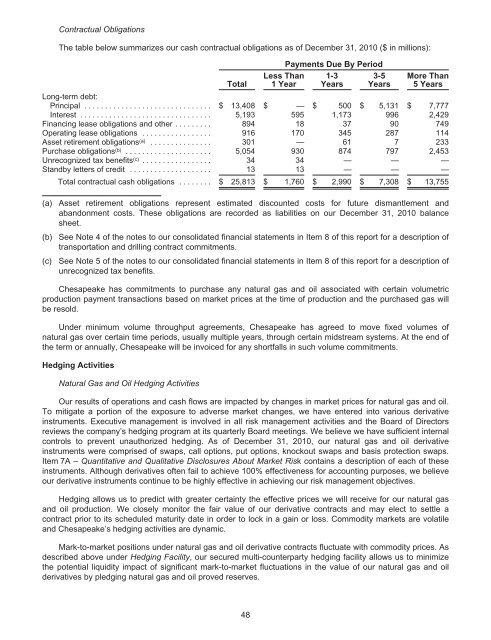

Contractual Obligations<br />

The table below summarizes our cash contractual obligations as of December 31, 2010 ($ in millions):<br />

Total<br />

Less Than<br />

1 Year<br />

Payments Due By Period<br />

1-3<br />

Years<br />

3-5<br />

Years<br />

More Than<br />

5 Years<br />

Long-term debt:<br />

Principal ............................... $ 13,408 $ — $ 500 $ 5,131 $ 7,777<br />

Interest ................................ 5,193 595 1,173 996 2,429<br />

Financing lease obligations and other ......... 894 18 37 90 749<br />

Operating lease obligations ................. 916 170 345 287 114<br />

Asset retirement obligations (a) ............... 301 — 61 7 233<br />

Purchase obligations (b) ..................... 5,054 930 874 797 2,453<br />

Unrecognized tax benefits (c) ................. 34 34 — — —<br />

Standby letters of credit .................... 13 13 — — —<br />

Total contractual cash obligations ........ $ 25,813 $ 1,760 $ 2,990 $ 7,308 $ 13,755<br />

(a) Asset retirement obligations represent estimated discounted costs for future dismantlement and<br />

(b)<br />

abandonment costs. These obligations are recorded as liabilities on our December 31, 2010 balance<br />

sheet.<br />

See Note 4 of the notes to our consolidated financial statements in Item 8 of this report for a description of<br />

transportation and drilling contract commitments.<br />

(c) See Note 5 of the notes to our consolidated financial statements in Item 8 of this report for a description of<br />

unrecognized tax benefits.<br />

Chesapeake has commitments to purchase any natural gas and oil associated with certain volumetric<br />

production payment transactions based on market prices at the time of production and the purchased gas will<br />

be resold.<br />

Under minimum volume throughput agreements, Chesapeake has agreed to move fixed volumes of<br />

natural gas over certain time periods, usually multiple years, through certain midstream systems. At the end of<br />

the term or annually, Chesapeake will be invoiced for any shortfalls in such volume commitments.<br />

Hedging Activities<br />

Natural Gas and Oil Hedging Activities<br />

Our results of operations and cash flows are impacted by changes in market prices for natural gas and oil.<br />

To mitigate a portion of the exposure to adverse market changes, we have entered into various derivative<br />

instruments. Executive management is involved in all risk management activities and the Board of Directors<br />

reviews the company’s hedging program at its quarterly Board meetings. We believe we have sufficient internal<br />

controls to prevent unauthorized hedging. As of December 31, 2010, our natural gas and oil derivative<br />

instruments were comprised of swaps, call options, put options, knockout swaps and basis protection swaps.<br />

Item 7A – Quantitative and Qualitative Disclosures About Market Risk contains a description of each of these<br />

instruments. Although derivatives often fail to achieve 100% effectiveness for accounting purposes, we believe<br />

our derivative instruments continue to be highly effective in achieving our risk management objectives.<br />

Hedging allows us to predict with greater certainty the effective prices we will receive for our natural gas<br />

and oil production. We closely monitor the fair value of our derivative contracts and may elect to settle a<br />

contract prior to its scheduled maturity date in order to lock in a gain or loss. Commodity markets are volatile<br />

and Chesapeake’s hedging activities are dynamic.<br />

Mark-to-market positions under natural gas and oil derivative contracts fluctuate with commodity prices. As<br />

described above under Hedging Facility, our secured multi-counterparty hedging facility allows us to minimize<br />

the potential liquidity impact of significant mark-to-market fluctuations in the value of our natural gas and oil<br />

derivatives by pledging natural gas and oil proved reserves.<br />

48